- United States

- /

- Marine and Shipping

- /

- NYSE:KEX

Kirby (KEX): Reassessing Valuation After Q3 Earnings Beat and Strong Coastal Marine, Power Generation Performance

Reviewed by Simply Wall St

Kirby (KEX) just delivered a Q3 earnings beat that caught the market’s attention, with revenue topping expectations and coastal marine plus power generation doing the heavy lifting for a sharp post report rally.

See our latest analysis for Kirby.

The upbeat Q3 has capped a powerful run, with a roughly 33% 3 month share price return and a 5 year total shareholder return of 117%. This suggests momentum is clearly building as investors reassess Kirby’s earnings power and risk profile.

If Kirby’s move has you rethinking transport and logistics exposure, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership

Still, with Kirby’s shares already up sharply and trading near analyst targets, investors need to decide whether the market is overlooking its long term earnings potential or has already priced in the next leg of growth.

Most Popular Narrative Narrative: 10.9% Undervalued

With Kirby’s fair value estimate sitting modestly above the last close of $111.72, the most followed narrative leans toward upside potential from structural demand shifts.

Data center driven demand for power generation equipment is fueling a robust and growing backlog in Kirby's Distribution and Services segment, indicating sustained multi year revenue and earnings growth, particularly as data center and industrial investments accelerate nationwide.

Want to see what kind of revenue ramp and margin lift this backlog is banking on, and how that feeds into a richer future earnings multiple? The narrative blends steady shipping growth, fatter profit margins, and a premium valuation usually reserved for faster growing sectors. Curious which long term assumptions have to hold for that fair value to stick, and how much execution wiggle room is left? Read on to unpack the full story behind Kirby’s projected upside.

Result: Fair Value of $125.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could easily wobble if petrochemical shipping stays soft or if labor and maintenance costs rise faster than Kirby can pass them through to customers.

Find out about the key risks to this Kirby narrative.

Another Angle on Valuation

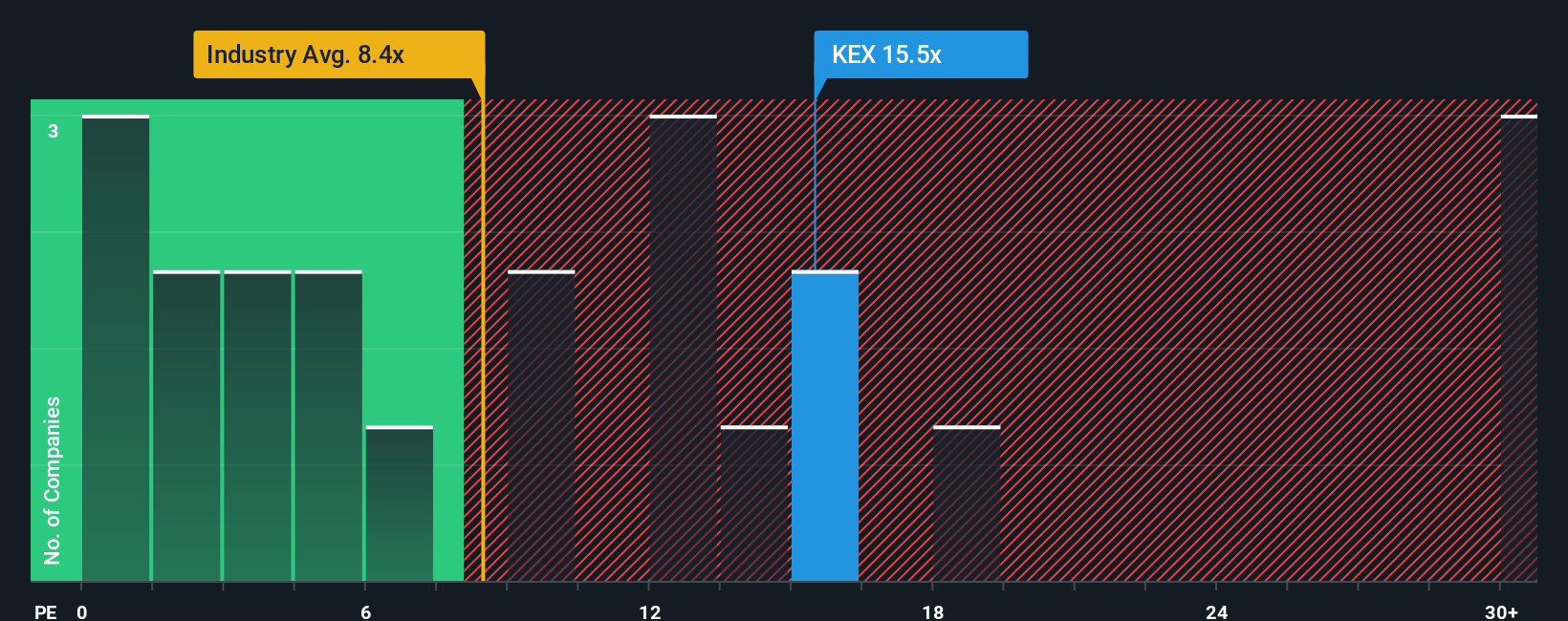

Step away from fair value models, and Kirby suddenly looks pricey. Its current P/E of 19.8x sits well above the Global Shipping average of 9.8x, the peer average of 12.2x, and even its own fair ratio of 13.6x. This raises the question: how much optimism is already in the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kirby Narrative

If you see Kirby’s story differently or want to pressure test the numbers yourself, you can build a personalized view in minutes: Do it your way

A great starting point for your Kirby research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by scanning focused stock lists that highlight quality, growth, and income potential other investors might be overlooking.

- Turn small positions into big potential by hunting for mispriced growth stories across these 3608 penny stocks with strong financials with strong financials and room to surprise.

- Ride the next wave of innovation by targeting companies powering intelligent automation and next gen platforms through these 24 AI penny stocks.

- Strengthen your portfolio’s cash engine by zeroing in on reliable payers using these 13 dividend stocks with yields > 3% to find income ideas with attractive yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kirby might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEX

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion