- United States

- /

- Airlines

- /

- NYSE:ALK

Does the Alaska Air Group Share Price Drop Signal a Fair Valuation Opportunity?

Reviewed by Bailey Pemberton

If you’ve been eyeing Alaska Air Group’s stock and wondering what your next move should be, you’re not alone. With the share price closing at $43.00, there is palpable buzz among investors asking whether the recent turbulence is a warning sign or a setup for a smoother ascent ahead. Over just the past week, Alaska Air Group has dropped 12.3%, a dip that extends to a 15.5% fall over the last month. Year-to-date, the stock has slid a hefty 33.1%, and trailed with an 8.4% decline over the last twelve months. Long-term holders might take some comfort in the five-year return of 11.5%. In context, it’s no wonder there is talk about shifting sentiment and a closer look at valuation.

Recent news has cast a spotlight on the sector’s shifting dynamics. Operational updates and industry regulations continue to bring both risk and new opportunities for carriers like Alaska Air Group. Investors have responded to these evolving headlines by re-thinking risk, which is visible in the recent price moves. Through it all, the company’s value score currently sits at 2 (out of a possible 6), which indicates Alaska Air Group appears undervalued in 2 areas by conventional analysis. But what does that really mean for investors right now?

Next, let’s break down how these valuation methods stack up, uncover what’s driving that value score, and explore if there’s a smarter way to judge Alaska Air Group’s true price potential before we’re done.

Alaska Air Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

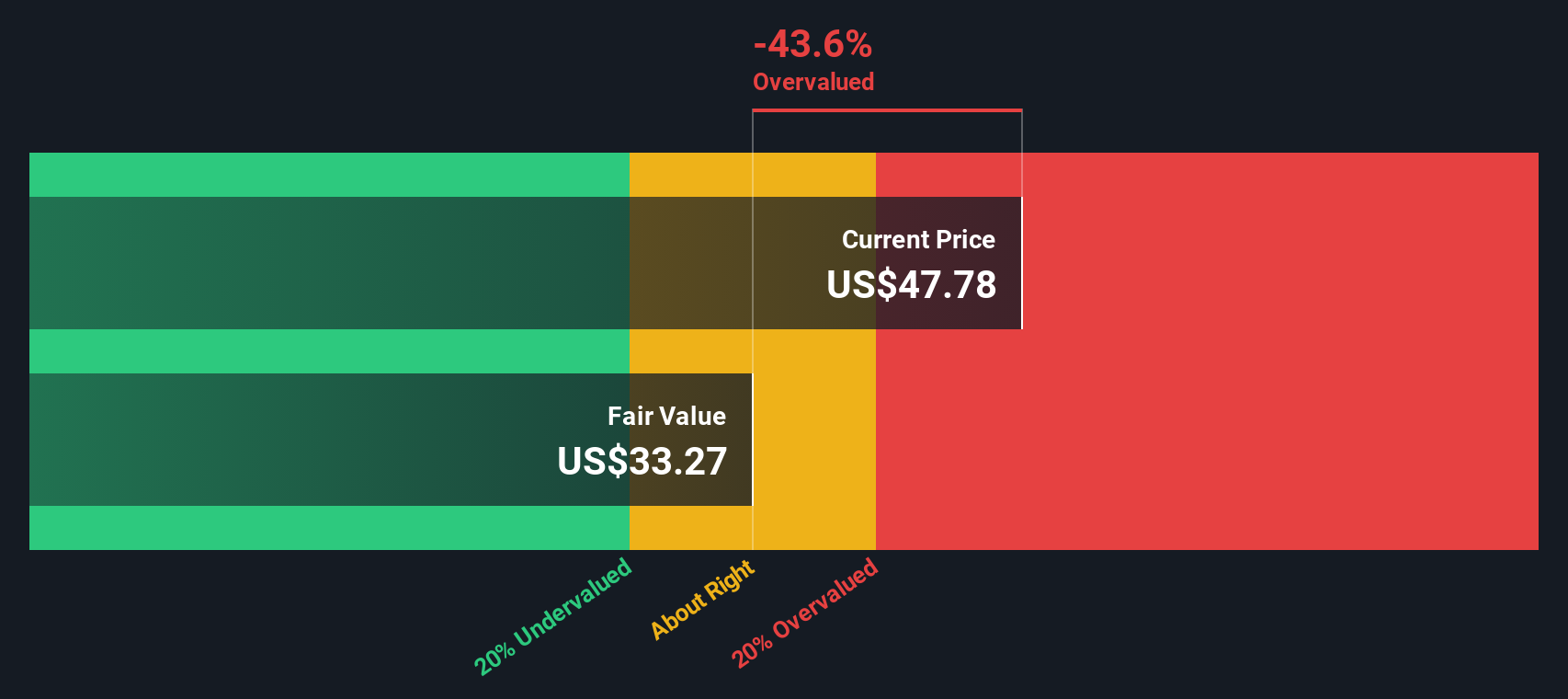

Approach 1: Alaska Air Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and discounting them back to today’s value. In Alaska Air Group’s case, analysts have used a two-stage Free Cash Flow to Equity approach to model future performance in dollars.

Currently, Alaska Air Group reports a last twelve months Free Cash Flow of -$452 million. Looking ahead, analysts expect the company’s FCF to rebound sharply into positive territory, rising to $344.7 million by 2026 and $385.9 million by 2027. While analyst coverage only extends a few years into the future, further projections extrapolated by Simply Wall St show estimated FCF continuing to grow through 2035, albeit at a moderating pace.

After adding up and discounting all these projections, the DCF model calculates an intrinsic value of $43.48 a share. With the stock currently trading at $43.00, this suggests the market price is just about 1.1% below the calculated fair value, meaning it is very close to what the model considers “fair.”

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Alaska Air Group's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

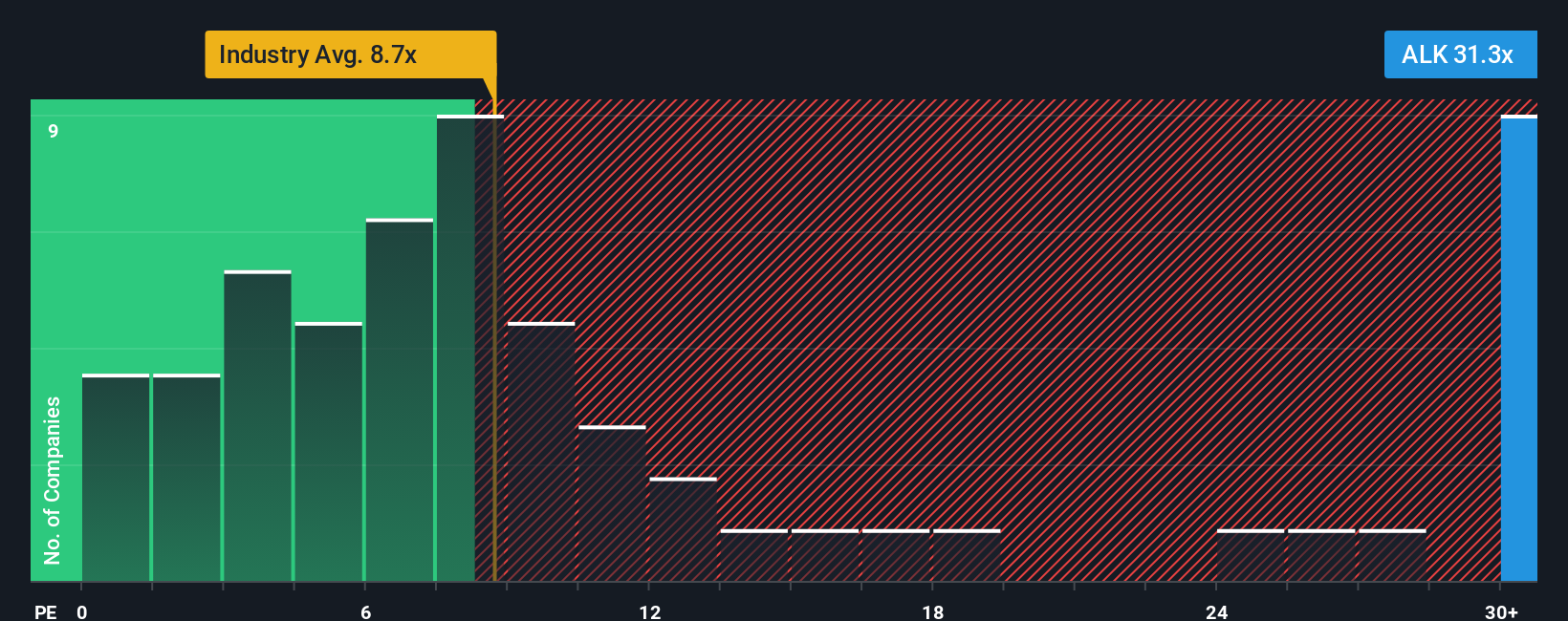

Approach 2: Alaska Air Group Price vs Earnings

The Price-to-Earnings (PE) ratio is the most widely used valuation metric for profitable companies. It measures how much investors are willing to pay today for each dollar of earnings a company generates. It offers quick insight, but context is crucial. A “normal” or fair PE depends on growth prospects, risk profile, and how consistently the business can turn profits into future gains.

Alaska Air Group’s current PE ratio stands at 33.0x. This is notably higher than both the airlines industry average of 8.9x and the peer group average of 18.6x. On pure comparisons, this might make the stock seem expensive. However, a fair assessment needs more nuance.

The Simply Wall St Fair Ratio offers a different perspective. Unlike a straight multiple comparison, the Fair Ratio incorporates Alaska Air Group’s expected growth, profitability, business risks, market capitalization, and specific industry standards. This method calculates a Fair Ratio of 54.9x, making it a much more tailored and holistic gauge of what investors should reasonably pay given the company’s unique characteristics.

With the current PE of 33.0x considerably below the Fair Ratio of 54.9x, the stock appears to offer value on this metric. The significant gap suggests Alaska Air Group could be trading at a discount compared to its underlying fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alaska Air Group Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple tool that helps you connect the story you believe about Alaska Air Group to a financial forecast and then to a fair value. Narratives let you express your perspective on the company by outlining your own expectations for its future revenue, profit margins, risks, and catalysts. The beauty of Narratives is that they bridge the gap between "what is" and "what you believe could be," linking real-world developments like Hawaiian Airlines integration, premium service growth, or rising operating costs to a dynamic forecast and a clear, actionable fair value.

Available for free to all investors on Simply Wall St's Community page, Narratives make it easy to compare your fair value with the current market price so you know when an opportunity arises or risks demand a rethink. Every Narrative is kept up to date as new earnings or news rolls in and can be authored, debated, and adjusted in real time so your decisions stay fresh and relevant. For example, one investor might see potential value as high as $80.00 due to successful market expansion and integration, while another might estimate just $56.00 because of concerns over rising costs and operational risks. Narratives empower you to decide whose story seems more likely and what a fair price truly means for you.

Do you think there's more to the story for Alaska Air Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALK

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives