- United States

- /

- Airlines

- /

- NasdaqGS:UAL

How Investors May Respond To United Airlines Holdings (UAL) New Transatlantic Routes and Expanded Summer 2026 Schedule

Reviewed by Sasha Jovanovic

- United Airlines recently announced its Summer 2026 schedule, introducing new nonstop routes from Newark to four European cities, Split, Bari, Glasgow, and Santiago de Compostela, and additional flights to Reykjavik, Seoul, and Tel Aviv, further expanding its international reach.

- This major route expansion highlights United's role as the U.S. airline with the most transatlantic destinations and exclusive nonstop service to several European cities unserved by other U.S. carriers.

- We'll examine how United's expanded transatlantic network could influence its growth prospects and investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

United Airlines Holdings Investment Narrative Recap

To believe in United Airlines Holdings as a shareholder, you need conviction in the long-term growth of international air travel and United’s focus on high-yield routes, even as industry risks like shifting business travel patterns and debt-funded expansion remain top of mind. The recent news of expanded transatlantic service is a timely catalyst, but by itself does not materially lower the risk of business travel stagnation or address concerns over financial leverage in the short term.

Among recent announcements, United’s unveiling of the new Polaris Studio Suite and upgraded premium cabins is especially relevant. This aligns with the Summer 2026 network expansion, supporting United’s drive to capture higher-yield, premium-seeking travelers, one of the key growth catalysts analysts believe underpins its investment appeal.

On the other hand, investors should be especially mindful of how ongoing exposure to labor agreements and congested hubs could create...

Read the full narrative on United Airlines Holdings (it's free!)

United Airlines Holdings' outlook forecasts $67.6 billion in revenue and $4.2 billion in earnings by 2028. Achieving this would require 5.2% annual revenue growth and an $0.9 billion increase in earnings from the current $3.3 billion.

Uncover how United Airlines Holdings' forecasts yield a $115.00 fair value, a 19% upside to its current price.

Exploring Other Perspectives

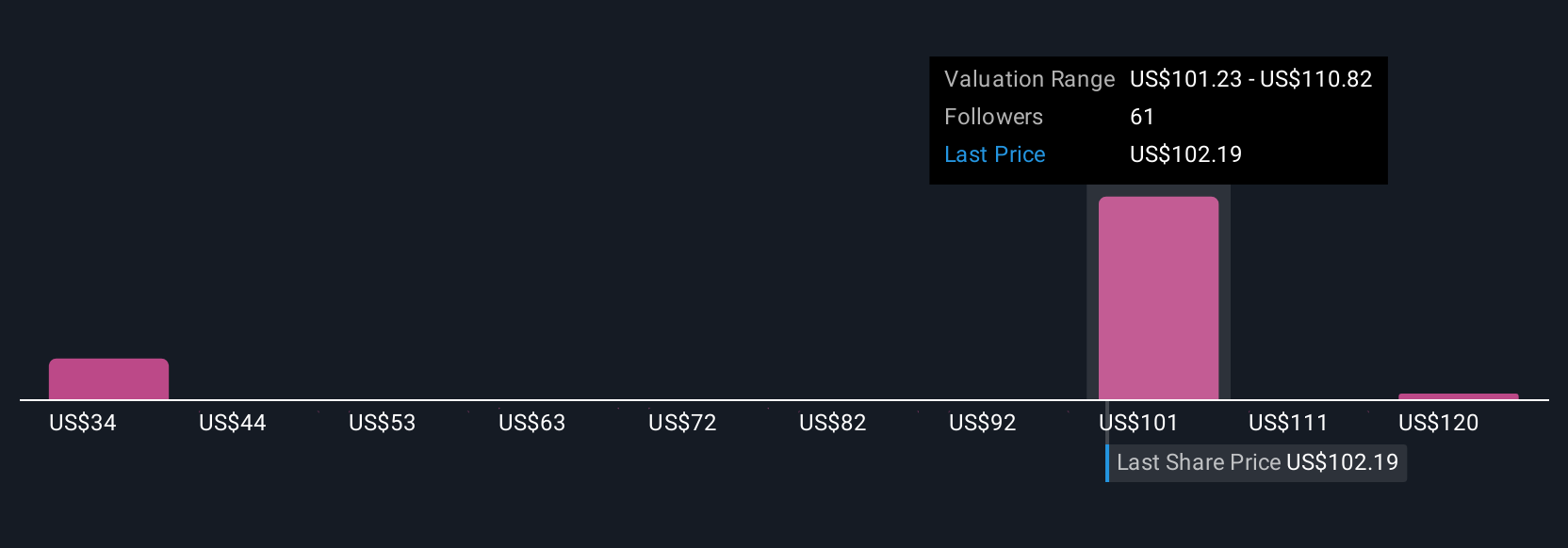

Simply Wall St Community members have posted seven fair value estimates for United Airlines Holdings, stretching from as low as US$37.15 to US$130. Capacity expansions are seen as a catalyst for international revenue growth, but your outlook may hinge on how you weigh risks around long-term demand and leverage.

Explore 7 other fair value estimates on United Airlines Holdings - why the stock might be worth less than half the current price!

Build Your Own United Airlines Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Airlines Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free United Airlines Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Airlines Holdings' overall financial health at a glance.

No Opportunity In United Airlines Holdings?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UAL

United Airlines Holdings

Through its subsidiaries, provides air transportation services in the United States, Canada, Atlantic, the Pacific, and Latin America.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives