- United States

- /

- Logistics

- /

- NYSE:UPS

Is UPS a Hidden Opportunity After a 33% Drop in the Past Year?

Reviewed by Bailey Pemberton

If you’ve been eyeing United Parcel Service shares and wondering whether now’s the right time to act, you are definitely not alone. With shipping volumes often reflecting wider economic chatter and consumer demand, watching UPS stock isn’t just about tracking a delivery giant; it’s about keeping a pulse on some big-picture market trends too. Over the past week, UPS edged up by 1.6%, and in the last 30 days, it's notched a modest gain of 3.1%. But stepping back to the bigger picture, the stock is still down 29.7% year-to-date and a hefty 33.1% over the past year, evidence that there’s been a clear shift in how investors are weighing the company's risks and opportunities.

These recent moves have unfolded against a backdrop of ongoing changes in the shipping industry, from new logistics partnerships to evolving consumer patterns in e-commerce. UPS has also been in the news for its strategic tweaks, including adjustments to its own service portfolio to keep up with competitors and changing client needs. While not all of these headlines have directly moved the stock in a meaningful way, they help shape investor sentiment and are worth considering as you think about where UPS should be valued now.

On that note, when it comes to valuation, the numbers put UPS in interesting territory: the company scores a 5 out of a possible 6 on the major tests for being undervalued. We’ll walk through those valuation approaches in detail next, and stick around, because there’s an even more insightful method for sizing up what the stock is truly worth, which we'll dig into before we wrap up.

Why United Parcel Service is lagging behind its peers

Approach 1: United Parcel Service Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and discounting them back to today's value. Put simply, it answers the question, "How much are all of UPS's expected future cash flows worth in today's dollars?"

For United Parcel Service, the current Free Cash Flow sits at approximately $2.75 Billion. According to analyst estimates and further projections, this figure is expected to steadily climb, reaching about $7.05 Billion by 2029. While analysts provide direct forecasts for the next few years, projections beyond that are based on estimated trends in UPS's growth and efficiency, calculated by third parties like Simply Wall St.

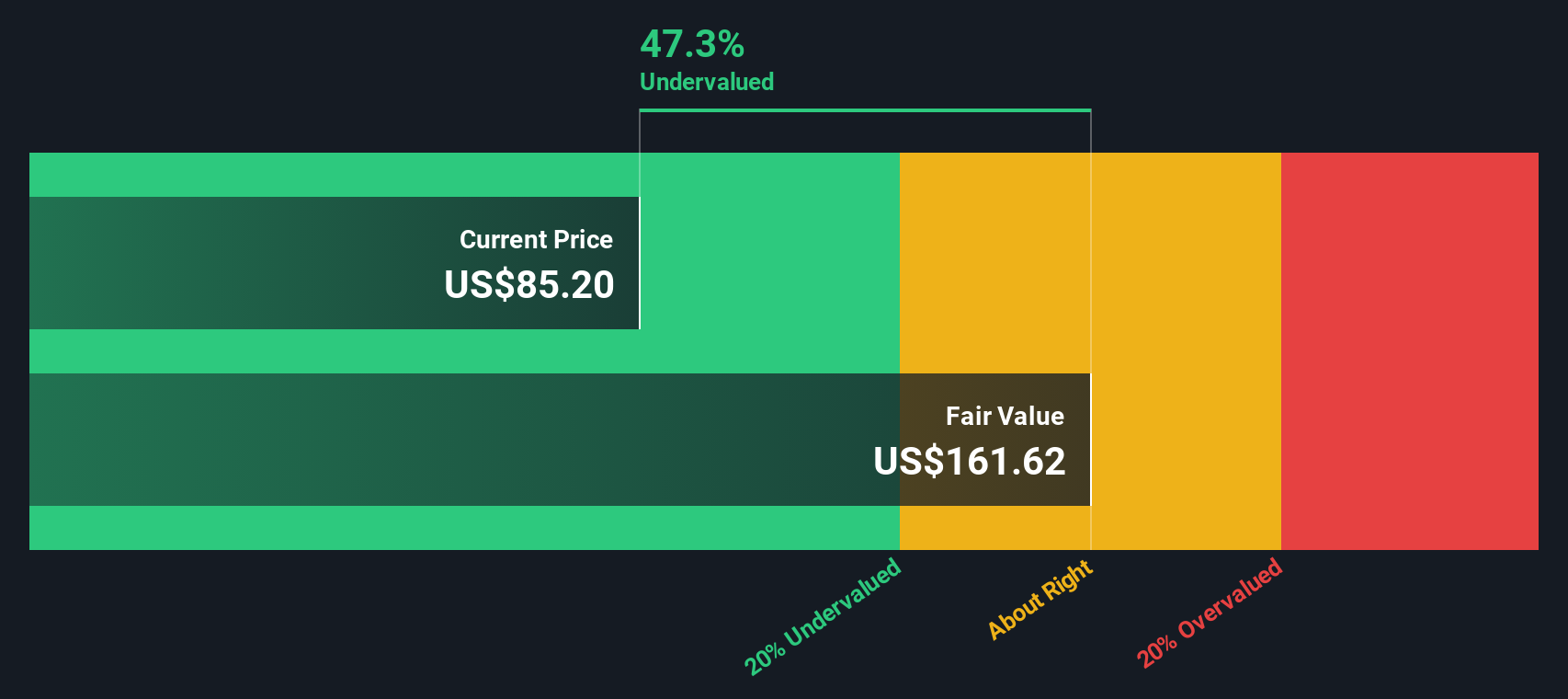

Based on this analysis, the estimated intrinsic value of UPS shares comes in at $163.55. This is notable because, according to the DCF calculation, the stock appears to be trading at a 46.8% discount to its true value. In other words, the current market price may significantly undervalue UPS when focusing only on its long-term cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests United Parcel Service is undervalued by 46.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: United Parcel Service Price vs Earnings

For profitable businesses like UPS, the Price-to-Earnings (PE) ratio is often considered the most meaningful valuation multiple. The PE ratio gives investors a snapshot of how much they are paying for each dollar of current earnings. This is especially relevant when the company is reliably generating profits and returning value through earnings growth.

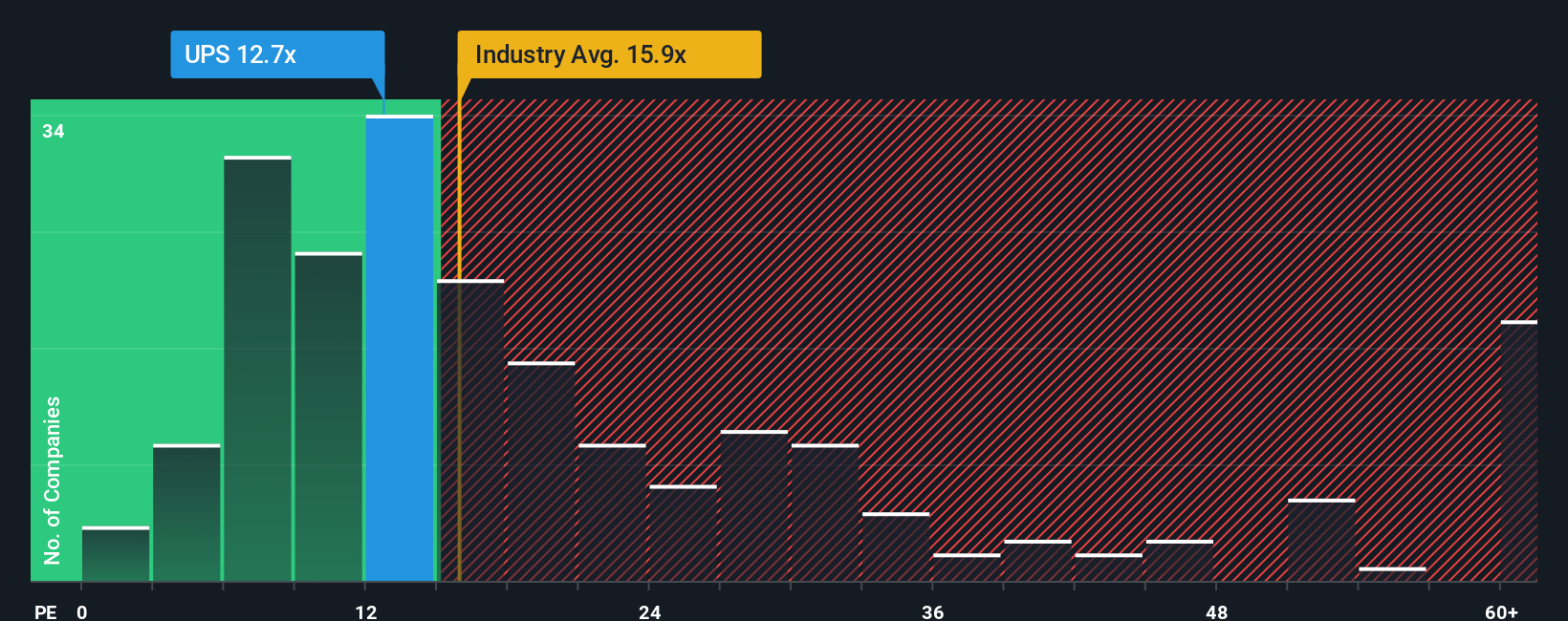

When evaluating whether a PE ratio is "fair," it is important to take into account both expected growth and risks. A higher growth outlook or lower risk typically justifies a higher PE multiple. In contrast, stagnant growth or added uncertainty brings that appropriate ratio down. Comparing with benchmarks, UPS currently trades at 12.87 times earnings, notably below the logistics industry average of 16.08 times and also under the peer group average of 18.16 times. At first glance, this might suggest the stock is attractively valued relative to its sector.

A more nuanced approach is the Fair Ratio, calculated by Simply Wall St. This proprietary measure sets an expected multiple for UPS (here, 17.33 times) by weighing factors unique to the company, such as growth prospects, earnings quality, industry context, profit margins, and market capitalization. Unlike a simple comparison with peers or industry averages, the Fair Ratio attempts to pinpoint what a reasonable market price should be based on UPS's own situation.

Given the Fair Ratio of 17.33 times compared to UPS’s current multiple of 12.87 times, there is a meaningful discount. This suggests that, based on core fundamentals and forward prospects, UPS shares are currently undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your United Parcel Service Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative connects your unique perspective on a company—what you believe about its strategy, growth, and risks—with a concrete financial forecast, resulting in your own fair value for the stock.

Instead of relying only on traditional ratios or analyst reports, Narratives let you explain the “story” behind your numbers: your assumptions about United Parcel Service’s earnings, margins, and future prospects, as well as what you think could go right or wrong. This approach is designed for every investor. On Simply Wall St’s Community page, millions of users can conveniently build, share, and update their Narratives as new information, such as earnings releases or market news, emerges.

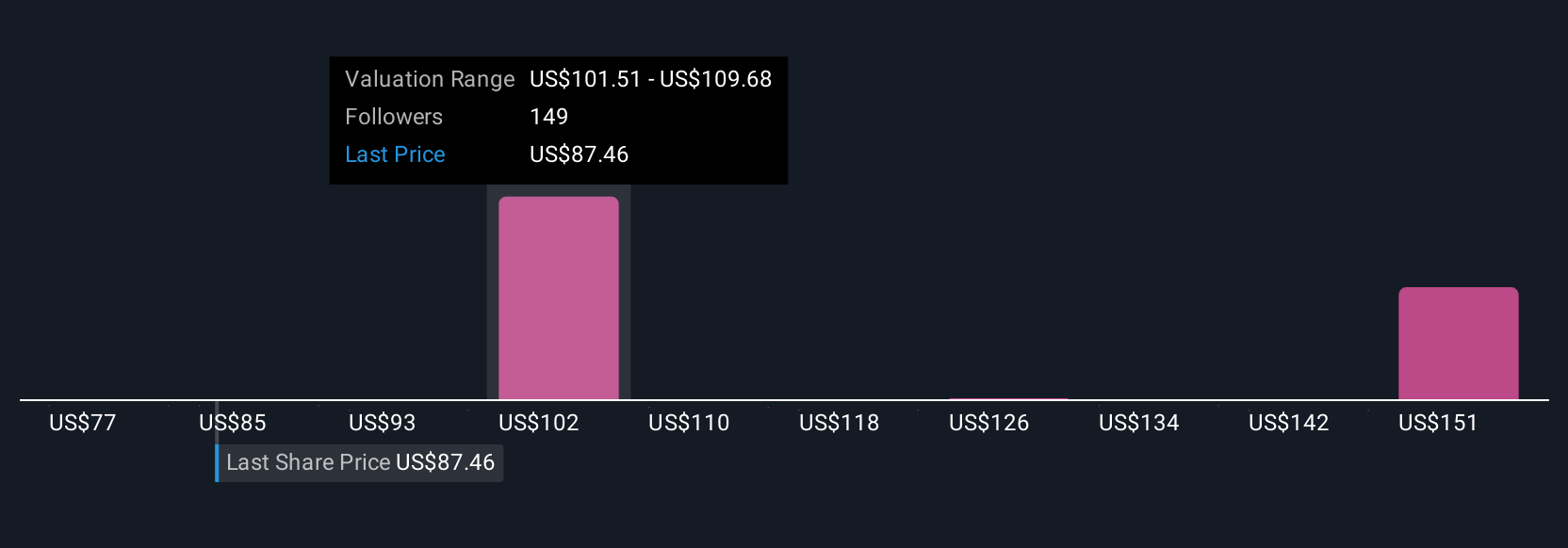

Narratives help you decide when to buy or sell by comparing your Fair Value to the current share price, making your investment process clearer and more personal. For example, some investors currently see UPS’s fair value as high as $132 per share, based on strong automation momentum and expanding healthcare logistics. Others estimate it as low as $75, given concerns about cost pressures and slowing revenue. Narratives flex with the market, so as new developments unfold, your investment view stays relevant and up to date, allowing you to make smarter decisions with confidence.

Do you think there's more to the story for United Parcel Service? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UPS

United Parcel Service

A package delivery and logistics provider, offers transportation and delivery services.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives