- United States

- /

- Marine and Shipping

- /

- NasdaqCM:SHIP

The Market Lifts Seanergy Maritime Holdings Corp. (NASDAQ:SHIP) Shares 28% But It Can Do More

Those holding Seanergy Maritime Holdings Corp. (NASDAQ:SHIP) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last month tops off a massive increase of 113% in the last year.

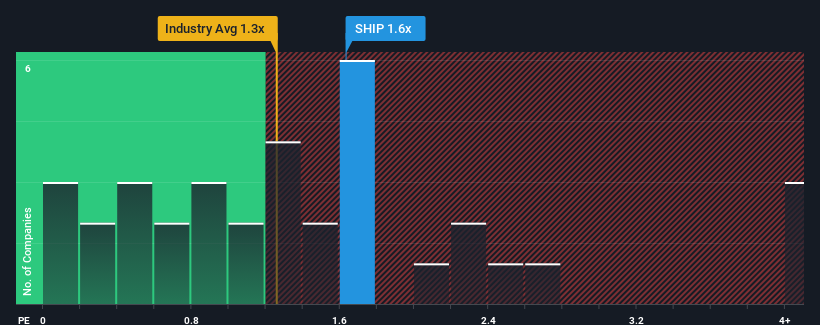

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Seanergy Maritime Holdings' P/S ratio of 1.6x, since the median price-to-sales (or "P/S") ratio for the Shipping industry in the United States is also close to 1.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Seanergy Maritime Holdings

How Seanergy Maritime Holdings Has Been Performing

Seanergy Maritime Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Seanergy Maritime Holdings will help you uncover what's on the horizon.How Is Seanergy Maritime Holdings' Revenue Growth Trending?

Seanergy Maritime Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 33% gain to the company's top line. The latest three year period has also seen an excellent 63% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 13% as estimated by the four analysts watching the company. With the rest of the industry predicted to shrink by 0.1%, that would be a fantastic result.

With this in mind, we find it intriguing that Seanergy Maritime Holdings' P/S trades in-line with its industry peers. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

What Does Seanergy Maritime Holdings' P/S Mean For Investors?

Seanergy Maritime Holdings' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Seanergy Maritime Holdings currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. Given the glowing revenue forecasts, we can only assume potential risks are what might be capping the P/S ratio at its current levels. The market could be pricing in the event that tough industry conditions will impact future revenues. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Seanergy Maritime Holdings (1 is significant) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SHIP

Seanergy Maritime Holdings

A shipping company, engages in the seaborne transportation of dry bulk commodities worldwide.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives