- United States

- /

- Transportation

- /

- NYSE:RXO

A Fresh Look at RXO (RXO) Valuation After Q3 Earnings Miss and Cautious Management Outlook

Reviewed by Simply Wall St

RXO (NYSE:RXO) shares came under pressure after the company’s third-quarter earnings release, as results fell short of expectations and highlighted ongoing challenges in the full-truckload market. Management discussed tough conditions and outlined new cost initiatives.

See our latest analysis for RXO.

After the earnings miss and cautious outlook, RXO shares reached fresh lows, dropping over 29% in just one week and leaving the 1-year total shareholder return at -57.5%. Short-term pain has erased momentum, but recent cost savings and capacity shake-ups could set the stage for a turnaround if market conditions stabilize.

If you’re looking for other opportunities beyond logistics, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With RXO stock trading well below analyst price targets after a tough year, the key question for investors is whether the market pessimism has gone too far. Is this a bargain entry point, or is further downside risk still ahead?

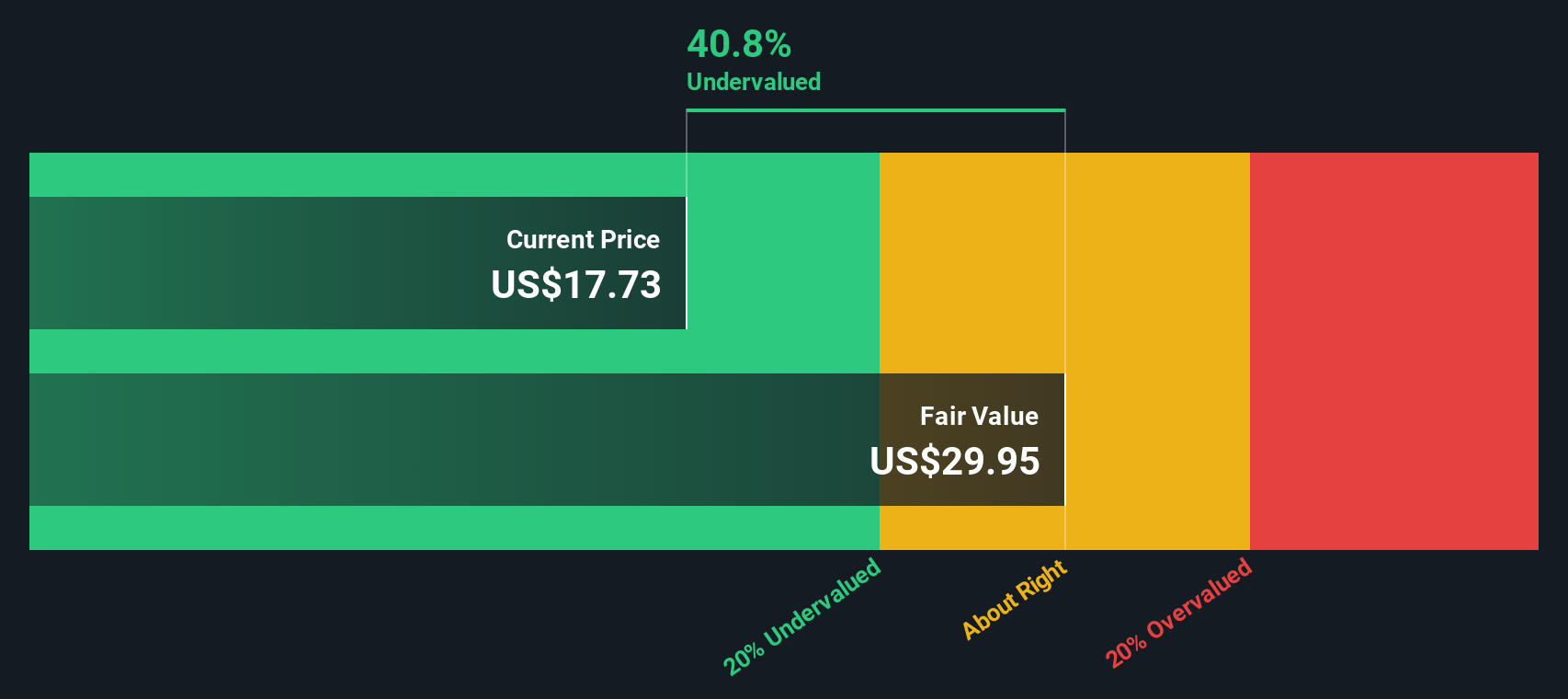

Most Popular Narrative: 20% Undervalued

Compared to RXO's last close at $12.49, the most widely followed narrative sees fair value near $15.67 per share. This highlights a substantial gap that could attract investors eyeing a rebound if expectations play out. The discount rate used is 8.64%, and the narrative builds its case around RXO's digital transformation and resilience across market cycles.

RXO's relentless investment in AI-powered, proprietary digital freight-matching technology is rapidly boosting employee productivity (up 45% in two years) and driving operating leverage. As digital adoption accelerates in logistics, this sets up sustainable margin and EBITDA growth, making the current valuation disconnect notable.

Want to know what powers this bold price gap? This narrative leans on remarkable efficiency gains and a future earnings surge that rivals industry leaders. Intrigued by the underlying financial forecasts and margin assumptions shaping this fair value? The real drivers behind this 20% upside might surprise you.

Result: Fair Value of $15.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in the automotive sector or further freight market softness could quickly challenge expectations for RXO’s recovery and margin expansion.

Find out about the key risks to this RXO narrative.

Another View: Our DCF Model Paints a Different Picture

While many see RXO as undervalued compared to analyst price targets, our SWS DCF model delivers a different signal. It suggests RXO is trading slightly above its estimated fair value. Could this mean the current discount is less compelling than it seems, or is the market looking past near-term uncertainty? The debate continues.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out RXO for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own RXO Narrative

If you see the numbers from a different angle or want to test your own assumptions, it only takes a few minutes to build your own case. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding RXO.

Ready for More Smart Market Moves?

Don’t second-guess your next opportunity. The right tools can put you ahead of the pack. Try these standout ideas to give your portfolio fresh energy.

- Tap into rapid industry shifts by scanning these 25 AI penny stocks. See which innovators are reshaping automation and intelligence.

- Maximize your yield potential when you check out these 16 dividend stocks with yields > 3%, featuring reliable payouts above 3% to help support steady returns in any market.

- Position yourself early on powerful trends by reviewing these 82 cryptocurrency and blockchain stocks, where companies are forging the next wave in digital asset technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RXO

RXO

Engages in truck brokerage business in the United States, Canada, Mexico, Asia, and Europe.

Adequate balance sheet and fair value.

Market Insights

Community Narratives