- United States

- /

- Transportation

- /

- NYSE:YMM

Can Full Truck Alliance's (YMM) AI Investments Offset Margin Pressures in Digital Logistics?

Reviewed by Sasha Jovanovic

- Full Truck Alliance recently reported mixed third-quarter results, with revenue rising to ¥3.36 billion but net income and earnings per share declining compared to the prior year, while also providing cautious fourth quarter guidance in the range of ¥3.08 billion to ¥3.18 billion in total net revenues.

- The company's acquisition of Giga.AI and subsequent enhancements in AI capabilities have contributed to record user numbers and a sharp increase in fulfilled orders, underscoring a growing focus on technological innovation in digital logistics solutions.

- We'll now assess how Full Truck Alliance's AI-driven platform advances and robust order growth impact the company's investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Full Truck Alliance Investment Narrative Recap

To be a shareholder in Full Truck Alliance, you need to believe in the company’s ability to scale China’s digital logistics market through AI-driven innovation and network effects, amid competitive and regulatory pressures. While the recent mixed third-quarter results and cautious fourth-quarter guidance reflected some immediate operational challenges, they do not materially change the key near-term catalyst: strong order growth from digital transformation. However, rising user acquisition costs and sensitivity to fee increases remain the most important risks to monitor.

Among the latest announcements, the Q4 guidance stands out, revenues excluding freight brokerage are expected to grow by 17.1% to 22.5% year-over-year. This segment’s resilience highlights order growth and adoption of technology-driven services as the main drivers behind the company’s growth profile, supporting optimism about platform scaling and value-added services despite ongoing margin pressures from increased marketing expenses.

In contrast, investors should be aware that a continued rise in user acquisition costs could...

Read the full narrative on Full Truck Alliance (it's free!)

Full Truck Alliance is projected to reach CN¥18.1 billion in revenue and CN¥8.7 billion in earnings by 2028. This outlook assumes a 14.2% annual revenue growth rate and an earnings increase of CN¥4.5 billion from the current earnings of CN¥4.2 billion.

Uncover how Full Truck Alliance's forecasts yield a $15.29 fair value, a 40% upside to its current price.

Exploring Other Perspectives

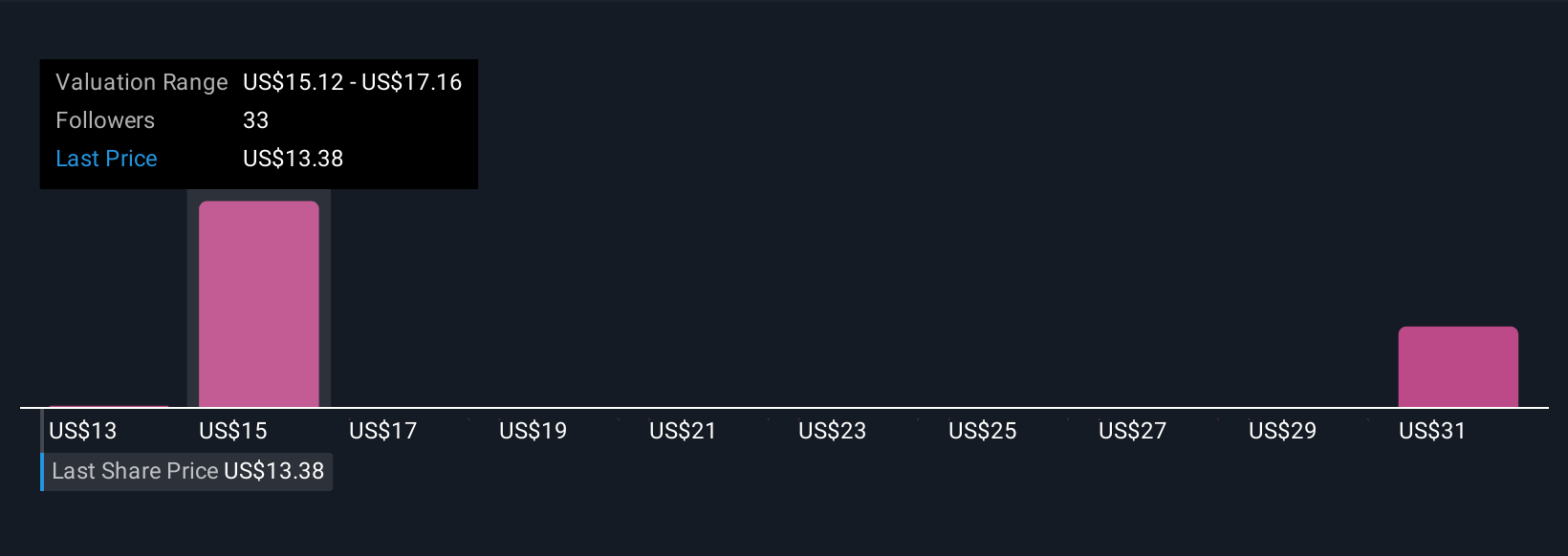

Simply Wall St Community contributors set fair value for Full Truck Alliance between CN¥13.09 and CN¥35.19 across 5 unique opinions. While order growth is robust, diverging views reflect ongoing debate about how margin pressures from marketing and cost sensitivity might affect future returns.

Explore 5 other fair value estimates on Full Truck Alliance - why the stock might be worth over 3x more than the current price!

Build Your Own Full Truck Alliance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Full Truck Alliance research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Full Truck Alliance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Full Truck Alliance's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YMM

Full Truck Alliance

Operates a digital freight platform that connects shippers with truckers to facilitate shipments across distance ranges, cargo weights, and types in the People’s Republic of China and Hong Kong.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives