- United States

- /

- Marine and Shipping

- /

- NYSE:GSL

Does Global Ship Lease's (GSL) Preferred Dividend Underscore Stability or Limit Flexibility in Uncertain Markets?

Reviewed by Simply Wall St

- Global Ship Lease, Inc. recently declared a cash dividend of US$0.546875 per depositary share for its 8.75% Series B Cumulative Redeemable Perpetual Preferred Shares, covering the July 1 to September 30, 2025 period and payable on October 1, 2025 to shareholders of record as of September 24, 2025.

- This consistent preferred dividend payment highlights the company’s ongoing commitment to capital returns and signals stability, even as the shipping industry faces ongoing uncertainties.

- We’ll now examine how the company’s commitment to shareholder returns reflected in this dividend payment shapes the current investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Global Ship Lease Investment Narrative Recap

To be a Global Ship Lease shareholder, you need to believe in the durability of global container trade and the company's ability to withstand cyclical downturns through disciplined capital returns and efficient fleet management. The recently declared preferred dividend underscores management’s ongoing cash return commitment but does not materially alter the near-term catalysts or mitigate pressing risks such as charter rate volatility and regulatory uncertainty.

Among recent announcements, the August 2025 Q2 earnings report stands out, with revenue and net income both up year-over-year. This continued financial strength, combined with regular dividend payments and a substantial contracted revenue backlog, offers some insulation against the market’s short-term uncertainties, but exposure to sudden drops in charter rates remains.

Yet, what really sets the risk profile is that, despite financial visibility today, prolonged weakness in charter rates or a swift correction could challenge returns for even the most disciplined operators, meaning investors should look out for...

Read the full narrative on Global Ship Lease (it's free!)

Global Ship Lease's outlook anticipates $621.0 million in revenue and $270.6 million in earnings by 2028. This is based on an expected annual revenue decline of 5.3% and a decrease in earnings of $112.4 million from the current $383.0 million level.

Uncover how Global Ship Lease's forecasts yield a $35.67 fair value, a 12% upside to its current price.

Exploring Other Perspectives

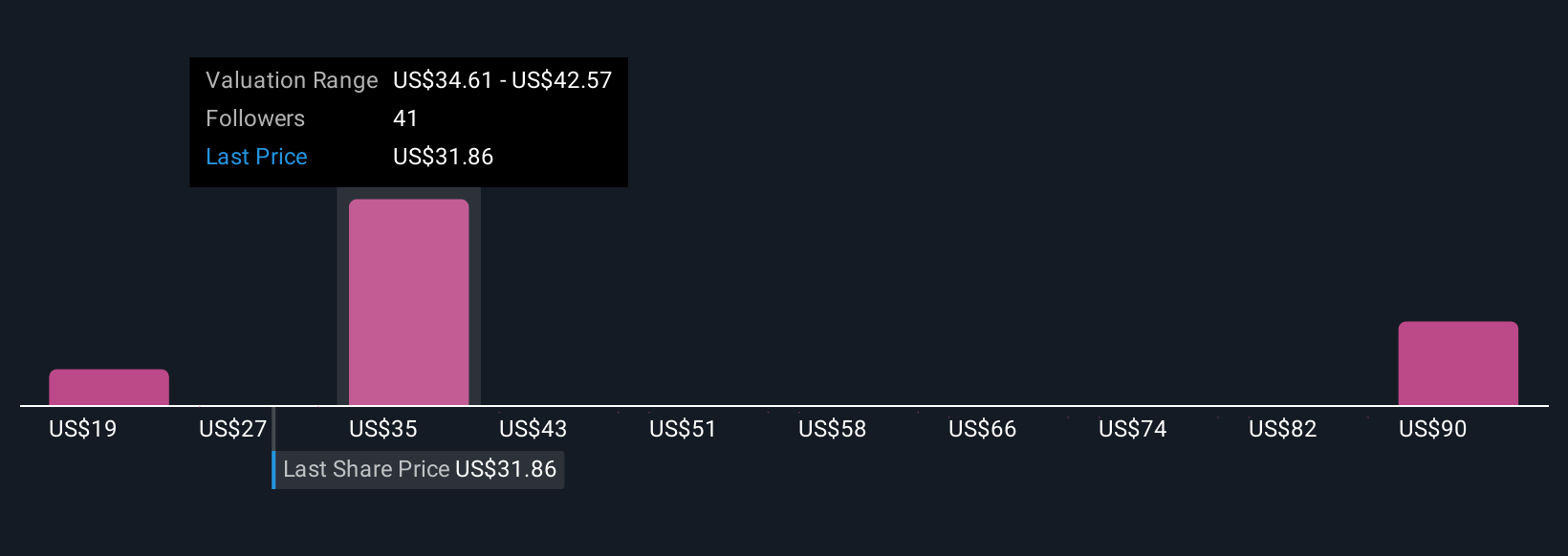

Ten members of the Simply Wall St Community provided fair value estimates for Global Ship Lease ranging from US$22.06 to US$95.56 per share. While you weigh these diverse outlooks, keep in mind that management’s regular dividends are seen as a signal of stability, but falling market charter rates could quickly challenge this view.

Explore 10 other fair value estimates on Global Ship Lease - why the stock might be worth over 2x more than the current price!

Build Your Own Global Ship Lease Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Ship Lease research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Global Ship Lease research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Ship Lease's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GSL

Global Ship Lease

Engages in owning and chartering of containerships under fixed-rate charters to container shipping companies worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives