- United States

- /

- Logistics

- /

- NYSE:FDX

Is FedEx a Hidden Opportunity After Cost-Cutting Initiatives and Recent Price Gains?

Reviewed by Bailey Pemberton

- Wondering if FedEx stock could be an undervalued gem or if it’s already priced for perfection? Let’s dig into what the numbers tell us.

- FedEx shares have climbed 2.6% over the past week and 3.7% over the last month, but they are still down about 6.6% since the start of the year, hinting at a shifting balance between optimism and caution.

- Recently, FedEx garnered attention for ongoing cost-cutting initiatives and adjustments in delivery operations. These moves have helped reassure investors about future profitability. Industry chatter has also focused on changing dynamics in e-commerce and global shipping, both of which continue to shape sentiment around FedEx’s value.

- Looking at our valuation checklist, FedEx scores 5 out of 6 for being undervalued. This strong showing leads us directly into a deep dive on the different ways to assess its true worth, as well as a fresh perspective you will not want to miss at the end of this article.

Approach 1: FedEx Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is really worth by projecting out future cash flows and discounting them back to today’s value. For FedEx, this involves estimating how much cash the business will generate over time and adjusting for the time value of money.

FedEx’s latest Free Cash Flow stands at $2.63 Billion. Analysts have forecast this figure to grow steadily, reaching $4.63 Billion by 2028. While professional estimates cover the next five years, further cash flow projections out to 2035 are extrapolated using Simply Wall St’s long-term methodology, with values ranging up to $7.1 Billion.

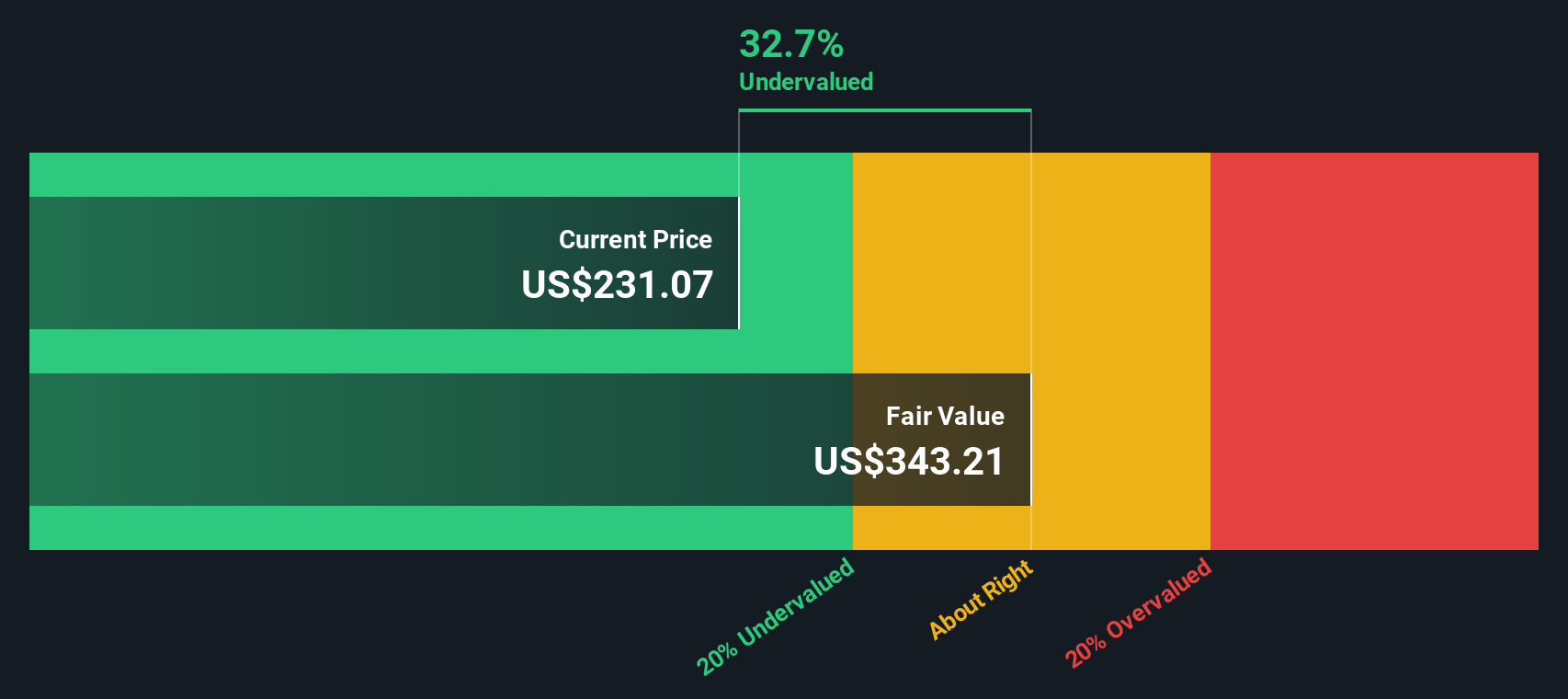

Based on these cash flow projections, the DCF model calculates an intrinsic value of $378.96 per FedEx share. The model implies a 32.4% discount to FedEx’s current trading price, which suggests the stock is meaningfully undervalued based on future cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests FedEx is undervalued by 32.4%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: FedEx Price vs Earnings (PE)

When evaluating a profitable company like FedEx, the Price-to-Earnings (PE) ratio stands out as a reliable valuation tool. The PE ratio quickly indicates how much investors are willing to pay for every dollar earned, making it especially relevant for companies with steady profits.

A company’s fair PE ratio is shaped by two main forces: its growth prospects and perceived risk. Faster-growing companies, or those with stable earnings and less risk, often support higher PE ratios, while riskier or slowly growing firms tend to see lower ratios.

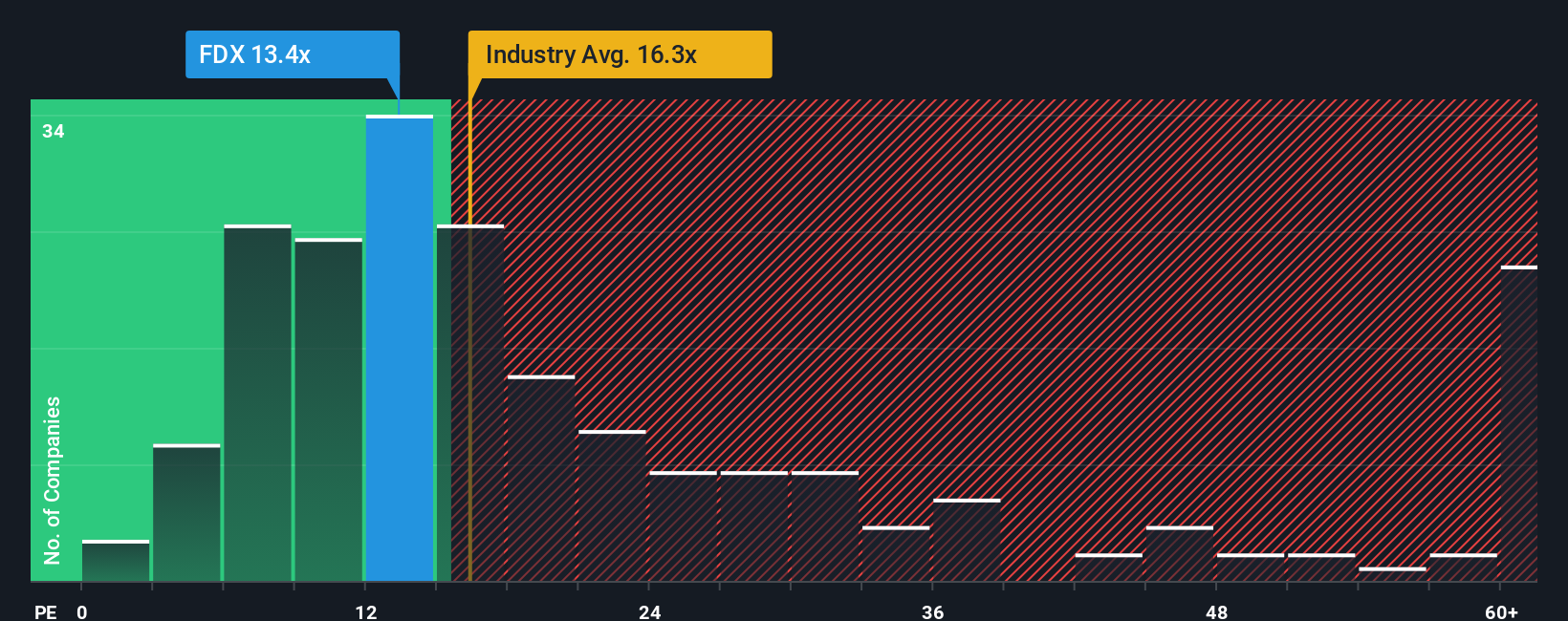

Currently, FedEx trades on a PE ratio of 14.7x. This sits below both the logistics industry average of 16.2x and the average of its closest peers at 19.6x. Numbers like these can signal a bargain, but context matters.

This is where Simply Wall St’s Fair Ratio provides deeper insight. Unlike plain industry or peer comparisons, which can miss the nuance of a company’s unique characteristics, the Fair Ratio factors in everything from earnings growth and profit margins to industry volatility, market cap, and risks. It builds a custom benchmark for FedEx. For FedEx, the Fair Ratio stands at 18.5x, suggesting that, when those factors are accounted for, FedEx is undervalued compared to where it should be trading.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your FedEx Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple, powerful tool that lets you connect your own perspective on a company, like FedEx, to a financial forecast and then to your estimate of fair value. Rather than just crunching numbers, Narratives highlight the story behind those numbers, letting you factor in your assumptions around revenue, margins, and future growth. For example, you might consider whether FedEx’s cost-cutting and network upgrades will deliver sustainable outperformance, or if industry headwinds will weigh on results.

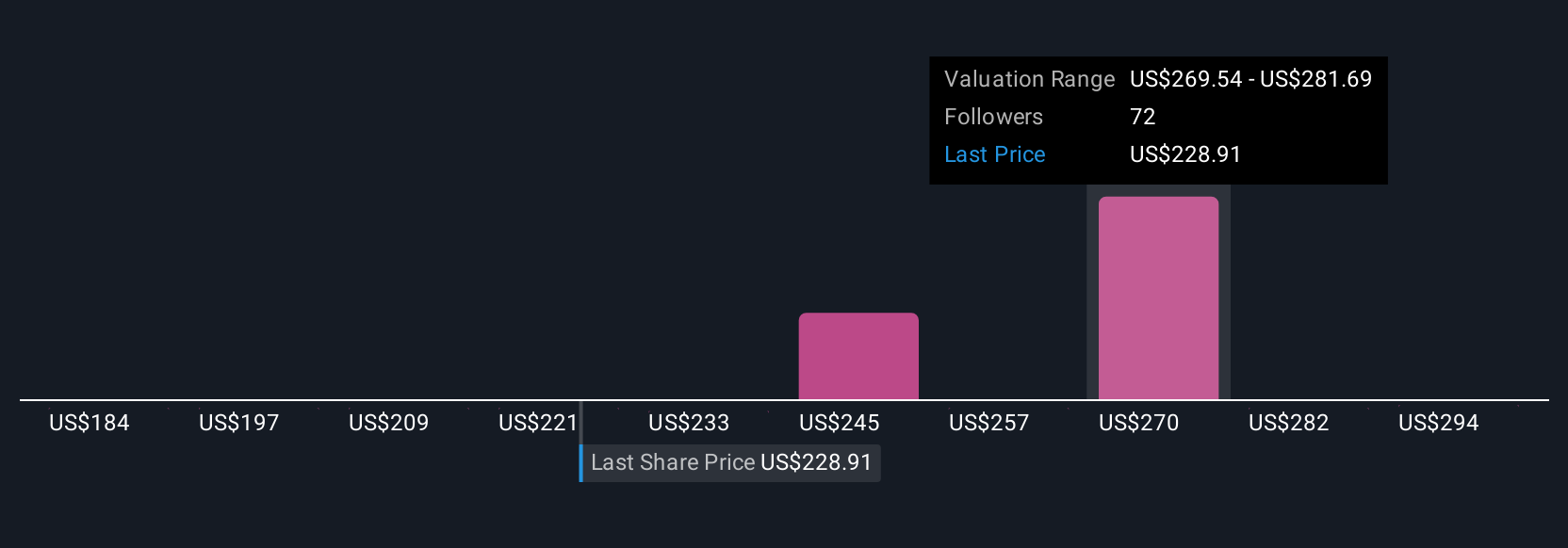

On Simply Wall St’s Community page, millions of investors use Narratives to frame their investment decisions, compare their fair value to the current share price, and see in real time how new information, like earnings or news, changes the picture. Narratives are accessible and dynamic, keeping you updated as events unfold and letting you quickly sense-check your strategy. For instance, among current Narratives for FedEx, some bulls see upside to $320, driven by efficiency gains and resilient demand, while the most cautious bear expects just $200, given freight challenges and macro uncertainties. Narratives put these perspectives and your own front and center when choosing to buy, sell, or hold.

Do you think there's more to the story for FedEx? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDX

FedEx

Provides transportation, e-commerce, and business services in the United States and internationally.

Undervalued established dividend payer.

Market Insights

Community Narratives