- United States

- /

- Airlines

- /

- NYSE:LUV

Why Southwest Airlines (LUV) Is Down 7.0% After Approving a $2 Billion Share Buyback Program – And What's Next

Reviewed by Simply Wall St

- Southwest Airlines recently announced a major US$2 billion share buyback program, with substantial repurchases completed and board approval reaffirmed on July 23, 2025.

- This significant buyback move often reflects management's confidence in the company’s outlook and can alter the shareholder value equation.

- We'll explore how this substantial share repurchase plan could influence Southwest Airlines' earnings outlook and future capital allocation decisions.

Find companies with promising cash flow potential yet trading below their fair value.

Southwest Airlines Investment Narrative Recap

To be a shareholder in Southwest Airlines, you need to believe in its ability to execute on operational improvements and capitalize on new revenue streams despite recent pressures on earnings and passenger demand. The newly authorized US$2 billion buyback is an encouraging show of confidence but does not materially change the short-term catalyst, which remains dependent on recovering travel demand and the successful monetization of new product initiatives. The most significant risk continues to be uncertain booking trends that could weigh on near-term results.

Of Southwest’s recent announcements, the launch of assigned and premium seating is especially relevant as it ties directly to revenue growth opportunities, a crucial catalyst if passenger volumes remain subdued. This initiative marks a shift in how Southwest approaches ancillary revenue, aligning the company with evolving industry practices and potentially offsetting risk from weaker demand or yield pressure.

Yet, in contrast to these potential positives, investors ought to be aware of the growing risk that delayed aircraft deliveries from Boeing could...

Read the full narrative on Southwest Airlines (it's free!)

Southwest Airlines' outlook anticipates $32.6 billion in revenue and $1.9 billion in earnings by 2028. This implies a 5.9% annual revenue growth rate and a $1.5 billion increase in earnings from the current $392 million.

Uncover how Southwest Airlines' forecasts yield a $31.46 fair value, in line with its current price.

Exploring Other Perspectives

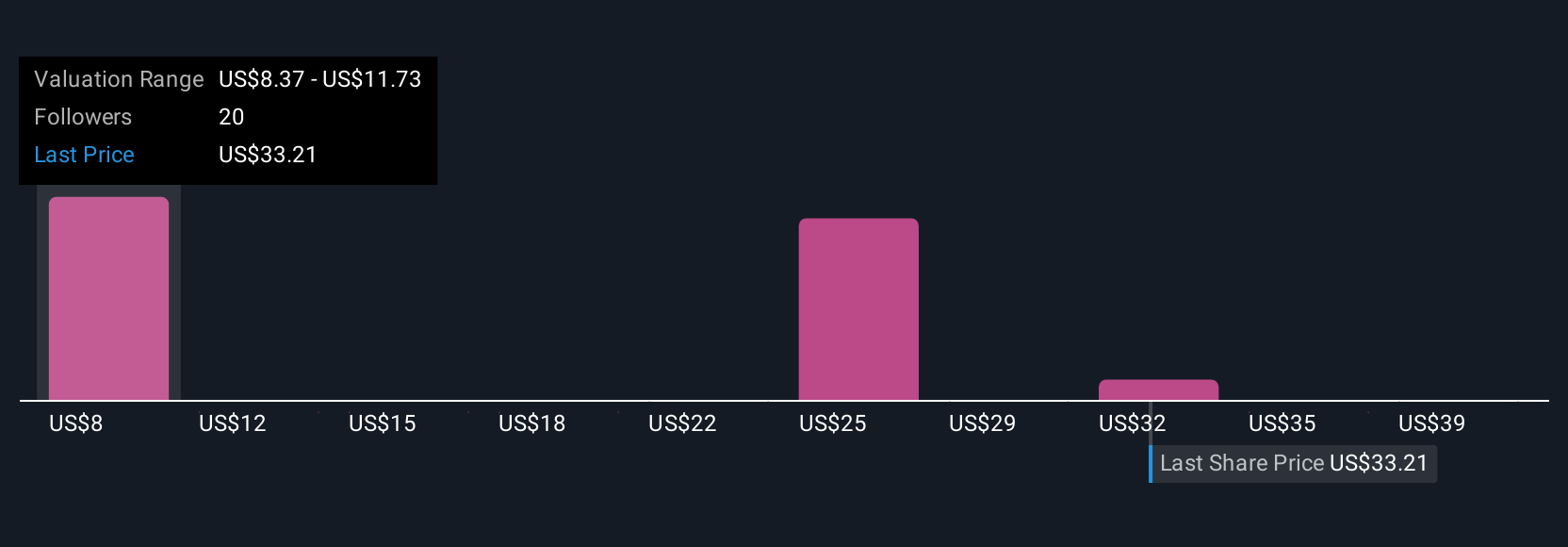

Eight perspectives from the Simply Wall St Community peg Southwest’s fair value between US$8.38 and US$42 per share. While bullish on new seating options, you should consider how macro uncertainty could influence actual performance and seek out more viewpoints.

Explore 8 other fair value estimates on Southwest Airlines - why the stock might be worth less than half the current price!

Build Your Own Southwest Airlines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southwest Airlines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southwest Airlines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southwest Airlines' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUV

Southwest Airlines

Operates as a passenger airline company that provides scheduled air transportation services in the United States and near-international markets.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives