- United States

- /

- Transportation

- /

- NYSE:UBER

Is Uber Stock Still a Value Opportunity After Latest Global Expansion News?

Reviewed by Bailey Pemberton

- Ever wondered if Uber Technologies is actually worth its current price, or if there is more value hidden in the stock than meets the eye?

- Uber’s stock has seen significant momentum, gaining 45.3% year-to-date and 217.8% over the past three years, despite a slight recent pullback.

- Recent headlines highlight Uber’s continued expansion efforts, with the company announcing a fresh partnership with businesses to broaden delivery services and deepen its presence across global markets. These strategic moves have fueled investor interest and offer important clues about where the stock’s price could head next.

- On our valuation checklist, Uber scores a perfect 6 out of 6, signaling the market might still be underestimating its potential. Let’s break down what drives that score using several common valuation methods, and stick around because we will show you an additional way to make sense of what Uber is really worth.

Approach 1: Uber Technologies Discounted Cash Flow (DCF) Analysis

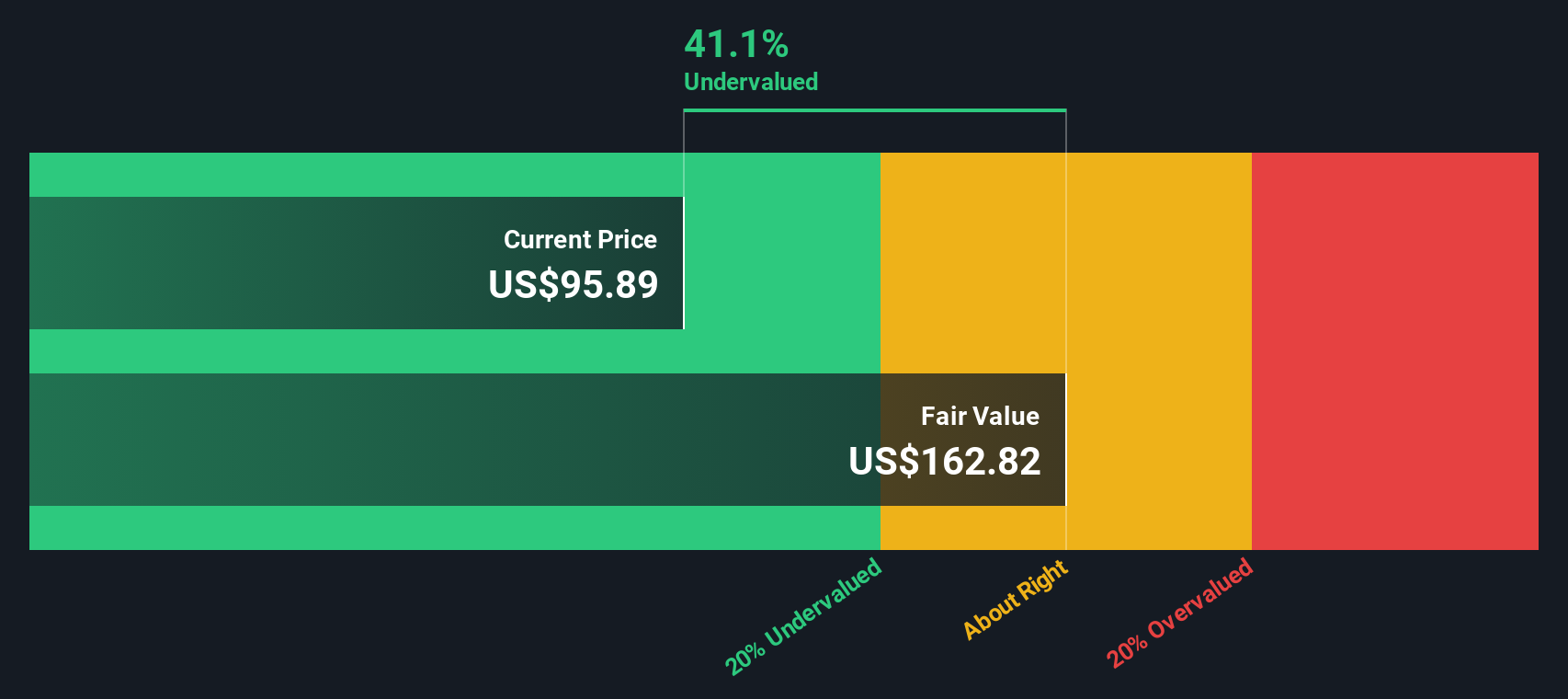

The Discounted Cash Flow (DCF) model estimates a company's worth by projecting its future cash flows and discounting them back to their present value using a required rate of return. This method aims to determine what Uber Technologies is truly worth based on its capacity to generate cash in the future.

Uber’s latest twelve months of Free Cash Flow stands at approximately $8.66 billion. Analyst forecasts suggest healthy annual growth over the next few years, projecting Free Cash Flow to rise to $16.51 billion by 2029. While these estimates are strongest in the next five years, projections beyond that are extrapolated to provide a full ten-year view. All figures are in US dollars.

Based on this DCF approach, the intrinsic value per share for Uber is calculated at $168.15. Compared to the current market price, this implies the stock is about 45.4% undervalued. This may indicate significant upside potential for investors willing to look beyond short-term volatility.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Uber Technologies is undervalued by 45.4%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

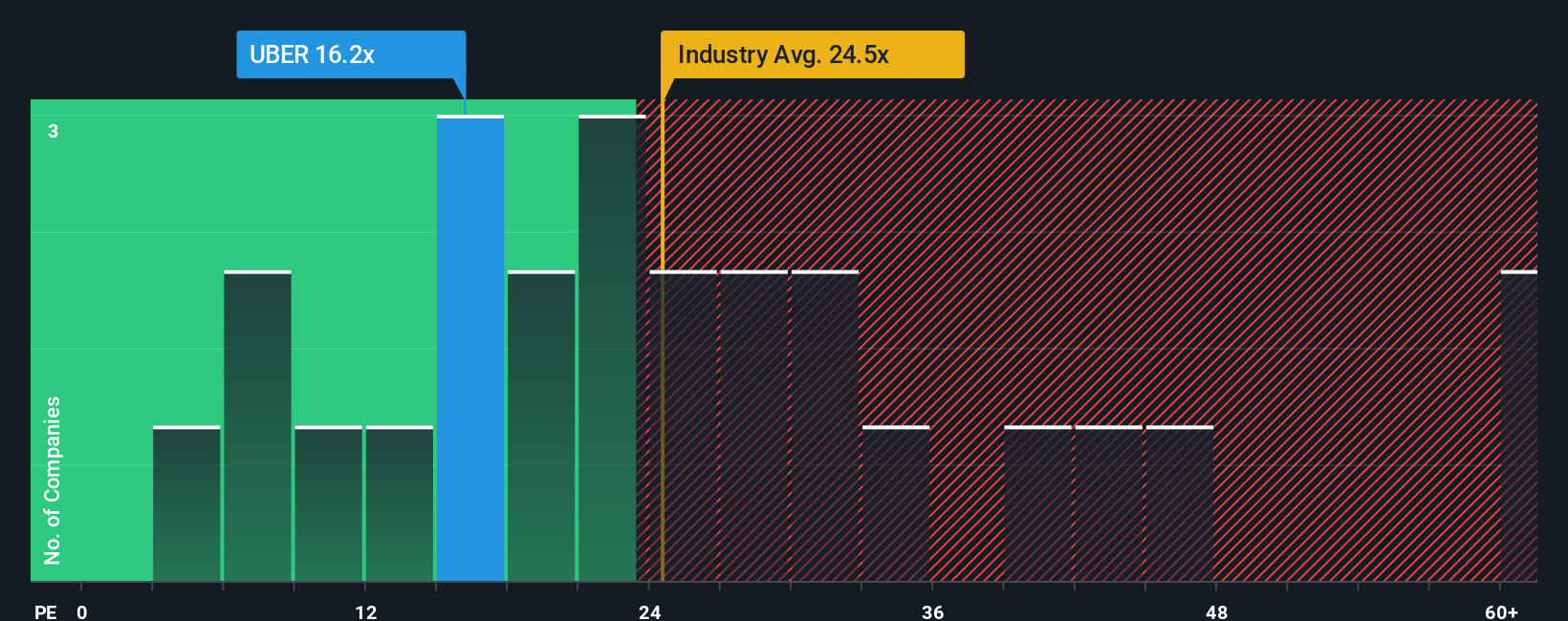

Approach 2: Uber Technologies Price vs Earnings

For profitable companies like Uber Technologies, the Price-to-Earnings (PE) ratio is a commonly used metric to assess value. The PE ratio shows how much investors are willing to pay for each dollar of earnings, making it especially useful for companies generating positive earnings and expected to sustain or grow them.

The "normal" or "fair" PE ratio for a stock depends on growth prospects and risk. Companies with higher expected earnings growth or lower risk typically deserve higher PE ratios, while those facing uncertainty or slower growth tend to trade at lower multiples.

Uber Technologies currently trades at a PE ratio of 11.5x. This is notably lower than the Transportation industry average of 26.8x and well below the peer average of 72.4x. At first glance, this suggests Uber is trading at an attractive discount compared to its competitors and the broader sector.

Simply Wall St's proprietary "Fair Ratio" for Uber stands at 13.5x. Unlike industry averages or peer comparisons, which can sometimes be distorted by outliers, the "Fair Ratio" is determined by factoring in Uber’s unique outlook on earnings growth, profitability, business model, market cap, and risks. This method provides a more nuanced picture of value tailored to Uber’s circumstances rather than relying solely on broad benchmarks.

Comparing Uber's current PE ratio of 11.5x to its Fair Ratio of 13.5x suggests that the stock may be undervalued. While industry and peer multiples indicate even greater upside, the Fair Ratio provides a grounded expectation that incorporates Uber’s fundamentals and risk profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1398 companies where insiders are betting big on explosive growth.

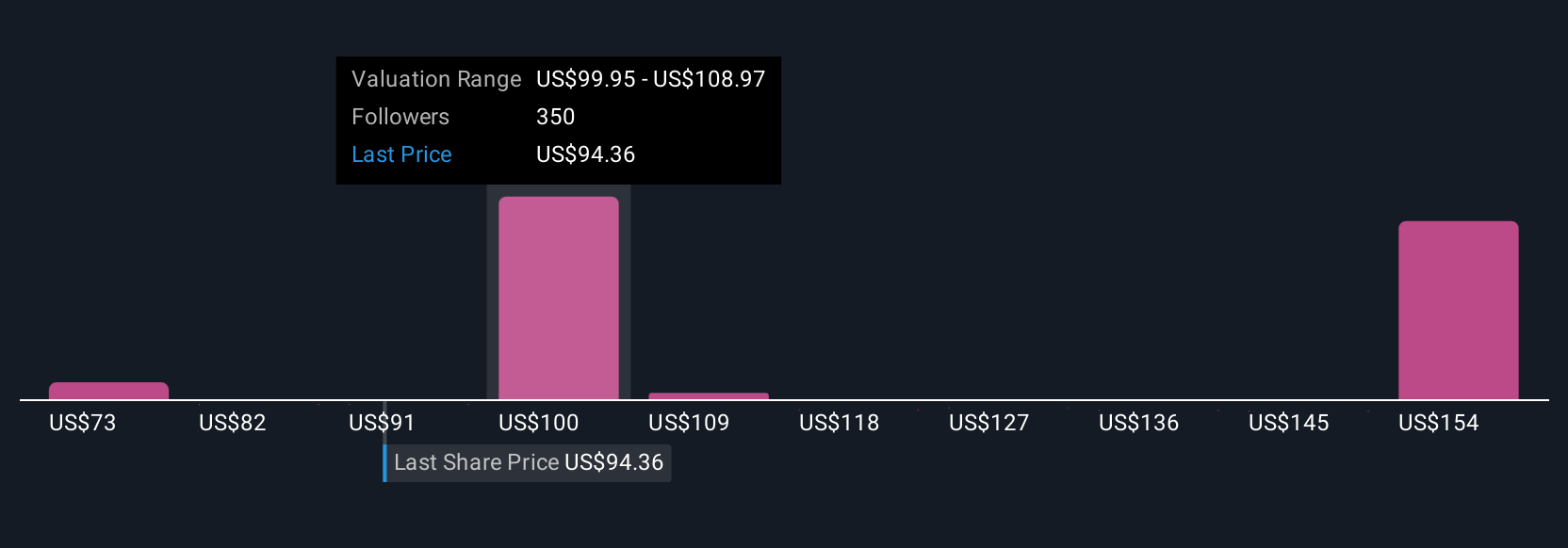

Upgrade Your Decision Making: Choose your Uber Technologies Narrative

Earlier we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your personal investment story; it's a way to connect your unique perspective on Uber Technologies with the numbers, such as future revenue, earnings, and margins, to create a fair value anchored in both facts and conviction.

Narratives seamlessly link the company's story (what you believe about Uber's opportunities, challenges, and future direction) to a financial model and fair value. This helps you bridge what's happening in the real world with what should show up in the share price. This method is easy and accessible, available directly through the Simply Wall St platform's Community page, where millions of investors shape and update Narratives for companies like Uber every day.

With Narratives, you can objectively compare your Fair Value against the current share price to decide whether it's time to buy or sell based on your personal outlook. As soon as fresh news or earnings drop, Narratives update dynamically so you're never caught off guard by new developments.

For example, one investor with a cautious view on Uber's growth and profitability might set a fair value of $75 per share, while another who believes in transformative technology and robust user growth could support a fair value as high as $150 per share.

For Uber Technologies, we’ll make it really easy for you with previews of two leading Uber Technologies Narratives:

- 🐂 Uber Technologies Bull Case

Fair Value Estimate: $108.88

Share is 15.7% undervalued versus latest close

Projected Revenue Growth: 14.7%

- Strong revenue growth and retention driven by expanding user base, cross-platform integration, and targeted promotions.

- Strategic investments in autonomous vehicles and high-margin services enhance profitability and competitive edge, but require continued execution.

- Risks include high capital intensity, fierce competition, and regulatory challenges. These are offset by consensus analyst price target of 10% above current market.

- 🐻 Uber Technologies Bear Case

Fair Value Estimate: $75.00

Share is 22.4% overvalued versus latest close

Projected Revenue Growth: 4.2%

- Despite robust quarterly results and improved cash flow, current market price significantly exceeds calculated fair value.

- 2024 to 2030 revenue growth anticipated to be modest; profitability gains may already be reflected in today’s price.

- Valuation emphasizes caution, suggesting a fair entry price below current levels due to risk of slower long-term growth.

Do you think there's more to the story for Uber Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives