- United States

- /

- Transportation

- /

- NYSE:UBER

Uber Technologies (NYSE:UBER) shareholders have earned a 23% CAGR over the last three years

It hasn't been the best quarter for Uber Technologies, Inc. (NYSE:UBER) shareholders, since the share price has fallen 16% in that time. But don't let that distract from the very nice return generated over three years. After all, the share price is up a market-beating 86% in that time.

So let's assess the underlying fundamentals over the last 3 years and see if they've moved in lock-step with shareholder returns.

View our latest analysis for Uber Technologies

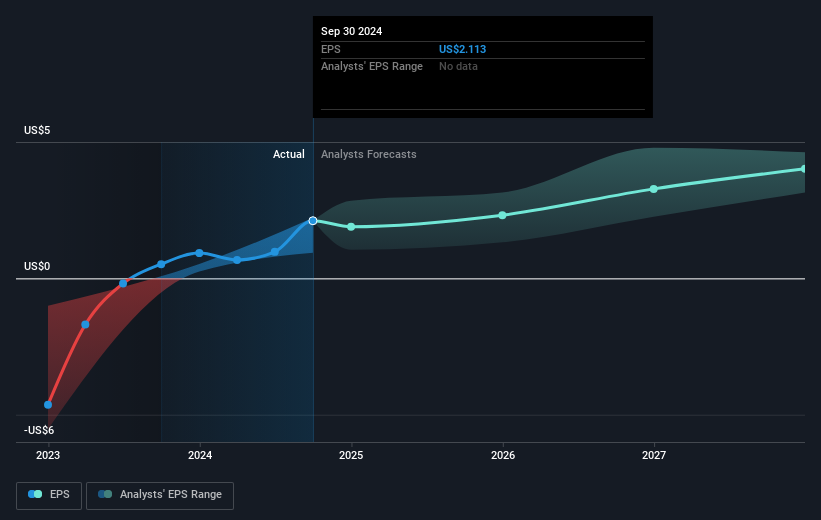

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Uber Technologies became profitable within the last three years. That would generally be considered a positive, so we'd expect the share price to be up.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Uber Technologies has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Uber Technologies shareholders are up 4.3% for the year. But that was short of the market average. If we look back over five years, the returns are even better, coming in at 13% per year for five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. It's always interesting to track share price performance over the longer term. But to understand Uber Technologies better, we need to consider many other factors. Even so, be aware that Uber Technologies is showing 2 warning signs in our investment analysis , you should know about...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives