- United States

- /

- Marine and Shipping

- /

- NYSE:CMRE

Does Costamare's (CMRE) Rising EPS From Core Operations Reveal Shifts in Its Earnings Quality?

Reviewed by Simply Wall St

- Costamare Inc. reported its second quarter 2025 earnings, posting revenue of US$217.9 million, nearly unchanged from a year ago, with net income at US$88.69 million, down from US$102.34 million in the prior-year period.

- Despite a dip in net income, earnings per share from continuing operations increased year-over-year, highlighting improved results from ongoing business segments.

- We'll examine how the higher earnings per share from continuing operations may influence Costamare's investment outlook and forward expectations.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Costamare Investment Narrative Recap

For investors considering Costamare, the main story rests on confidence in the company’s ability to lock in future revenues through long-term charters, even as trade route uncertainty and dry bulk market weakness linger. The recent Q2 2025 results, with stable revenue and rising earnings per share from continuing operations, do not materially alter the main short-term catalyst: Costamare’s high rate of fixed revenue days for the year. However, exposure to evolving trade dynamics, particularly around the Red Sea, remains a key risk.

Among recent announcements, the July affirmation of the quarterly common dividend underscores Costamare’s commitment to shareholder returns, even amid modest year-over-year changes in headline financials. This steady payout may reassure income-focused investors but does not reduce the business’s underlying exposure to a possible normalization of key trade routes, which could quickly impact future charter rates and revenues. While these commitments provide stability, investors should not overlook the potential volatility if...

Read the full narrative on Costamare (it's free!)

Costamare's outlook anticipates $340.0 million in revenue and $325.7 million in earnings by 2028. This scenario assumes revenues will decline by 45.1% per year, while earnings are forecast to rise by $34.2 million from the current $291.5 million.

Uncover how Costamare's forecasts yield a $9.90 fair value, in line with its current price.

Exploring Other Perspectives

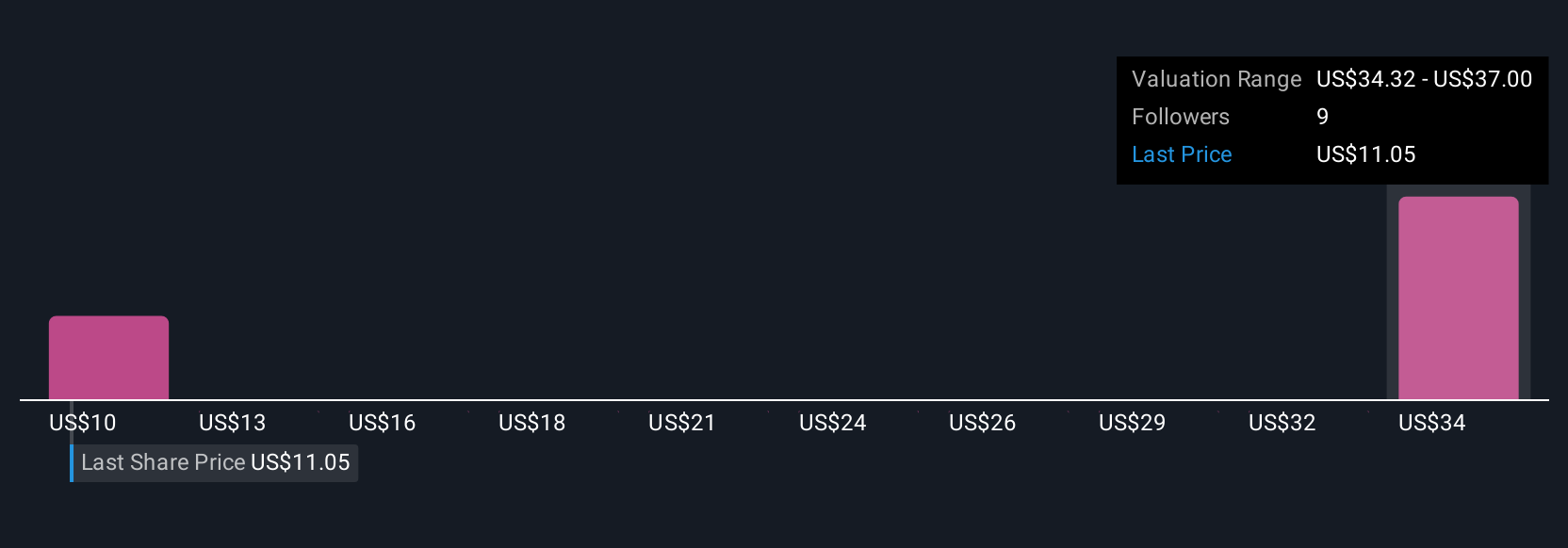

Simply Wall St Community members have posted fair value estimates for Costamare between US$9.90 and US$19.10, drawing on two detailed personal analyses. With contract coverage for 96 percent of revenue days in 2025, the risk of trade route normalization could be a critical consideration for those rethinking their outlook.

Explore 2 other fair value estimates on Costamare - why the stock might be worth as much as 89% more than the current price!

Build Your Own Costamare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Costamare research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Costamare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Costamare's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMRE

Costamare

Owns and operates containerships and dry bulk vessels worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives