- United States

- /

- Transportation

- /

- NYSE:SNDR

Schneider National (SNDR): Valuation Insights After Q3 Revenue Growth and Earnings Shortfall

Reviewed by Simply Wall St

Schneider National (SNDR) released third-quarter results that immediately got investors talking. While revenue increased by double digits and beat forecasts, earnings and profit margins fell short of what Wall Street had anticipated.

See our latest analysis for Schneider National.

Despite upbeat sales and renewed progress on its digital initiatives, Schneider National’s share price has struggled to gain momentum, down more than 26% year-to-date and showing a 1-year total shareholder return of -23.7%. Recent efforts such as the AI-driven logistics upgrade and a fresh dividend announcement have not yet sparked a sustainable recovery, suggesting that investors remain focused on profitability risks rather than near-term growth potential.

If you’re looking for the next standout in transportation, this could be a good time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a discount to analyst price targets and recent profitability disappointments still fresh, the real question is whether Schneider is a bargain waiting to rebound or if the market already reflects tempered growth prospects.

Most Popular Narrative: 19.6% Undervalued

Schneider National's most-followed valuation narrative points to a fair value that sits well above the recent close. This suggests the market may be underestimating its earnings power. The stage is set for a closer look at the catalysts and projections shaping this outlook.

Schneider's continued investments and focus on technology-driven efficiency (AI, automation, digital freight platform) and cost reduction initiatives are set to drive sustainable operational improvements, containing expenses even in inflationary environments. These efforts should support higher net margins and earnings growth as volumes recover.

Curious what ambitious earnings and margin forecasts are powering this bold price target? The narrative hangs on whether new digital strategies will actually boost profitability as freight volumes rebound. Discover the financial leap at the heart of this valuation.

Result: Fair Value of $26.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing pricing pressure and persistent weak freight volumes could stall margin gains, which casts doubt on Schneider’s ability to meet analysts’ optimistic forecasts.

Find out about the key risks to this Schneider National narrative.

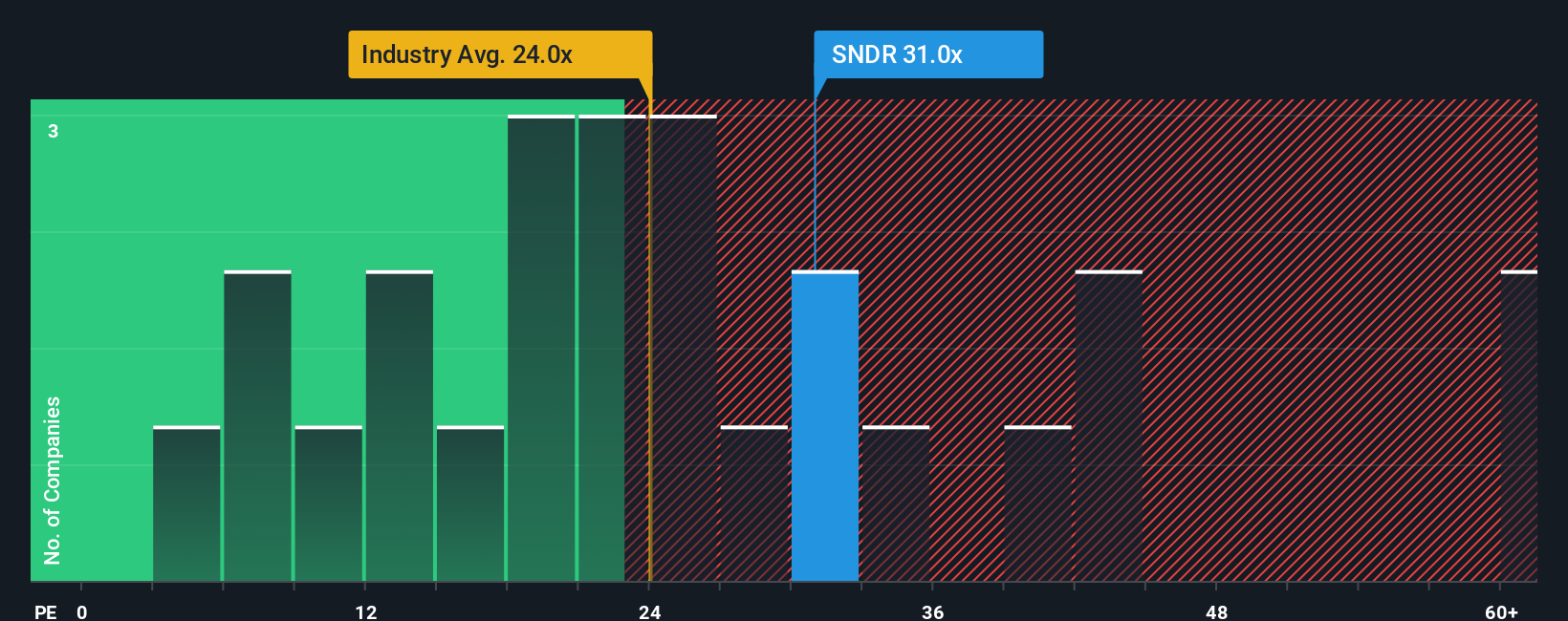

Another View: Multiples Paint a Pricier Picture

While fair value models suggest Schneider National is undervalued, looking at its price-to-earnings ratio tells a different story. At 32.8x, it trades well above both the US Transportation average of 25.9x and the fair ratio of 22.4x. This suggests a premium valuation compared to its peers. Does this premium reflect optimism or increased risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Schneider National Narrative

If you have a different perspective or want to dig into the numbers your own way, it takes just a few minutes to build your unique take. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Schneider National.

Looking for More High-Potential Opportunities?

Break out of your usual investing routine and capture bold trends bubbling under the surface. Let Simply Wall Street’s powerful tools help you spot hidden winners before the crowd.

- Supercharge your portfolio with value picks by scanning these 832 undervalued stocks based on cash flows that experts believe are trading well below their true worth.

- Capture unstoppable AI momentum by starting with these 26 AI penny stocks that are reshaping industries through machine intelligence and breakthrough automation.

- Lock in attractive yields for steady growth by targeting these 22 dividend stocks with yields > 3% that consistently reward shareholders with reliable income streams.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNDR

Schneider National

Provides multimodal surface transportation and logistics solutions in the United States, Canada, and Mexico.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives