- United States

- /

- Logistics

- /

- NYSE:GXO

How Much Does the Dolce&Gabbana Partnership Deepen GXO (GXO)'s Hold on the Luxury Logistics Niche?

Reviewed by Sasha Jovanovic

- GXO Logistics recently announced the renewal of its long-term partnership with Dolce&Gabbana Beauty, which includes managing a new, dedicated 25,000 square meter warehouse in Calvenzano, Italy, handling global distribution, returns, and value-added services with a direct staffing model.

- This expanded agreement with a major luxury client not only reinforces GXO’s expertise in high-end supply chain management but also highlights ongoing commitments to sustainability and operational innovation.

- We'll explore how the Dolce&Gabbana Beauty partnership expansion strengthens GXO's luxury market presence and supports its long-term growth narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

GXO Logistics Investment Narrative Recap

To believe in GXO Logistics as a shareholder, you need to have conviction in the company's ability to win and retain long-term, high-value logistics contracts in premium verticals like luxury, while staying ahead in automation and technology. The Dolce&Gabbana Beauty partnership renewal is a clear win, boosting GXO’s credibility in high-touch, high-margin segments, but it may not significantly ease the most pressing short-term catalyst: how effectively GXO can execute rapid integration and synergy delivery from its Wincanton acquisition. Likewise, the biggest present risk, leadership turnover, remains center stage as new management navigates strategy and customer retention.

The recent CFO transition announcement is highly relevant, arriving just as GXO steps up its commitments to global brands like Dolce&Gabbana Beauty and manages complex integration efforts. Leadership stability is a critical factor in ensuring these major customer wins translate into margin improvement and execution on future growth expectations, making the timing and impact of executive changes especially important to monitor.

But investors should be mindful that despite contract renewals and sector wins, significant uncertainty still surrounds new management’s ability to deliver operational discipline and sustain customer momentum...

Read the full narrative on GXO Logistics (it's free!)

GXO Logistics' outlook anticipates $15.3 billion in revenue and $440.6 million in earnings by 2028. This scenario depends on 6.5% annual revenue growth and a $377.6 million increase in earnings from the current $63.0 million.

Uncover how GXO Logistics' forecasts yield a $61.94 fair value, a 12% upside to its current price.

Exploring Other Perspectives

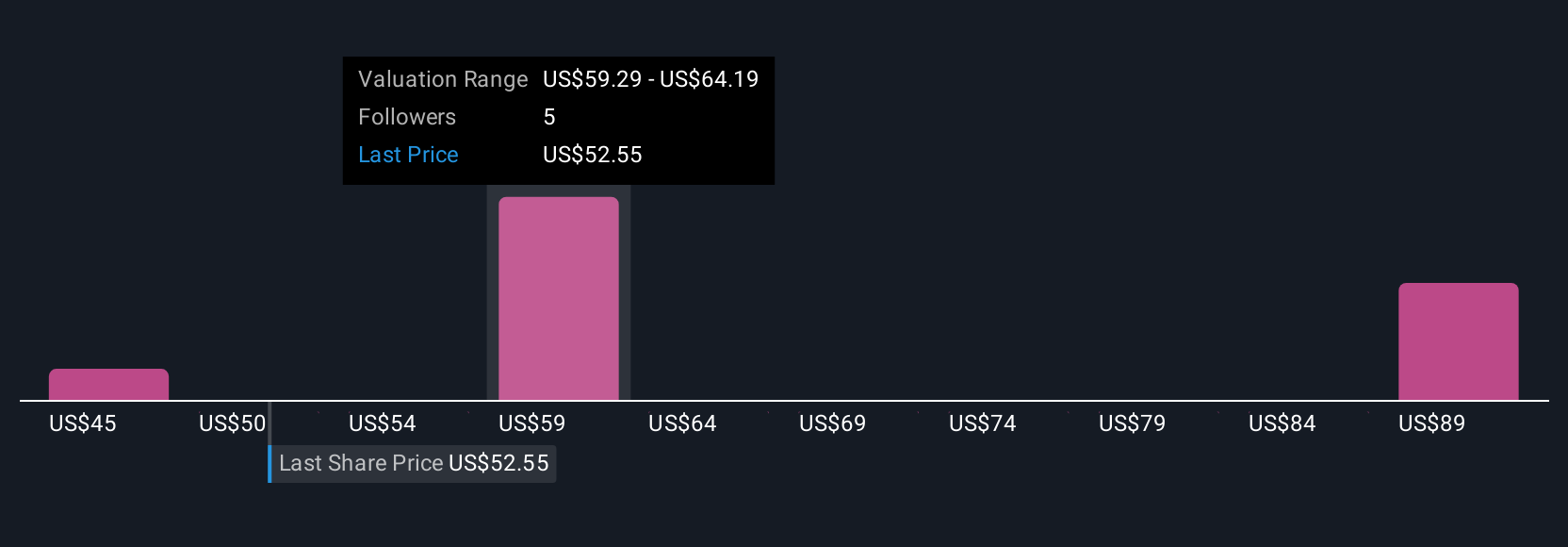

Three Simply Wall St Community members estimate GXO’s fair value anywhere from US$44.61 to US$99.26 per share, with views spread across ten price buckets. While opinions differ, many are keeping a close eye on how recent leadership changes could shape financial discipline and long-term execution, encouraging you to consider multiple viewpoints before making up your mind.

Explore 3 other fair value estimates on GXO Logistics - why the stock might be worth as much as 80% more than the current price!

Build Your Own GXO Logistics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GXO Logistics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free GXO Logistics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GXO Logistics' overall financial health at a glance.

No Opportunity In GXO Logistics?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GXO

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives