- United States

- /

- Transportation

- /

- NYSE:UBER

Uber Technologies (UBER) Expands Retail Reach with Dollar Tree Partnership Across 9,000 Stores

Reviewed by Simply Wall St

Uber Technologies (UBER) experienced a notable price movement of 14% over the last quarter, bolstered by strategic partnerships enhancing its market presence. The addition of nearly 9,000 Dollar Tree stores to the Uber Eats platform on August 28 expanded the company's retail footprint across suburban and rural America. Another key partnership with Dollar General further diversified Uber’s offerings to over 14,000 locations, emphasizing convenience and affordability. While these endeavors reinforced Uber's retail expansion, the overall market's upward trajectory and continued positive economic indicators may have also buoyed the company's stock performance.

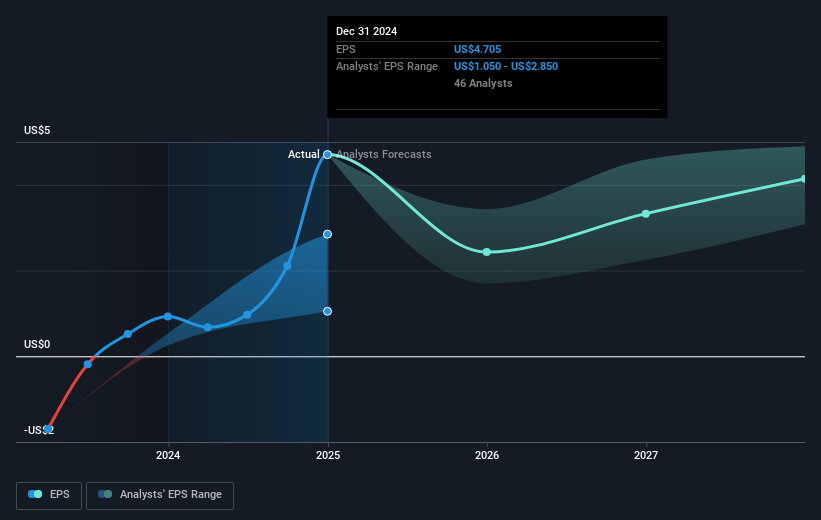

The recent partnerships with Dollar Tree and Dollar General are poised to influence Uber Technologies' broader narrative by potentially increasing its retail customer base and diversifying its offerings. This expansion into new retail locations may contribute positively to revenue growth and customer engagement, reinforcing Uber's existing strategies in user base expansion and product diversification. Such moves could fortify its market presence, possibly supporting future revenue and earnings forecasts, despite analysts' expectations of a decline in profit margins.

Over a three-year period, Uber's shareholders saw a total return of 231.81%, reflecting substantial growth beyond the performance of the US Transportation industry, which returned 6.2% over the past year. This performance also exceeded the broader US market's 17.2% return in the same annual timeframe.

The current share price of US$95.96 is approaching the consensus analyst price target of US$106.14, suggesting a potential upside. However, the price target reflects varying opinions among analysts, with estimates ranging from US$82.00 to US$150.00. The company's ongoing investments and competitive positioning are critical factors that investors might consider when evaluating its price movement in relation to the forecasted target.

Assess Uber Technologies' future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives