- United States

- /

- Transportation

- /

- NYSE:UBER

Assessing the Value of Uber After Major Price Rally and Push Toward Profitability

Reviewed by Bailey Pemberton

If you have been watching Uber Technologies lately, you might be wondering if now is the right time to buy in, sit tight, or lock in some profits. The stock has been on quite a journey, up 1.9% in the past week and recovering from a dip of 3.8% over the past month. It is still riding high with a significant 48.9% gain year-to-date. Looking at a longer time frame, Uber has surged an impressive 242.1% over three years, illustrating that sometimes, patience pays off.

Recent news coverage has focused on Uber’s continued push toward profitability and its expansion into new markets. Investors have also noted regulatory developments that appear less risky than many had once feared, contributing to a shift in risk perception and potentially fueling some of this year’s strong rally. The company’s ability to handle both regulatory and competitive landscapes is a central topic for many market watchers, especially as ride-sharing and delivery continue their global growth.

With a valuation score of 5 out of 6 possible checks for undervaluation, Uber is showing some compelling signals for value-focused investors. Still, a score is just the starting point. In the next section, we will break down what goes into this assessment, looking at traditional and unconventional valuation methods. Stay tuned, as there is an insightful way to consider Uber’s true worth that will be revealed at the end of the article.

Approach 1: Uber Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future cash flows and discounting them back to today's dollars. For Uber Technologies, this approach uses a 2 Stage Free Cash Flow to Equity model, which extrapolates near-term and longer-term cash flows.

Currently, Uber reports Free Cash Flow of $8.5 Billion, a figure that has steadily increased as the business has scaled. Analysts forecast Uber’s Free Cash Flow to climb each year, reaching $16.8 Billion by 2029, with projections beyond 2029 derived from more generalized growth assumptions.

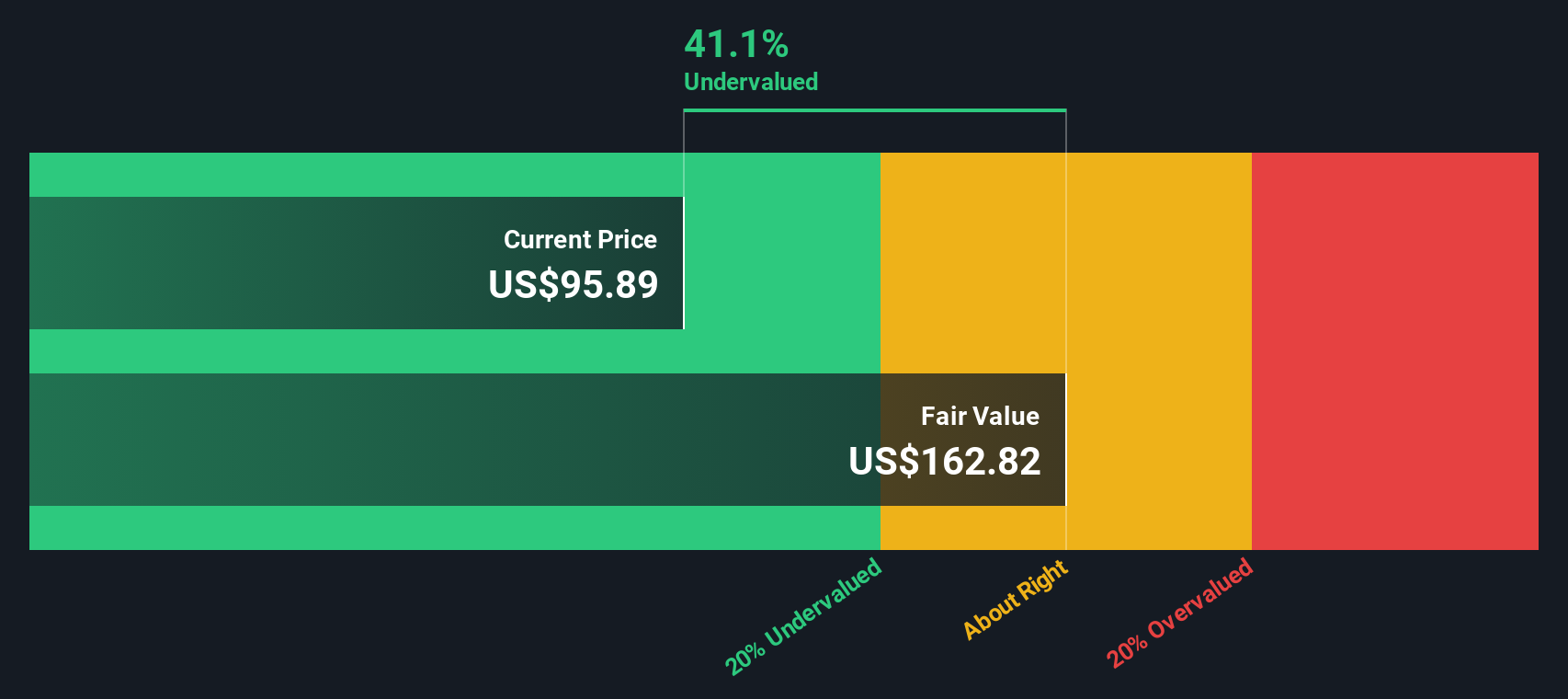

The DCF analysis results in an estimated intrinsic value of $170.60 per share. Compared to Uber's current market price, this signals an implied discount of 44.9 percent. In other words, the stock is considered 44.9 percent undervalued based on this rigorous projection of future cash generation.

This substantial discount suggests Uber’s shares are trading at a significant bargain, especially for those with a long investment horizon.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Uber Technologies is undervalued by 44.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Uber Technologies Price vs Earnings (PE)

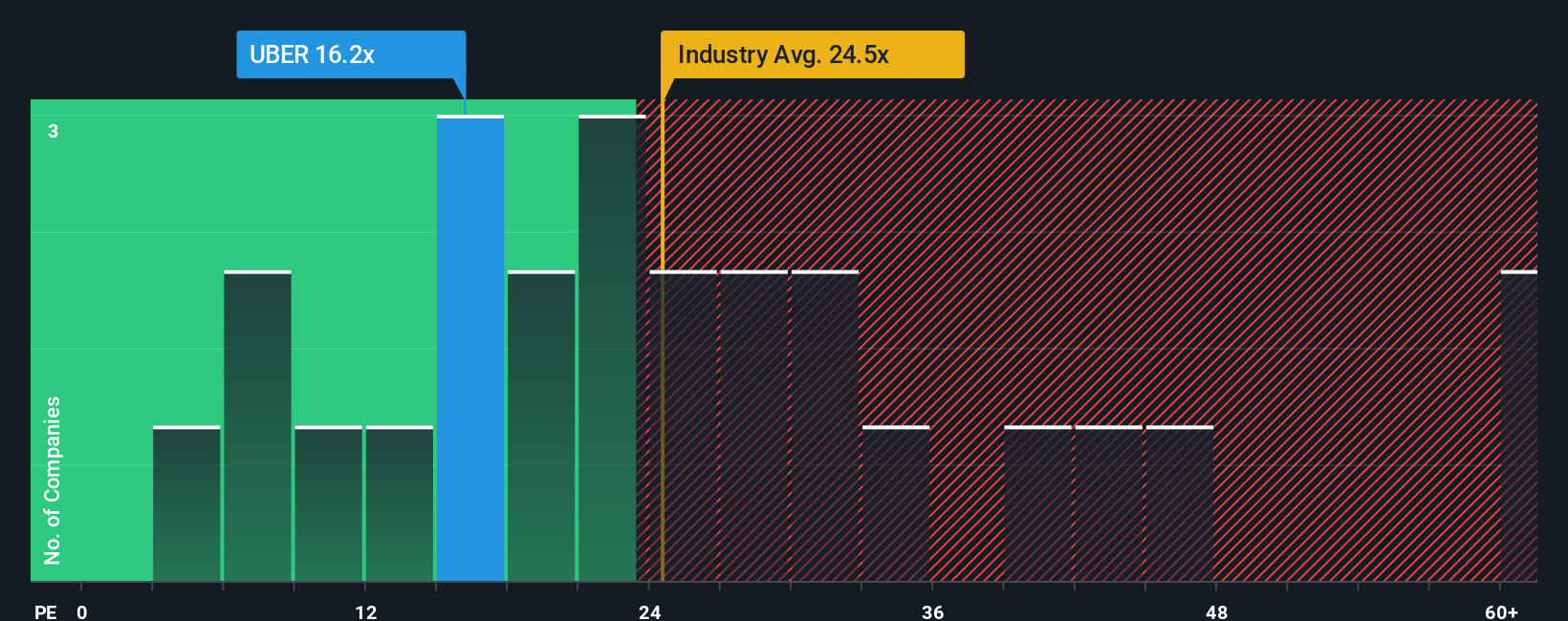

The price-to-earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies, as it relates a company’s current share price to its per-share earnings. For businesses like Uber Technologies that are moving steadily into profitability, the PE ratio can offer a straightforward perspective on whether investors are paying a reasonable amount for future earnings growth.

Growth expectations and risk both play a large role in what constitutes a "normal" or "fair" PE ratio. Faster-growing companies or those with lower perceived risk tend to receive higher PE ratios from the market. In contrast, slower-growing or higher-risk businesses are usually valued at lower multiples.

Currently, Uber trades at a PE ratio of 15.54x. This compares favorably to the Transportation industry average of 26.35x and a peer average of 38.23x, indicating that Uber’s stock costs less per dollar of earnings than many competitors. However, not all companies are created equal. Simply Wall St’s proprietary "Fair Ratio" adjusts this benchmark by considering Uber’s earnings growth prospects, industry position, profit margin, market cap, and risk profile, resulting in a Fair Ratio of 16.84x.

The Fair Ratio offers an improved perspective over simple peer or industry averages as it focuses on Uber’s own growth drivers, profitability, and risk factors. By weighing these elements, it highlights whether Uber deserves a valuation premium or discount compared to others in the sector.

Comparing the Fair Ratio (16.84x) with Uber’s current PE (15.54x), the stock appears to be modestly undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Uber Technologies Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple but powerful concept: it is your story about a company, connecting what you believe its future will look like to the numbers behind a financial forecast and, ultimately, a fair value.

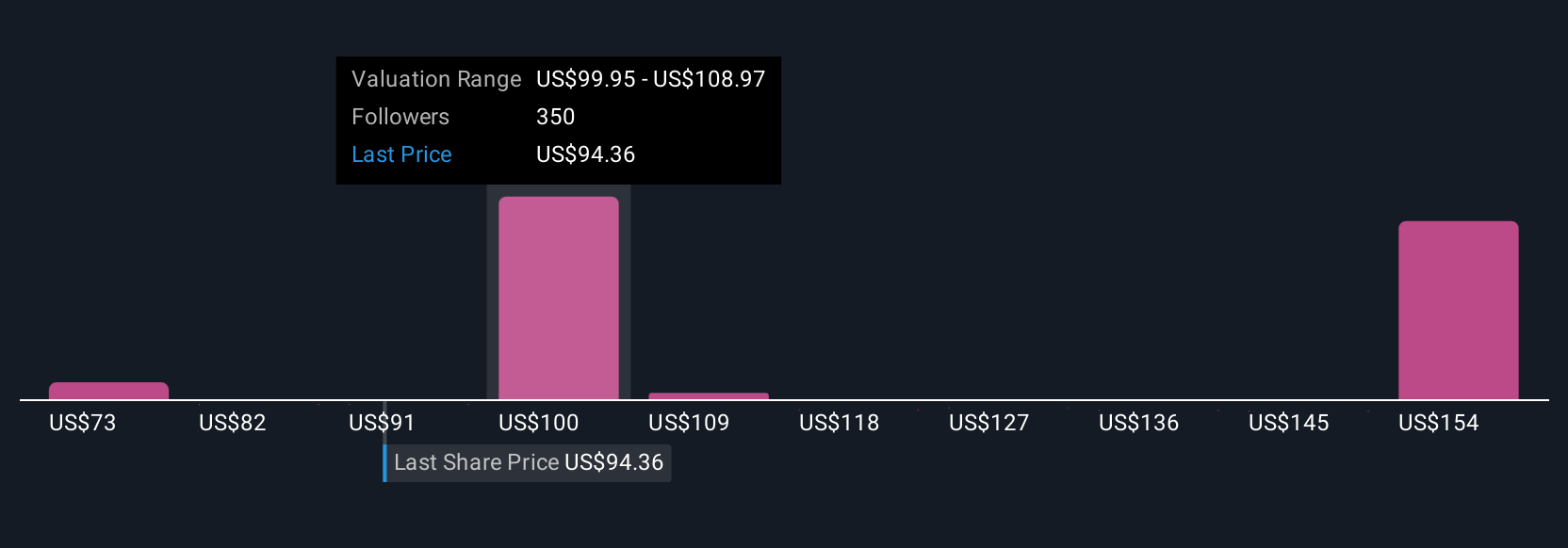

Instead of relying solely on rigid valuation models, Narratives let you combine your perspective on Uber’s revenue growth, margins, risks, or industry trends with your own assumptions about what the future holds. On Simply Wall St’s Community page, millions of investors use Narratives as an easy, accessible way to express their outlook and instantly see how their opinions translate into a fair value for the stock.

Narratives equip you to decide when to buy, hold, or sell by automatically comparing your calculated Fair Value to Uber’s current share price. Because they update dynamically with every major news story or quarterly result, your Narrative stays current and relevant even as the facts change.

For example, some investors see Uber’s fair value as low as $75 per share based on conservative forecasts and concerns about overvaluation, while the most optimistic Narrative places fair value above $108 per share, reflecting belief in aggressive growth, new opportunities, and expanding profit margins. Whatever your view, Narratives help ensure investment decisions are built on your story, not just the market’s.

For Uber Technologies however we'll make it really easy for you with previews of two leading Uber Technologies Narratives:

Fair Value: $108.52

Implied Undervalued: 13.3%

Revenue Growth Forecast: 14.6%

- Analysts believe urban expansion, cross-platform integration, and high-margin ancillary services will continue to drive strong growth and improve customer engagement for Uber.

- Strategic investments in autonomous vehicles and electrification are expected to enhance long-term profitability, though these bring risks related to capital intensity, competition, and operational complexity.

- The consensus price target of $106.43 is 10.3% above the current share price, reflecting expectations of robust future earnings. Analysts caution to cross-check assumptions given mixed analyst outlooks and sector uncertainties.

Fair Value: $75.00

Implied Overvalued: 25.3%

Revenue Growth Forecast: 4.2%

- While Uber shows excellent business fundamentals, including sustainable profitability and strong cash generation, the current share price offers no margin of safety and trades at a significant 40%+ premium to intrinsic value.

- 2025 revenue growth and margins are solid, yet future projections indicate that fair value may be much lower than today’s price. The estimated target entry is $65 to $75 per share.

- Bear case investors warn that, despite operational momentum, Uber's valuation has run ahead of fundamentals and long-term growth prospects, making it less attractive at current levels.

Do you think there's more to the story for Uber Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives