- United States

- /

- Airlines

- /

- NYSE:DAL

Delta Air Lines (NYSE:DAL) Reports 63% Increase In Net Income To US$2,130 Million

Reviewed by Simply Wall St

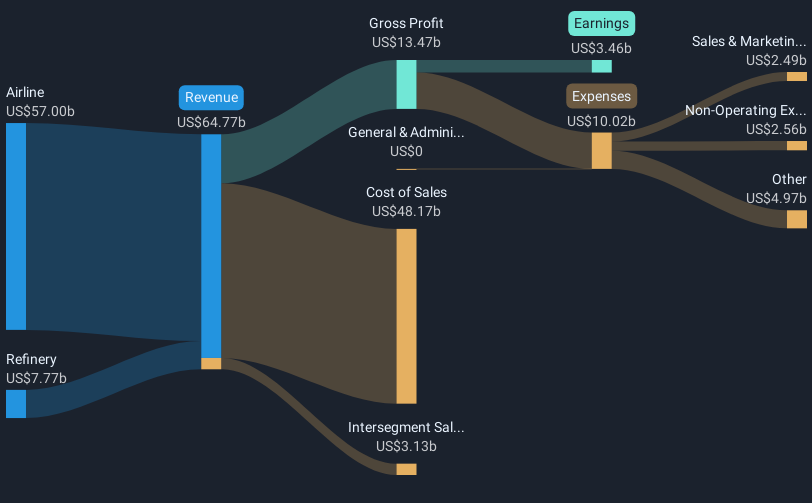

Delta Air Lines (NYSE:DAL) reported strong second-quarter results with net income increasing to USD 2,130 million from USD 1,305 million the previous year, highlighting significant earnings growth. Despite a market that remained flat in the last week but grew 13% over the past year, Delta's 39% share price increase this quarter suggests investor confidence following the positive earnings. The company's announcement of a 25% dividend increase further underscores its robust financial position. The aforementioned developments likely supported Delta's stock performance aligned with broader market trends, despite no significant directional deviation.

The recent announcement of Delta Air Lines' strong second-quarter results, with net income rising to US$2.13 billion, coupled with a 25% dividend increase, signals robust financial health. These developments bolster the narrative that Delta is effectively managing its resources to align supply with demand, maintaining flat capacity growth, and supporting net margins through careful cost management. This is reflected in a significant 39% share price increase this quarter, indicating investor confidence.

Examining the bigger picture, Delta's shares have delivered a total return of 113.87% over the past five years. This highlights a substantial long-term performance trajectory, despite short-term fluctuations. In comparison to the broader market's 13% growth over the last year, Delta's impressive total return emphasizes its resilience and appeal as an investment.

The company's recent earnings announcement reaffirms its focus on premium services and strategic partnerships, such as the 10-year MRO partnership with UPS, which are anticipated to enhance revenue diversification and growth. These initiatives align with earnings forecasts, suggesting strong potential for maintaining profitability and supporting a favorable market position. However, these forecasts aren't without risks, including economic uncertainty and competitive pressures that could impact margins and revenue.

Currently trading at US$44.81, Delta's share price is significantly below the consensus analyst price target of US$56.60. This suggests potential upside from current levels if the company's revenue and earnings projections hold true, and it reaches an estimated PE ratio of 10.6x by 2028. Investors must weigh these insights with the outlined challenges to reach informed conclusions about Delta's investment potential.

Learn about Delta Air Lines' future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAL

Delta Air Lines

Provides scheduled air transportation for passengers and cargo in the United States and internationally.

Good value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)