- United States

- /

- Transportation

- /

- NYSE:USX

Did You Miss U.S. Xpress Enterprises' (NYSE:USX) 43% Share Price Gain?

U.S. Xpress Enterprises, Inc. (NYSE:USX) shareholders might be concerned after seeing the share price drop 18% in the last quarter. But that doesn't change the reality that over twelve months the stock has done really well. To wit, it had solidly beat the market, up 43%.

Check out our latest analysis for U.S. Xpress Enterprises

While U.S. Xpress Enterprises made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last twelve months, U.S. Xpress Enterprises' revenue grew by 0.5%. That's not a very high growth rate considering it doesn't make profits. The modest growth is probably largely reflected in the share price, which is up 43%. While not a huge gain tht seems pretty reasonable. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

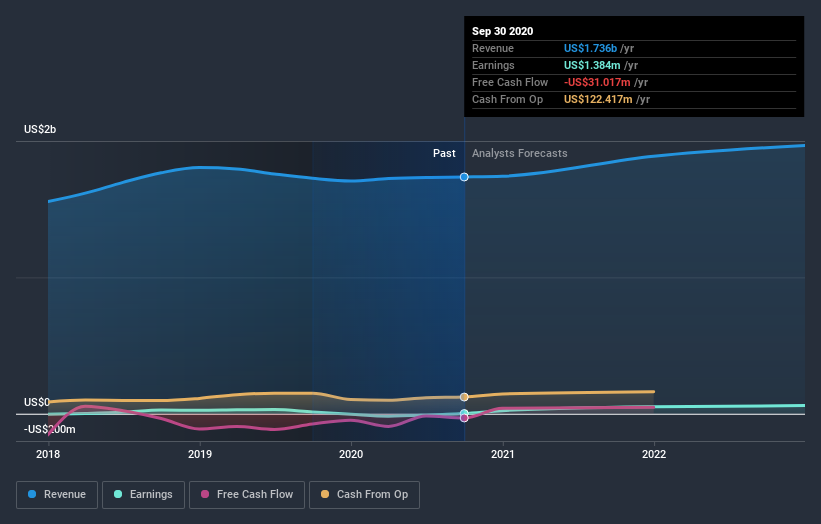

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So it makes a lot of sense to check out what analysts think U.S. Xpress Enterprises will earn in the future (free profit forecasts).

A Different Perspective

U.S. Xpress Enterprises boasts a total shareholder return of 43% for the last year. We regret to report that the share price is down 18% over ninety days. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. It's always interesting to track share price performance over the longer term. But to understand U.S. Xpress Enterprises better, we need to consider many other factors. Even so, be aware that U.S. Xpress Enterprises is showing 4 warning signs in our investment analysis , and 1 of those can't be ignored...

U.S. Xpress Enterprises is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade U.S. Xpress Enterprises, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:USX

U.S. Xpress Enterprises

U.S. Xpress Enterprises, Inc. operates as an asset-based truckload carrier primarily in the United States.

Slightly overvalued with worrying balance sheet.

Market Insights

Community Narratives