- United States

- /

- Transportation

- /

- NYSE:XPO

Assessing XPO (XPO) Valuation as Shares Bounce 3% Following Sideways Month

Reviewed by Simply Wall St

See our latest analysis for XPO.

XPO’s recent 3% share price jump stands out against a broader year-to-date climb, even as the company’s one-year total shareholder return is down 7.5%. Momentum seems to be building again this quarter, suggesting that investor sentiment around its long-term outlook may be shifting.

If this latest move has you curious about what else might be gaining traction, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

That leaves investors weighing the latest uptick against XPO’s fundamentals, wondering if the recent gains reveal an undervalued stock with more room to run, or if the market has already priced in what comes next.

Most Popular Narrative: Fairly Valued

With XPO’s fair value pegged at $141.52 according to the most widely followed narrative and shares closing at $140.77, the stock appears very close to consensus fair value. This indicates little perceived mispricing after weighing recent operational improvements and forecasts.

XPO's ongoing investments in AI-powered optimization and proprietary technology are driving measurable productivity gains, even in a weak freight market, by reducing linehaul miles, improving labor efficiency, and cutting maintenance costs. As industry shipping volumes recover and these technology benefits compound, this should drive sustained margin expansion and higher net income.

Want to know what underpins this barely-there valuation gap? It is not just technology upgrades. Behind the scenes, ambitious projections and margin leaps give this narrative its edge. Could these key assumptions be XPO’s secret to justifying today’s price and beyond? Don’t miss the detailed breakdown that is sparking debate among market-watchers.

Result: Fair Value of $141.52 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent freight demand weakness and rising labor costs could quickly undermine optimism. These factors act as key risks to the bullish narrative for XPO.

Find out about the key risks to this XPO narrative.

Another View: Valuation Based on Earnings Multiple

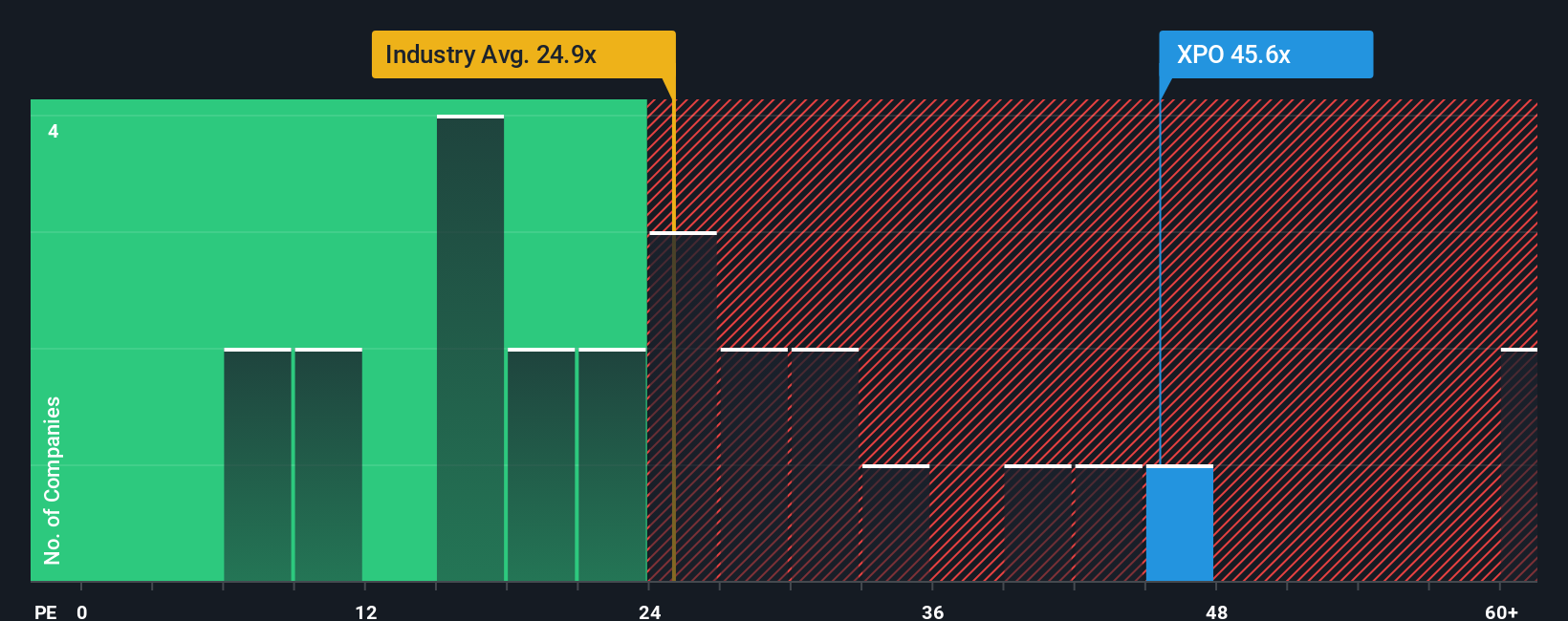

Taking a closer look at XPO’s price-to-earnings ratio, the stock trades at 49.8x, which is substantially higher than both its industry average of 26.5x and the peer average of 30.4x. The market’s current multiple is also well above the fair ratio of 19.5x, suggesting limited upside unless earnings exceed expectations. Does this stretch signal overconfidence or is there more beneath the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own XPO Narrative

If you think there is another side to the story or want to dive deeper into the numbers yourself, you can put together your own view in just a few minutes. Do it your way

A great starting point for your XPO research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for the obvious when smarter opportunities await? Use Simply Wall Street’s research tools to pinpoint stocks that match your goals and could change your portfolio’s trajectory. You could be just one strategic move away from your next big win.

- Secure reliable income streams by checking out these 16 dividend stocks with yields > 3%, which consistently yield above 3%, so you never miss a payout opportunity.

- Position yourself at the forefront of digital innovation by tapping into the power of these 82 cryptocurrency and blockchain stocks as the next generation of finance takes shape.

- Uncover hidden gems with strong cash flows and growth prospects among these 870 undervalued stocks based on cash flows, before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPO

XPO

Provides freight transportation services in the United States, North America, France, the United Kingdom, and rest of Europe.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives