- United States

- /

- Marine and Shipping

- /

- NYSE:MATX

Can Matson (MATX) Sustain Dividend Growth as Tariff Uncertainties Test Freight Recovery?

Reviewed by Sasha Jovanovic

- In recent days, Matson, Inc. reported that operating income in its Ocean Transportation segment declined amid continued market volatility and global trade uncertainty linked to tariffs, with freight demand initially falling after tariffs but starting to recover following a temporary US-China agreement to reduce tariff levels.

- Despite these pressures, Matson has maintained 13 consecutive years of dividend growth, which continues to appeal to income-focused investors even as the shipping industry faces challenges.

- We'll examine how early signs of freight demand recovery following US-China tariff reductions could impact Matson's investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Matson Investment Narrative Recap

To be a Matson shareholder, you need to believe in the long-term value of its protected trade lanes and its ability to adapt as global shipping shifts amidst volatile trade policies. The recent exemption of US-built cargo ships from new Chinese docking fees could ease near-term costs but has limited impact on the core risk of unpredictable freight demand and continued trade friction, particularly for the critical China lane.

Among recent Matson announcements, the $1 billion investment in fleet modernization stands out. This is particularly relevant given ongoing trade developments, as more efficient, new vessels may help Matson stay resilient against cost pressures and regulatory requirements, reinforcing its position as trade dynamics and shipping volumes remain in flux.

Yet, despite these positives, investors should be aware that shifting trade patterns and ongoing tariff risks could affect Matson’s revenue predictability, especially if ...

Read the full narrative on Matson (it's free!)

Matson's outlook forecasts $3.4 billion in revenue and $289.2 million in earnings by 2028. This scenario assumes a -0.3% annual revenue decline and a decrease in earnings of $204.9 million from current earnings of $494.1 million.

Uncover how Matson's forecasts yield a $135.00 fair value, a 43% upside to its current price.

Exploring Other Perspectives

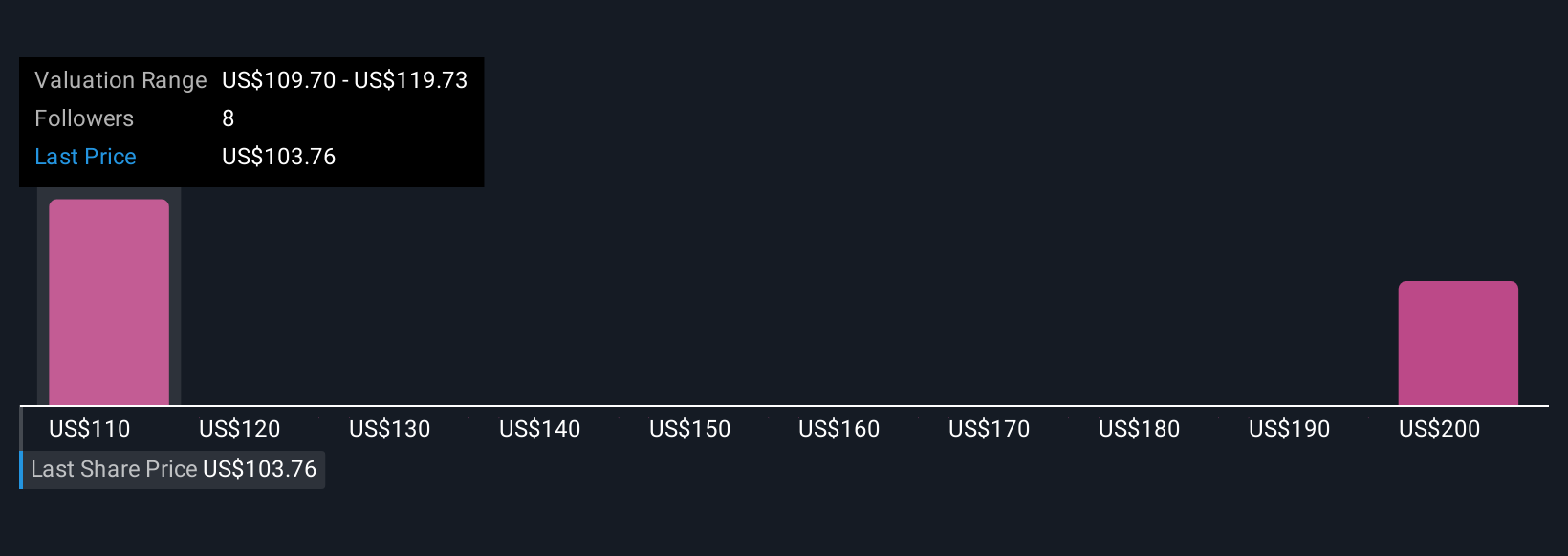

Seven separate fair value estimates from the Simply Wall St Community for Matson, Inc. range from US$92 to US$210 per share. Such wide differences appear just as persistent trade volatility continues to weigh on expectations for future shipping volumes, prompting you to compare many viewpoints before making any judgments.

Explore 7 other fair value estimates on Matson - why the stock might be worth just $92.00!

Build Your Own Matson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Matson research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Matson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Matson's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MATX

Matson

Engages in the provision of ocean transportation and logistics services.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives