- United States

- /

- Logistics

- /

- NYSE:FDX

Could FedEx’s (FDX) AI Partnership Reveal a New Edge in Digital Supply Chain Transformation?

Reviewed by Sasha Jovanovic

- ServiceNow and FedEx Dataworks recently announced a multi-year strategic collaboration to integrate artificial intelligence, data, and workflow solutions for enhancing supply chain operations through real-time insights and disruption prediction capabilities.

- This partnership will also establish joint innovation hubs and shared engineering resources, underscoring FedEx’s shift toward digital transformation and AI-driven logistics solutions.

- We'll explore how FedEx's integration of AI-driven real-time supply chain insights could impact its investment narrative and future outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

FedEx Investment Narrative Recap

For FedEx shareholders, the investment case centers on the company’s ability to drive operational efficiencies and earnings growth through cost reduction initiatives like DRIVE and digital transformation efforts. The recently announced partnership with ServiceNow to integrate AI-driven supply chain insights showcases FedEx’s ongoing push toward innovation; however, this news is unlikely to materially shift the short-term catalyst, which remains centered on delivering permanent cost savings, or to alter the main risk from industrial economy weakness and contract expirations.

Among recent developments, the expanded integration with ServiceNow’s procurement solutions stands out as most relevant. By leveraging FedEx Dataworks’ supply chain intelligence capabilities, this initiative feeds directly into FedEx’s structural efficiency goals and supports the catalysts around cost management and improved net margins, aligning with investor focus on enhanced operational outcomes.

Yet, against this positive momentum, it is important for investors not to overlook risks like the potential impact from the expiration of key contracts and...

Read the full narrative on FedEx (it's free!)

FedEx's narrative projects $95.1 billion revenue and $5.2 billion earnings by 2028. This requires 2.6% yearly revenue growth and a $1.1 billion earnings increase from the current $4.1 billion.

Uncover how FedEx's forecasts yield a $266.17 fair value, a 5% upside to its current price.

Exploring Other Perspectives

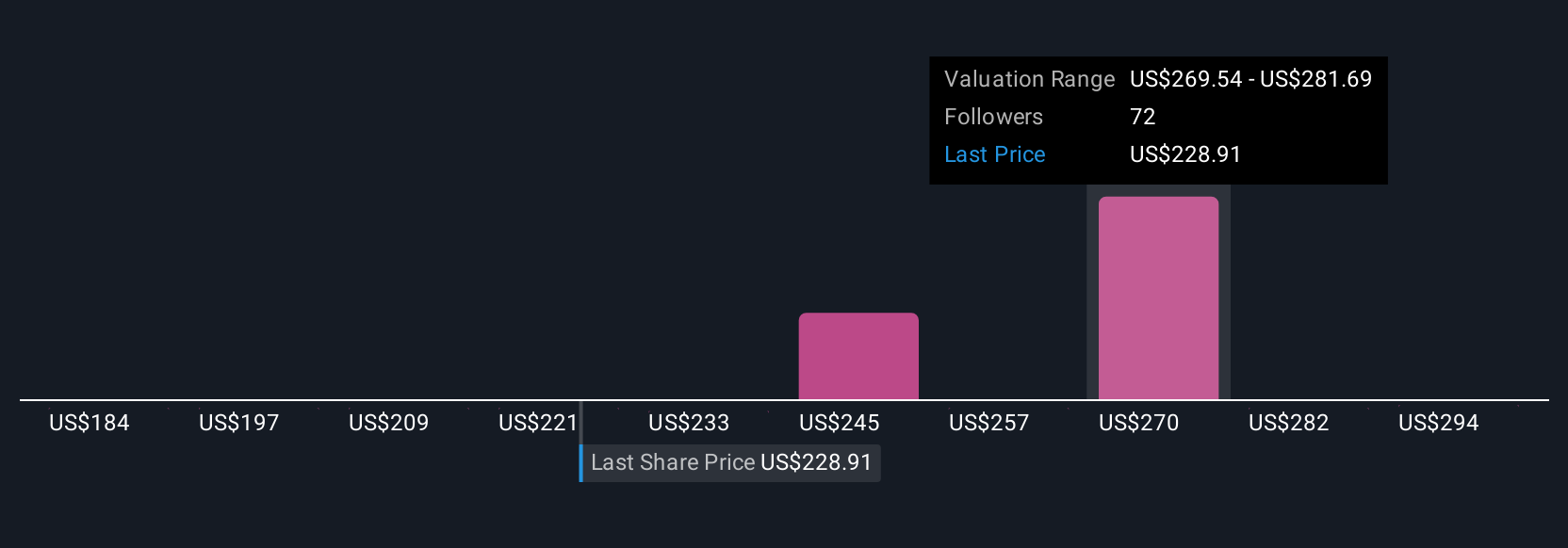

Five members of the Simply Wall St Community put FedEx’s fair value between US$266 and US$387 per share, with a wide spread of views. While some see room for cost-driven growth, others remain cautious about pressures from contract and volume risks, so it pays to compare their varied forecasts.

Explore 5 other fair value estimates on FedEx - why the stock might be worth just $266.17!

Build Your Own FedEx Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FedEx research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FedEx research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FedEx's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDX

FedEx

Provides transportation, e-commerce, and business services in the United States and internationally.

Undervalued established dividend payer.

Market Insights

Community Narratives