- United States

- /

- Marine and Shipping

- /

- NYSE:NMM

Did Recent Vessel Sales and Charter Deals Change Navios Maritime Partners' (NMM) Cash Flow Outlook?

Reviewed by Sasha Jovanovic

- Navios Maritime Partners L.P. recently announced the sale of three vessels for US$69.1 million, the delivery of a 2025-built MR2 product tanker, and new long-term charters expected to generate US$113.9 million in contracted revenue.

- These developments increase the company’s contracted revenue visibility to US$3.6 billion through 2037, highlighting an ongoing focus on fleet optimization and balance sheet strengthening.

- We’ll explore how these new long-term charters may support Navios Maritime Partners’ investment outlook and cash flow stability.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Navios Maritime Partners Investment Narrative Recap

For investors considering Navios Maritime Partners, the core belief centers on the company’s ability to maintain stable cash flows and capture upside from shipping market cycles through fleet renewal and long-term charter coverage. While the recent vessel sales and new charters further shore up contracted revenue to US$3.6 billion through 2037, these moves do not appear to materially shift the short-term catalyst of strengthening charter rates or fully address the biggest risk: sector oversupply and pressure on earnings from the large containership order book.

Among the recent announcements, the five-year charter of a newly delivered MR2 product tanker stands out as particularly relevant. This long-term charter, at a rate of US$22,669 net per day, adds much-needed cash flow predictability and helps partially offset the exposure to more volatile spot and index-linked revenues, tying directly to the immediate catalyst of improved revenue visibility.

However, it’s important to remember that in contrast to the improved contracted backlog, investors should also keep in mind the persistent risk of oversupply in the containership sector due to ...

Read the full narrative on Navios Maritime Partners (it's free!)

Navios Maritime Partners is projected to reach $1.5 billion in revenue and $430.1 million in earnings by 2028. This outlook assumes a 5.7% annual revenue growth rate and a $125.9 million earnings increase from the current $304.2 million.

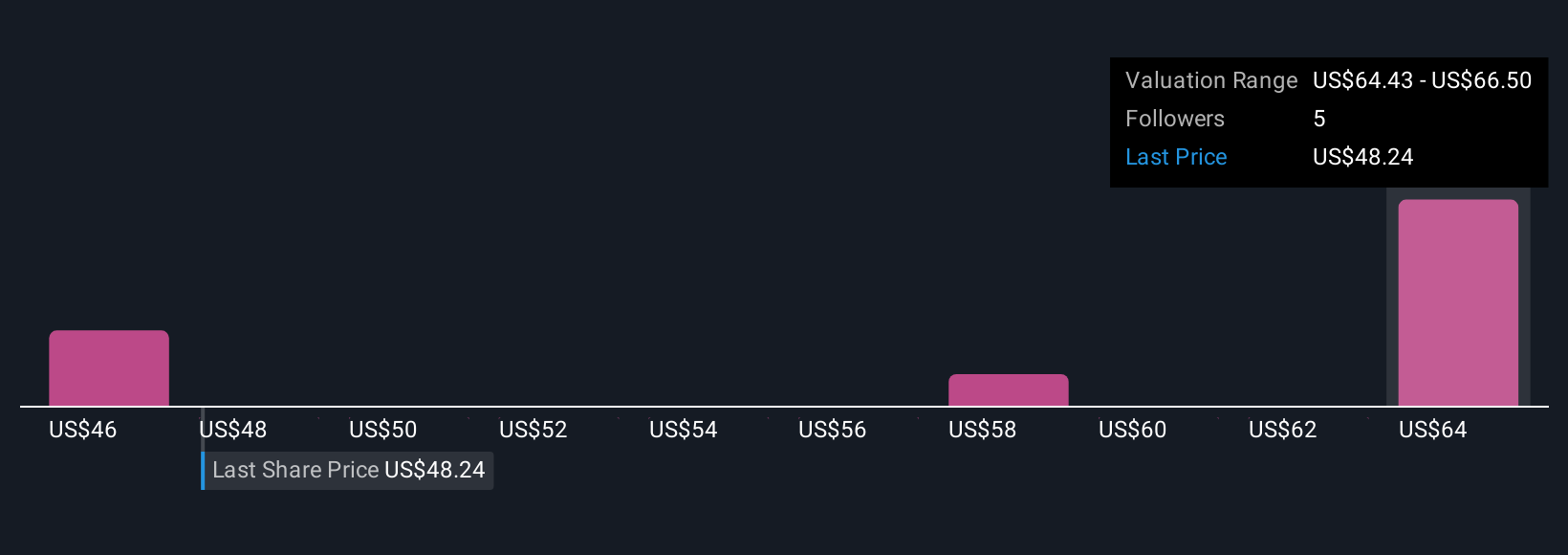

Uncover how Navios Maritime Partners' forecasts yield a $66.50 fair value, a 50% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members estimate fair values for Navios Maritime Partners from US$44.66 up to US$66.50. While the latest moves may boost revenue security, ongoing sector oversupply could continue to weigh on cash flows and performance, so opinions will differ widely.

Explore 3 other fair value estimates on Navios Maritime Partners - why the stock might be worth just $44.66!

Build Your Own Navios Maritime Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Navios Maritime Partners research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Navios Maritime Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Navios Maritime Partners' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navios Maritime Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NMM

Navios Maritime Partners

Owns and operates dry cargo vessels in Asia, Europe, North America, and Australia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives