- United States

- /

- Transportation

- /

- NasdaqGM:PAMT

Insufficient Growth At Pamt Corp. (NASDAQ:PAMT) Hampers Share Price

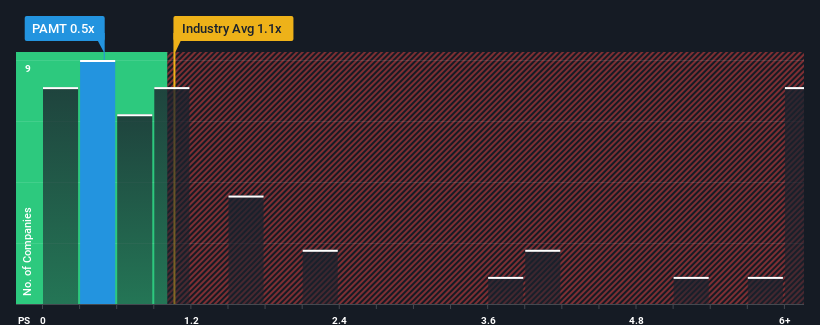

You may think that with a price-to-sales (or "P/S") ratio of 0.5x Pamt Corp. (NASDAQ:PAMT) is a stock worth checking out, seeing as almost half of all the Transportation companies in the United States have P/S ratios greater than 1.1x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 1 warning sign investors should be aware of before investing in Pamt. Read for free now.Check out our latest analysis for Pamt

How Has Pamt Performed Recently?

Pamt hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Pamt will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Pamt's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. The last three years don't look nice either as the company has shrunk revenue by 12% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue growth is heading into negative territory, declining 0.8% over the next year. With the industry predicted to deliver 7.3% growth, that's a disappointing outcome.

With this information, we are not surprised that Pamt is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Pamt's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Pamt's P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Pamt's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

Plus, you should also learn about this 1 warning sign we've spotted with Pamt.

If these risks are making you reconsider your opinion on Pamt, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PAMT

Pamt

Through its subsidiaries, operates as a truckload transportation and logistics company in the United States, Mexico, and Canada.

Low risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success