- United States

- /

- Marine and Shipping

- /

- NYSE:ZIM

Should ZIM’s Major LNG Fleet Expansion and Cost Cuts Require Action From Investors? (ZIM)

Reviewed by Sasha Jovanovic

- Recently, ZIM Integrated Shipping Services completed a major fleet renewal, adding 46 LNG-fueled vessels that now make up two-thirds of its capacity and cutting unit costs in response to significant freight rate volatility and tariff headwinds seen since late last year.

- An interesting development is that despite reporting a sharp decline in quarterly net income and facing ongoing revenue challenges, ZIM is viewed by some analysts as undervalued due to its enhanced LNG fleet, robust cash position of US$2.9 billion, and perceived stability from long-term charters.

- We'll examine how the combination of fleet modernization and improving sentiment may impact ZIM's investment narrative and outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

ZIM Integrated Shipping Services Investment Narrative Recap

To be a shareholder in ZIM Integrated Shipping Services right now, you need to believe the company’s heavy investment in an LNG-powered fleet and disciplined cash management can outweigh volatility from freight rates and geopolitical risks, particularly its exposure to the unstable Transpacific trade. While the completed fleet renewal directly addresses unit cost pressure, it does not significantly lessen near-term revenue risk stemming from softer shipping demand and ongoing tariff or regulatory shocks.

The recent regulatory action by Turkish port authorities, restricting Israeli-linked vessels from entering Turkish ports, stands out as especially relevant. Given the company’s push to reduce geographic risk and broaden its shipping footprint, this announcement highlights how external policy changes can directly impact ZIM’s operational flexibility at a time when freight rate stability remains the largest catalyst for short-term performance.

However, despite modernization efforts, the threat remains that concentrated exposure to volatile trade routes and unexpected regulatory changes could still...

Read the full narrative on ZIM Integrated Shipping Services (it's free!)

ZIM Integrated Shipping Services is projected to generate $4.9 billion in revenue and $61.6 million in earnings by 2028. This outlook is based on an expected annual revenue decline of 16.8% and represents a decrease in earnings of about $1.94 billion from the current $2.0 billion.

Uncover how ZIM Integrated Shipping Services' forecasts yield a $13.26 fair value, a 5% downside to its current price.

Exploring Other Perspectives

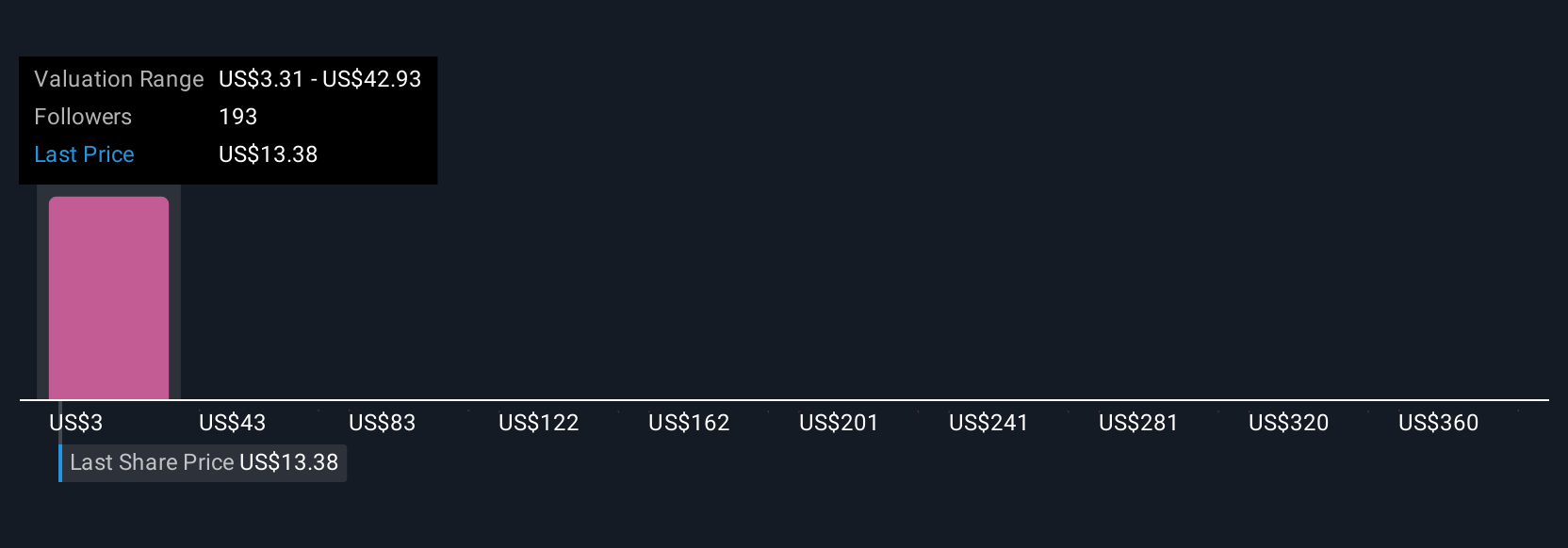

Simply Wall St Community members placed fair value estimates for ZIM anywhere from US$3.24 to US$452.35, based on 33 opinions. Against this wide spectrum, freight rate volatility remains a central issue that could determine whether these projections prove optimistic or cautious.

Explore 33 other fair value estimates on ZIM Integrated Shipping Services - why the stock might be a potential multi-bagger!

Build Your Own ZIM Integrated Shipping Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ZIM Integrated Shipping Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ZIM Integrated Shipping Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ZIM Integrated Shipping Services' overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZIM Integrated Shipping Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZIM

ZIM Integrated Shipping Services

Provides container shipping and related services in Israel and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives