- United States

- /

- Marine and Shipping

- /

- NYSE:ZIM

Investors Aren't Buying ZIM Integrated Shipping Services Ltd.'s (NYSE:ZIM) Revenues

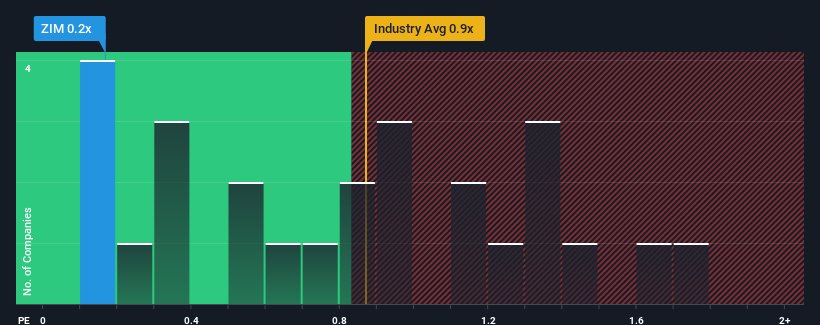

When close to half the companies operating in the Shipping industry in the United States have price-to-sales ratios (or "P/S") above 0.9x, you may consider ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) as an attractive investment with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for ZIM Integrated Shipping Services

What Does ZIM Integrated Shipping Services' P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, ZIM Integrated Shipping Services has been very sluggish. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. You'd much rather the company improve its revenue performance if you still believe in the business. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Keen to find out how analysts think ZIM Integrated Shipping Services' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

ZIM Integrated Shipping Services' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. Still, the latest three year period has seen an excellent 207% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should bring plunging returns, with revenue decreasing 46% as estimated by the six analysts watching the company. The industry is also set to see revenue decline 12% but the stock is shaping up to perform materially worse.

With this in consideration, it's clear to us why ZIM Integrated Shipping Services' P/S isn't quite up to scratch with its industry peers. However, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares heavily.

What Does ZIM Integrated Shipping Services' P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of ZIM Integrated Shipping Services' analyst forecasts revealed that its even shakier outlook against the industry is contributing factor to why its P/S is so low. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Although, we would be concerned whether the company can even maintain this level of performance under these tough industry conditions. For now though, it's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - ZIM Integrated Shipping Services has 2 warning signs (and 1 which is significant) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if ZIM Integrated Shipping Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ZIM

ZIM Integrated Shipping Services

Provides container shipping and related services in Israel and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives