- United States

- /

- Airlines

- /

- NYSE:DAL

How Investors May Respond To Delta Air Lines (DAL) Trackonomy Partnership and Affirmed Earnings Guidance

Reviewed by Sasha Jovanovic

- Delta Air Lines recently affirmed its positive third-quarter earnings guidance and announced a new partnership with logistics technology firm Trackonomy to modernize its global cargo operations, following the declaration of a US$0.1875 per share quarterly dividend payable in November 2025.

- The collaboration with Trackonomy marks a significant move in Delta's digital transformation efforts, aiming to boost operational efficiency and provide real-time visibility across 200 airports worldwide.

- We'll examine how Delta's digital transformation push, highlighted by the Trackonomy partnership, could influence its long-term investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Delta Air Lines Investment Narrative Recap

To be a Delta Air Lines shareholder right now, you need to believe in the airline’s ability to maintain healthy margins in a competitive and uncertain environment by leaning on its premium, loyalty, and international revenue streams. The newly affirmed third-quarter earnings guidance and expanded digital transformation may bolster short-term investor sentiment, but ongoing economic uncertainty and weak growth in main cabin travel remain the most critical risks. These recent developments are positive, but do not significantly change the key risk that demand softness could pressure net margins.

The recently announced partnership between Delta Cargo and Trackonomy stands out in the context of Delta's push for operational efficiency and technological leadership. By replacing legacy cargo management systems with Trackonomy’s real-time visibility platform, Delta is strengthening one of its important catalysts, its ability to boost reliability and potentially contain costs in a sector that faces persistent margin pressure.

Yet, in contrast to this forward-looking optimism, investors should be aware that Delta’s exposure to economic slowdowns and the risk of softening demand...

Read the full narrative on Delta Air Lines (it's free!)

Delta Air Lines is projected to reach $68.4 billion in revenue and $4.6 billion in earnings by 2028. This outlook assumes a 3.4% annual revenue growth rate and a modest $0.1 billion increase in earnings from the current $4.5 billion.

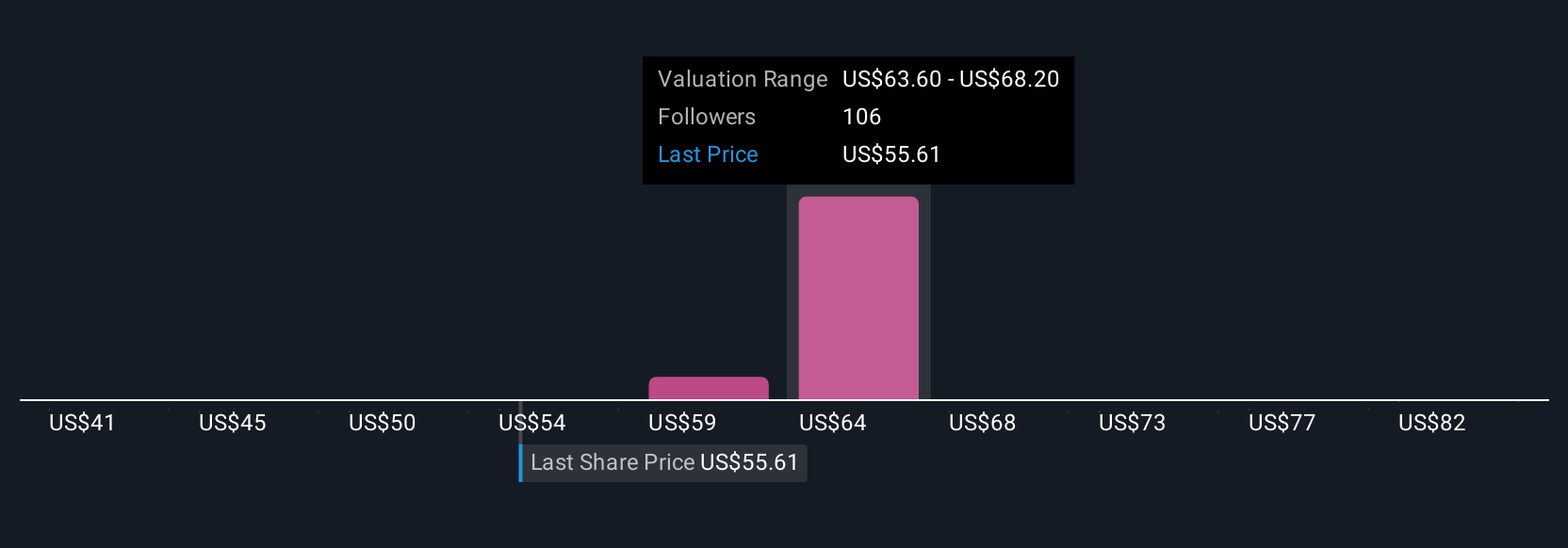

Uncover how Delta Air Lines' forecasts yield a $69.66 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Delta’s fair value between US$39.88 and US$153.44, with nine separate viewpoints reflecting a wide price target spread. While analysts see resilience in premium and loyalty revenues, you can explore a variety of alternate views on Delta’s future performance here.

Explore 9 other fair value estimates on Delta Air Lines - why the stock might be worth over 2x more than the current price!

Build Your Own Delta Air Lines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Delta Air Lines research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Delta Air Lines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Delta Air Lines' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAL

Delta Air Lines

Provides scheduled air transportation for passengers and cargo in the United States and internationally.

Very undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives