- United States

- /

- Airlines

- /

- NYSE:SRFM

Surf Air Mobility (SRFM): Exploring Valuation with Board Addition of Tech Executive Shawn Pelsinger

Reviewed by Kshitija Bhandaru

Surf Air Mobility (NYSE:SRFM) just named Shawn Pelsinger to its Board of Directors, effective October 8. Pelsinger brings years of experience in partnerships, aviation technology, and data-driven platforms. This appointment highlights the company's focus on tech-enabled growth strategies.

See our latest analysis for Surf Air Mobility.

Surf Air Mobility’s latest board move comes at a fascinating moment for the stock. While the share price has faced volatility this year, down 21.7% year-to-date, it recently delivered a standout one-year total shareholder return of 135%, reflecting renewed optimism around tech partnerships like SurfOS and strategic hires such as Pelsinger. Momentum is building as the company looks to grow its tech edge in transportation.

If this shift in leadership and approach interests you, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

Yet with the stock still trading well below analyst targets, investors may wonder if this recent momentum hints at an undervalued opportunity or if the market has already factored in Surf Air Mobility's future growth prospects.

Most Popular Narrative: 41.2% Undervalued

The most popular narrative places Surf Air Mobility’s fair value at $7.88, significantly above the last close price of $4.63. This sets the stage for bold growth assumptions that are tied directly to tech adoption and margin expansion.

Widespread digitization and adoption of app-driven travel is enabling Surf Air Mobility's software-first approach, including the commercial rollout of the SurfOS platform (powered by Palantir) in 2026. This is bringing new high-margin recurring revenue streams and improved customer acquisition efficiency, supporting both revenue and net margin expansion.

What is fueling such a leap in value? This narrative hints at a future where rapid revenue takeoff and a striking profit multiple power Surf Air Mobility’s potential. Want a closer look at these aggressive projections and the numbers that might support them? Dive in to uncover the playbook behind that lofty fair value.

Result: Fair Value of $7.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including the company’s heavy reliance on government contracts and the unproven commercialization of its SurfOS software platform.

Find out about the key risks to this Surf Air Mobility narrative.

Another View: Looking Through a Sales Lens

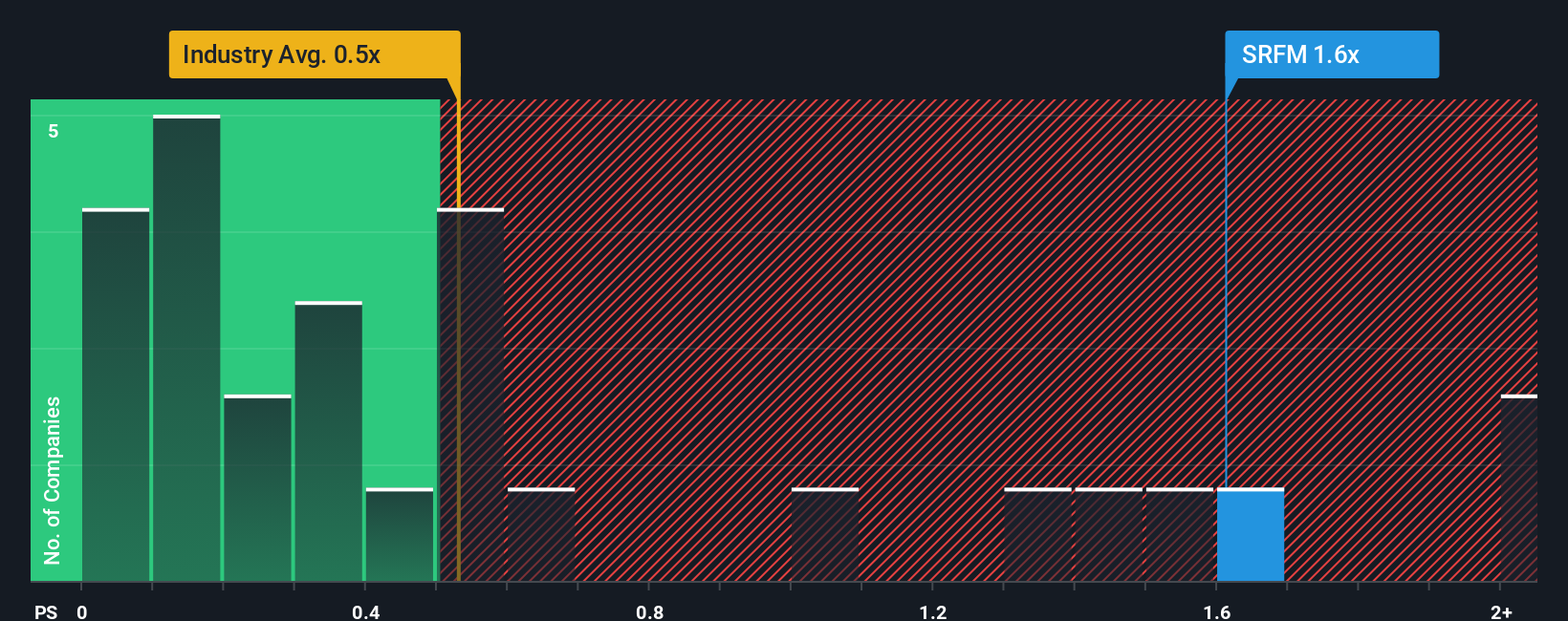

Taking a different angle, Surf Air Mobility is currently more expensive than both peers and the wider industry when viewed through its price-to-sales ratio. With a ratio of 1.8x, compared to the industry average of 0.5x and a fair ratio of 0.8x, the stock looks pricey by this measure. Does this premium signal true growth potential, or just extra risk if forecasts disappoint?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Surf Air Mobility Narrative

If you see the story differently or want to dig into the details yourself, you can build a fresh take in just a few minutes. Do it your way

A great starting point for your Surf Air Mobility research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that the best opportunities don’t wait around. Open the door to more potential winners by using these hand-picked screeners below.

- Unlock explosive growth by targeting these 24 AI penny stocks, which are transforming industries through advanced automation, smarter data analytics, and dynamic innovation.

- Capture steady income and stability by selecting these 18 dividend stocks with yields > 3% offering yields above 3 percent. This approach is suited for building long-term wealth and cushioning your portfolio.

- Tap into high-upside potential with these 3596 penny stocks with strong financials featuring strong financials. This gives you a chance to be early on the next breakout story.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SRFM

Surf Air Mobility

Engages in the air mobility business in the United States and internationally.

Moderate risk with limited growth.

Market Insights

Community Narratives