- United States

- /

- Logistics

- /

- NYSE:UPS

What United Parcel Service (UPS)'s Healthcare Pivot and Safety Probe Mean for Shareholders

Reviewed by Sasha Jovanovic

- United Parcel Service (UPS) recently completed its acquisition of Andlauer Healthcare and has undertaken significant operational shifts, including grounding its MD-11 fleet following a fatal crash and announcing a 5.9% rate increase effective December 22.

- Amid these changes, UPS is undergoing a substantial transformation by reducing its reliance on Amazon, executing large-scale cost-cutting initiatives, and investing in higher-margin healthcare logistics, while being subject to a regulatory investigation after the crash.

- We'll assess how the ongoing safety probe and UPS's focus on healthcare logistics may alter the company's investment outlook going forward.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

United Parcel Service Investment Narrative Recap

For UPS shareholders, belief in the company centers on its ability to transform through higher-margin logistics, reducing reliance on Amazon and aggressively cutting costs. The recent grounding of the MD-11 fleet after a fatal crash places near-term focus on regulatory scrutiny and potential operational disruption, which now stands as the key risk overshadowing the benefits of rate increases and network streamlining.

Among recent announcements, UPS’s acquisition of Andlauer Healthcare directly ties into its effort to grow in specialized, higher-margin sectors. This deal reinforces the company’s focus on healthcare logistics as a catalyst, offering revenue diversity and partially offsetting headwinds from traditional e-commerce and Amazon volume reductions.

By contrast, investors should be alert to the possibility that the ongoing safety investigation could expose UPS to new regulatory or operational headwinds that...

Read the full narrative on United Parcel Service (it's free!)

United Parcel Service's narrative projects $94.5 billion revenue and $7.1 billion earnings by 2028. This requires 1.5% yearly revenue growth and a $1.4 billion increase in earnings from the current $5.7 billion.

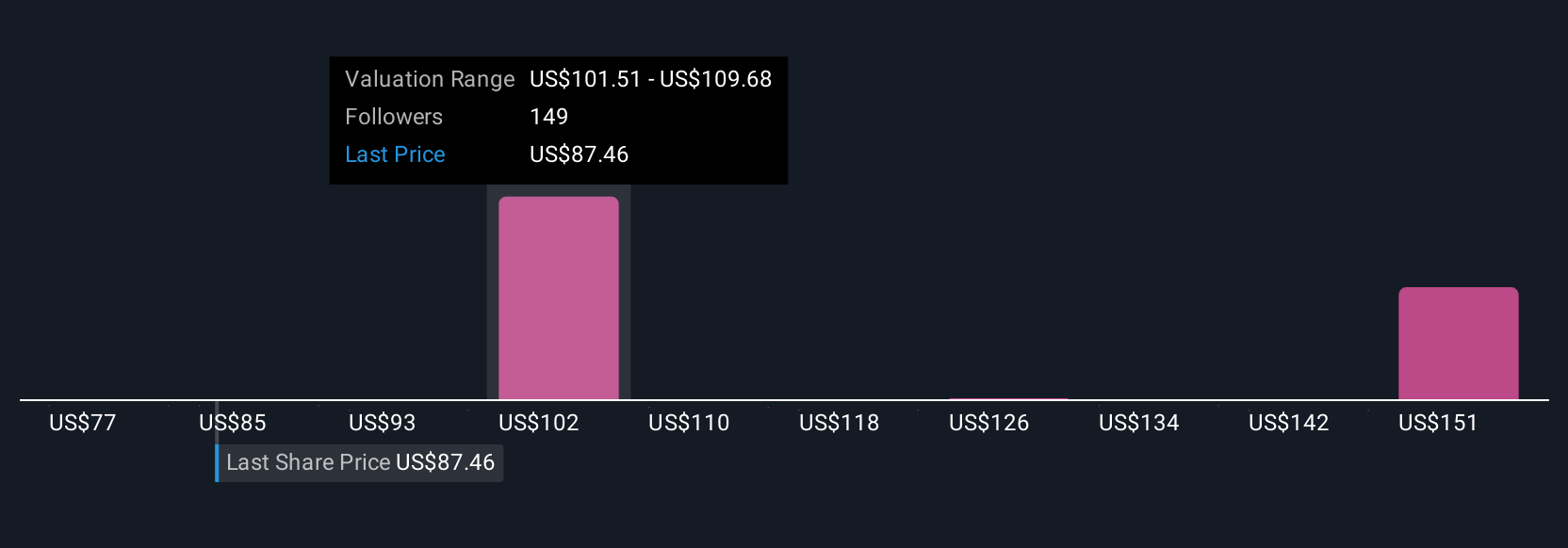

Uncover how United Parcel Service's forecasts yield a $100.50 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Compared to the consensus view, the most optimistic analysts recently saw UPS’s annual revenue reaching US$96.7 billion with earnings up to US$8 billion by 2028. However, their narrative focused on rapid automation and global network gains, and may change if recent safety investigations and fleet disruptions impact operating costs or margins. You should know that analyst opinions vary widely, so it’s worth considering how these forecasts might shift based on unfolding events.

Explore 21 other fair value estimates on United Parcel Service - why the stock might be worth as much as 42% more than the current price!

Build Your Own United Parcel Service Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Parcel Service research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free United Parcel Service research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Parcel Service's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UPS

United Parcel Service

A package delivery and logistics provider, offers transportation and delivery services.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success