- United States

- /

- Airlines

- /

- NYSE:SRFM

Surf Air Mobility (SRFM): Evaluating Valuation Following Board Addition and Renewed Focus on Technology Strategy

Reviewed by Kshitija Bhandaru

Surf Air Mobility (SRFM) has just welcomed Shawn Pelsinger to its Board of Directors, highlighting the company's drive to deepen its technology expertise and strengthen alliances in aviation and data-driven services. Pelsinger's appointment could bring fresh insight as SurfOS gains traction.

See our latest analysis for Surf Air Mobility.

Beyond boardroom changes, Surf Air Mobility's story lately has been one of fast-moving share price swings. The stock has surged 26.6% over the last month, more than offsetting earlier declines, and its total shareholder return over the past year stands at an impressive 144%. Momentum appears to be rebuilding as investors weigh both recent volatility and renewed interest following the leadership news.

If leadership shakeups spark your curiosity, now is a smart moment to explore other fast-moving opportunities. Discover fast growing stocks with high insider ownership.

Given the company’s striking share price rebound and a valuation still roughly 57% below consensus analyst targets, investors now face the central question: is this a buying opportunity, or is the market already accounting for future growth?

Most Popular Narrative: 36.5% Undervalued

Surf Air Mobility's current share price sits well below the most followed narrative's fair value, hinting at significant upside if projections become reality. This valuation reflects ambitious growth targets and powerful industry tailwinds that could propel future earnings far higher than present levels.

"Widespread digitization and adoption of app-driven travel is enabling Surf Air Mobility's software-first approach, including the commercial rollout of the SurfOS platform (powered by Palantir) in 2026. This will bring new high-margin recurring revenue streams and improved customer acquisition efficiency, supporting both revenue and net margin expansion."

Want to know what fuels this high potential? The narrative is built on explosive growth assumptions, vastly improved margins, and game-changing platform revenues. Find out which bold projections turn this into a top growth story. Discover the exact numbers powering this eye-popping fair value.

Result: Fair Value of $7.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

Still, heavy reliance on government contracts and unproven software commercialization could challenge the bullish outlook if key milestones are not achieved.

Find out about the key risks to this Surf Air Mobility narrative.

Another View: Market Multiples Paint a Different Picture

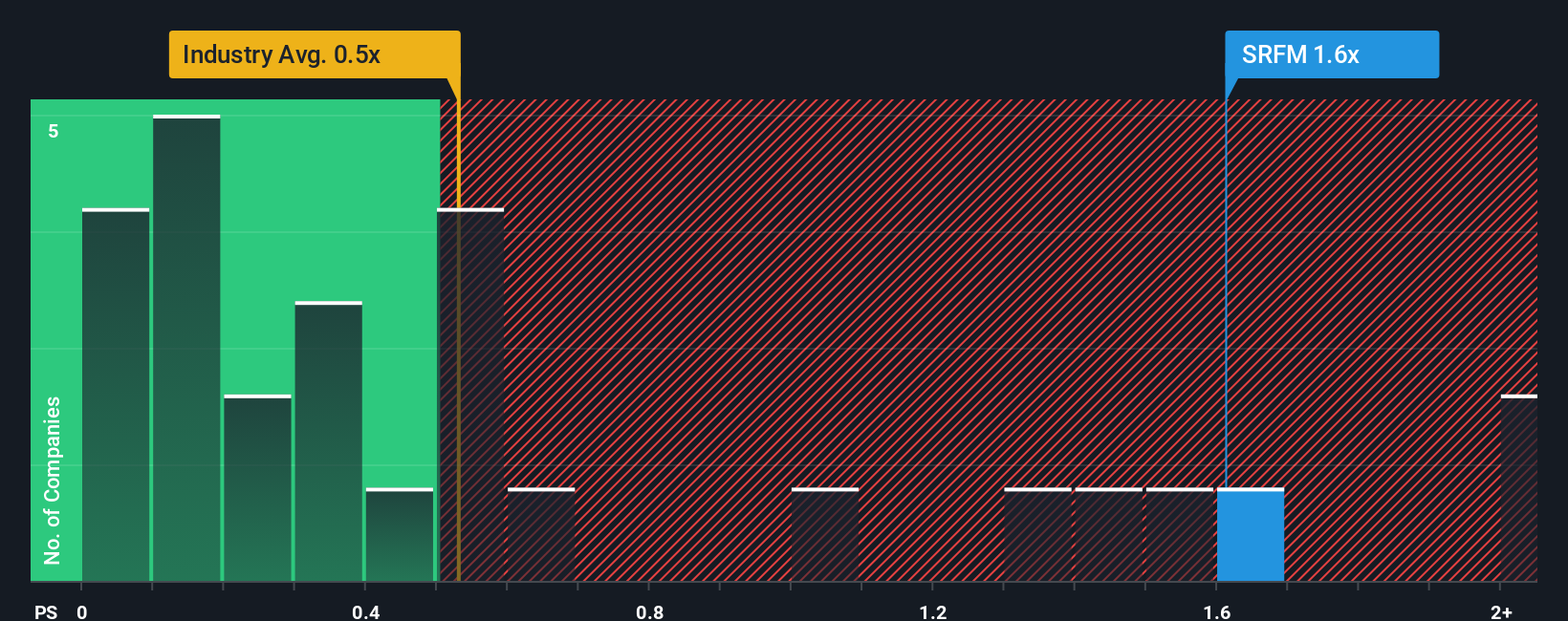

While the most popular narrative sees Surf Air Mobility as significantly undervalued, a look at the company's price-to-sales ratio tells a more cautious story. The stock trades at 2x sales, which is noticeably higher than both the North American Airlines industry average of 0.6x and the estimated fair ratio of 0.9x. This premium suggests the market is already factoring in high growth and future success. If results do not meet expectations, this could increase risks for investors. Is the market too optimistic, or is there still room to run?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Surf Air Mobility Narrative

If you see things differently or want a deeper dive into the numbers, you can shape your own perspective in just a few minutes, too. Do it your way

A great starting point for your Surf Air Mobility research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Act now to uncover other stocks with breakout potential, smart dividends, and exposure to tomorrow's transformative tech sectors using these targeted lists:

- Accelerate your search for hidden market gems with these 898 undervalued stocks based on cash flows to see which companies may be trading below their true worth.

- Fuel your portfolio with income opportunities by checking out these 19 dividend stocks with yields > 3% for strong yields and reliable payout histories.

- Spot the innovators shaping healthcare’s future by reviewing these 32 healthcare AI stocks focused on revolutionizing patient treatment and medical analytics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SRFM

Surf Air Mobility

Engages in the air mobility business in the United States and internationally.

Moderate risk with limited growth.

Market Insights

Community Narratives