- United States

- /

- Airlines

- /

- NYSE:DAL

Delta Air Lines (DAL): Reassessing Valuation After Earnings Beat and Upgraded Guidance

Reviewed by Simply Wall St

Delta Air Lines (DAL) is back in the spotlight after beating revenue expectations and raising its earnings outlook, as investors weigh how its premium strategy and Amex partnership could reshape long term profitability.

See our latest analysis for Delta Air Lines.

That upbeat guidance is landing against a strong backdrop, with the share price at $67.24 and a 20.83% 1 month share price return suggesting momentum is building after robust Q3 results and resilient demand. The 3 year total shareholder return of 106.13% underlines how the long term story has already rewarded patient holders.

If Delta’s recent move has you rethinking the whole travel and mobility theme, it could be worth exploring other opportunities among auto manufacturers to see how the market is pricing different cyclical stories.

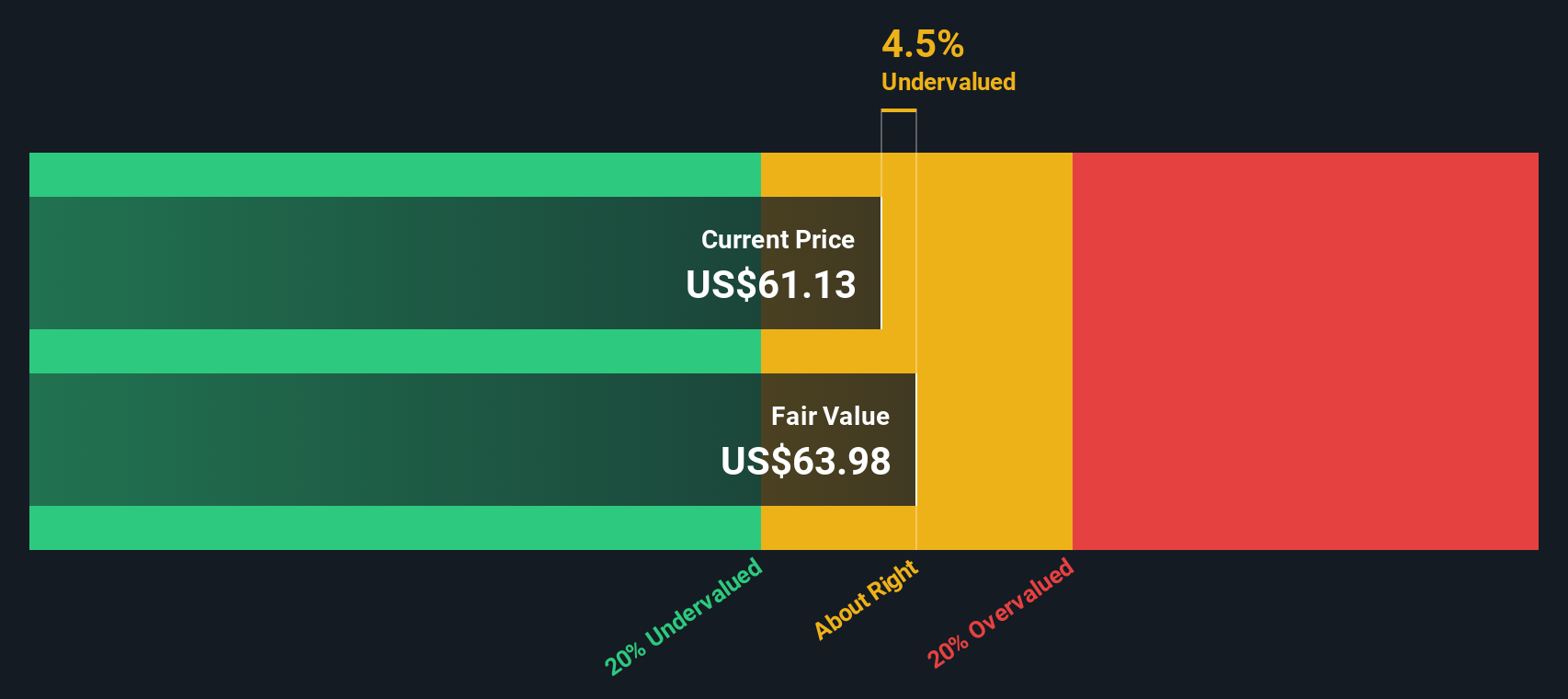

With the stock near recent highs yet still trading at a sizeable intrinsic discount and only modestly below analyst targets, the key question now is whether Delta remains undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative Narrative: 12.4% Overvalued

According to PittTheYounger, the latest fair value estimate now sits below Delta’s $67.24 share price, reframing earlier upside assumptions after shifting demand signals.

Yet with its early warning about waning travel demand in March, my original assumptions in February regarding revenue growth and future PE had to be revised downwards from 4 to 2 per cent p.a. and 12, respectively. This resulted in a fair value of about $53.50 a share. After DAL's quarterly numbers as of 9 April and the related poor visibility for the remainder of the year, I have to lower my anticipated PE further to 11, leading to a new fair value of about 49 bucks a share that still leaves some upside.

Want to see the math behind that downgrade, and why the narrative still gives Delta a premium earnings multiple and resilient margins, despite softer growth assumptions?

Result: Fair Value of $59.84 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should watch for renewed trade tensions or a sharper than expected pullback in travel demand, either of which could quickly erode Delta’s premium.

Find out about the key risks to this Delta Air Lines narrative.

Another Take on Value

Our SWS DCF model paints a far more optimistic picture, putting fair value at $109.07, around 38% above the current $67.24 price. That clash with PittTheYounger’s $59.84 estimate raises a simple question: which view of Delta’s future cash flows do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Delta Air Lines Narrative

If you see Delta’s story differently or simply want to dig into the numbers yourself, you can build a custom view in just minutes using Do it your way.

A great starting point for your Delta Air Lines research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

You have a clear view on Delta, so keep your edge by scanning fresh opportunities on Simply Wall Street before the market moves without you.

- Capture high-upside turnarounds by targeting these 3572 penny stocks with strong financials that already show real financial strength beneath their tiny share prices.

- Position yourself at the heart of the next tech wave by focusing on these 26 AI penny stocks that link AI breakthroughs to tangible revenue growth.

- Lock in quality at a discount by reviewing these 912 undervalued stocks based on cash flows where solid cash flows and sensible valuations work together in your favor.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAL

Delta Air Lines

Provides scheduled air transportation for passengers and cargo in the United States and internationally.

Good value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026