- United States

- /

- Transportation

- /

- NYSE:UBER

Uber Technologies (UBER) Expands SNAP EBT Options With New Retail Partnerships

Reviewed by Simply Wall St

Uber Technologies (UBER) recently announced the expansion of its Uber Eats segment to include more grocery and convenience stores accepting SNAP EBT payments, reflecting a commitment to enhancing food accessibility. This was concurrent with a 26% increase in Uber's share price over the last quarter. In light of these developments, the company's significant earnings growth and strategic expansion efforts across various sectors, including partnerships and technological advancements, could have added weight to its upward trajectory. Market influences, such as overall stock volatility and sector-specific trends, provided a backdrop that either supported or countered these decisive moves.

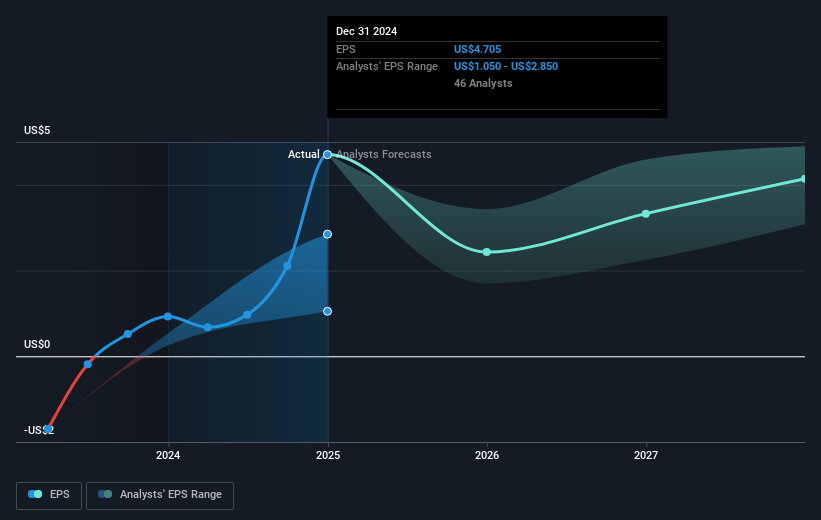

Uber Technologies' recent announcement about expanding its Uber Eats segment to include grocery stores accepting SNAP EBT payments is a sign of the company's commitment to food accessibility, potentially driving user growth and increasing market penetration. This move can enhance Uber's revenue streams as it taps into a broader customer base, particularly benefiting from government-supported programs. However, while earnings forecasts involve a projected decline over the next three years due to investments and competition, the integration of such initiatives may provide a gradual boost to earnings stability.

Over the last three years, Uber’s share price achieved a total return of 306.75%. Relative to the US Transportation industry's performance over the past year, Uber notably outperformed, with the industry returning just 4.4%. This longer-term success highlights Uber's market resilience and strong growth trajectory, despite industry volatility and the broader economic challenges impacting competitors.

With a current share price of US$92.21, just under the analyst consensus price target of US$98.50, it implies a modest discount of approximately 6.82%, suggesting that analysts view the stock as close to fair value. The divergence between Uber's current market valuation and analysts’ expectations mainly hinges on assumptions of future revenue growth and earnings power, with varying projections reflecting uncertainty in global market expansion and AV development impacts.

Understand Uber Technologies' track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives