- United States

- /

- Transportation

- /

- NasdaqGS:WERN

Werner Enterprises (WERN): Assessing Valuation After $18 Million Class Action Settlement Resolution

Reviewed by Simply Wall St

Werner Enterprises (WERN) has agreed to settle a long-running class action lawsuit for $18 million, pending court approval. This decision addresses extensive driver claims that have weighed on the company for more than a decade.

See our latest analysis for Werner Enterprises.

Shares of Werner Enterprises have been under pressure this year, with a year-to-date share price return of -22.09% and a one-year total shareholder return of -26.13%. While momentum appeared to build last month with a 5.41% gain, investors remain watchful as the company navigates operational headwinds. The company is also turning the page on a major legal hurdle, suggesting sentiment could shift if fundamentals start to improve.

If resolving big overhangs like lawsuits has you rethinking your approach, now could be the moment to broaden your search and discover fast growing stocks with high insider ownership.

With the long-awaited lawsuit nearing resolution and shares trading well below recent highs, the question now is whether Werner stock offers hidden value or if the current price already reflects any recovery in growth.

Most Popular Narrative: 2.5% Overvalued

With the stock closing at $27.68 and the consensus narrative fair value only slightly higher at $29.07, the market appears to be pricing in muted upside potential for Werner Enterprises. The story is finely balanced between operational improvements and significant industry headwinds, which puts the spotlight on the company’s ability to execute.

Strong operational execution and disciplined capital allocation, including a modern, low-age fleet and share repurchases at depressed prices, have positioned Werner for efficient scaling as volumes rebound. Incremental margins are likely to accelerate as Dedicated and Logistics growth absorbs fixed costs and technology leverage begins to take effect.

Curious about what’s underpinning this narrow fair value gap? The narrative forecasts a margin expansion and revenue mix shift, but key financial projections are what make or break the calculation. The real surprise lies in their expectations for sustainable growth and the required profit multiple. Don't miss the deeper assumptions pushing this valuation just above today’s price.

Result: Fair Value of $29.07 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent insurance costs and ongoing labor shortages still threaten Werner’s margins. These issues serve as possible catalysts that could challenge the current outlook.

Find out about the key risks to this Werner Enterprises narrative.

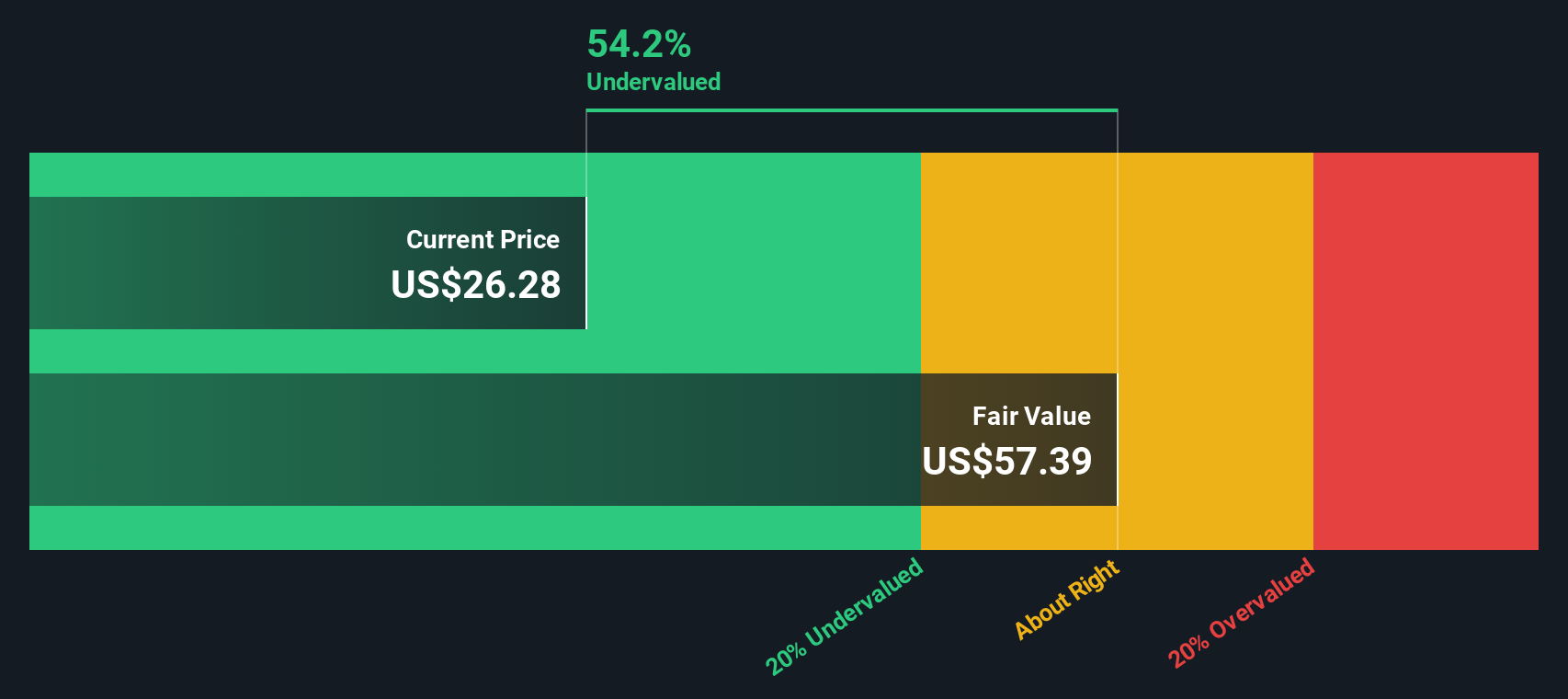

Another View: Discounted Cash Flow Model Suggests Hidden Upside

While the consensus fair value and analyst price targets leave little room for optimism, the SWS DCF model tells a different story. It values Werner at $57.99 per share, placing the current price at a steep 52% discount. This sharp divergence raises the question: is the market missing a deeper source of value, or does it know risks that the models cannot capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Werner Enterprises for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Werner Enterprises Narrative

Not convinced by these conclusions or want a personalized angle? You can analyze the numbers and develop your own thesis in just minutes. Do it your way.

A great starting point for your Werner Enterprises research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Level up your portfolio by tracking opportunities other investors miss. The Simply Wall Street Screener makes it easy to target winners in any market environment.

- Capture income potential and secure steady returns when you check out these 17 dividend stocks with yields > 3% with yields above 3%.

- Harness the momentum of the artificial intelligence boom by following these 27 AI penny stocks that are reshaping entire industries.

- Seize undervalued opportunities before the crowd by investigating these 873 undervalued stocks based on cash flows based on strong cash flow signals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Werner Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WERN

Werner Enterprises

Engages in transporting truckload shipments of general commodities in interstate and intrastate commerce in the United States, Mexico, and internationally.

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives