- United States

- /

- Airlines

- /

- NasdaqGS:SNCY

Sun Country Airlines Holdings, Inc. (NASDAQ:SNCY) Stock Rockets 47% But Many Are Still Ignoring The Company

Sun Country Airlines Holdings, Inc. (NASDAQ:SNCY) shareholders would be excited to see that the share price has had a great month, posting a 47% gain and recovering from prior weakness. Unfortunately, despite the strong performance over the last month, the full year gain of 9.8% isn't as attractive.

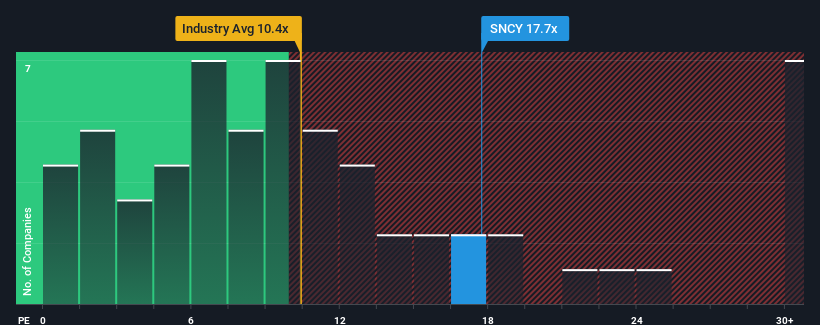

Although its price has surged higher, it's still not a stretch to say that Sun Country Airlines Holdings' price-to-earnings (or "P/E") ratio of 17.7x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 18x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings that are retreating more than the market's of late, Sun Country Airlines Holdings has been very sluggish. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

View our latest analysis for Sun Country Airlines Holdings

Is There Some Growth For Sun Country Airlines Holdings?

Sun Country Airlines Holdings' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 35% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 40% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 81% during the coming year according to the five analysts following the company. With the market only predicted to deliver 15%, the company is positioned for a stronger earnings result.

In light of this, it's curious that Sun Country Airlines Holdings' P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Sun Country Airlines Holdings' P/E?

Sun Country Airlines Holdings appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Sun Country Airlines Holdings currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Sun Country Airlines Holdings you should be aware of.

If these risks are making you reconsider your opinion on Sun Country Airlines Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SNCY

Sun Country Airlines Holdings

An air carrier company, operates scheduled passenger, air cargo, charter air transportation, and related services in the United States, Latin America, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives