- United States

- /

- Transportation

- /

- NasdaqGS:ODFL

Old Dominion Freight Line (ODFL): Assessing Valuation After Third-Quarter Sales and Earnings Decline

Reviewed by Simply Wall St

Old Dominion Freight Line (ODFL) just released its earnings report for the third quarter, showing declines in both sales and net income compared to a year ago. Investors are already weighing what this trend could mean for the future.

See our latest analysis for Old Dominion Freight Line.

After a string of solid years, Old Dominion Freight Line’s 1-year total shareholder return has dropped to -37.8%, with the latest share price sitting at $137.69. This recent weakness in shareholder returns comes as the company reported lower earnings and sales. Momentum has faded for now even though long-term holders have still seen gains over five years.

If Old Dominion’s recent results have you rethinking your watchlist, this could be the moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock well below its highs and trading at a discount to some analyst targets, investors are now left to consider whether this is a buying opportunity for Old Dominion or if the market is already factoring in muted growth ahead.

Most Popular Narrative: 12.5% Undervalued

The most-discussed narrative puts Old Dominion Freight Line’s fair value at $157.38, well above the last close of $137.69, making the latest discount hard to ignore. Analyst attention is sharply focused on margin expansion and strategic moves that could set ODFL up for a rebound, if forecasts hold true.

“Strategic adjustments in capital spending and disciplined yield management support long-term growth, improving operating leverage and net margins. Economic uncertainty and decreased LTL tons per day could hinder Old Dominion's revenue growth and pressure margins amid increased overhead costs and global trade uncertainties.”

Want to see what really drives this optimistic outlook? Analysts are betting on margin gains and rising profits, but the financial leap behind the target is built on bold forecasts. What’s the pivotal assumption that could turn this gap into shareholder gains or dashed hopes? Read the breakdown to discover what moves the needle in this popular valuation.

Result: Fair Value of $157.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, current economic uncertainty and declining shipment volumes could limit Old Dominion’s revenue and earnings growth if these negative trends persist.

Find out about the key risks to this Old Dominion Freight Line narrative.

Another View: Market Ratios Suggest Caution

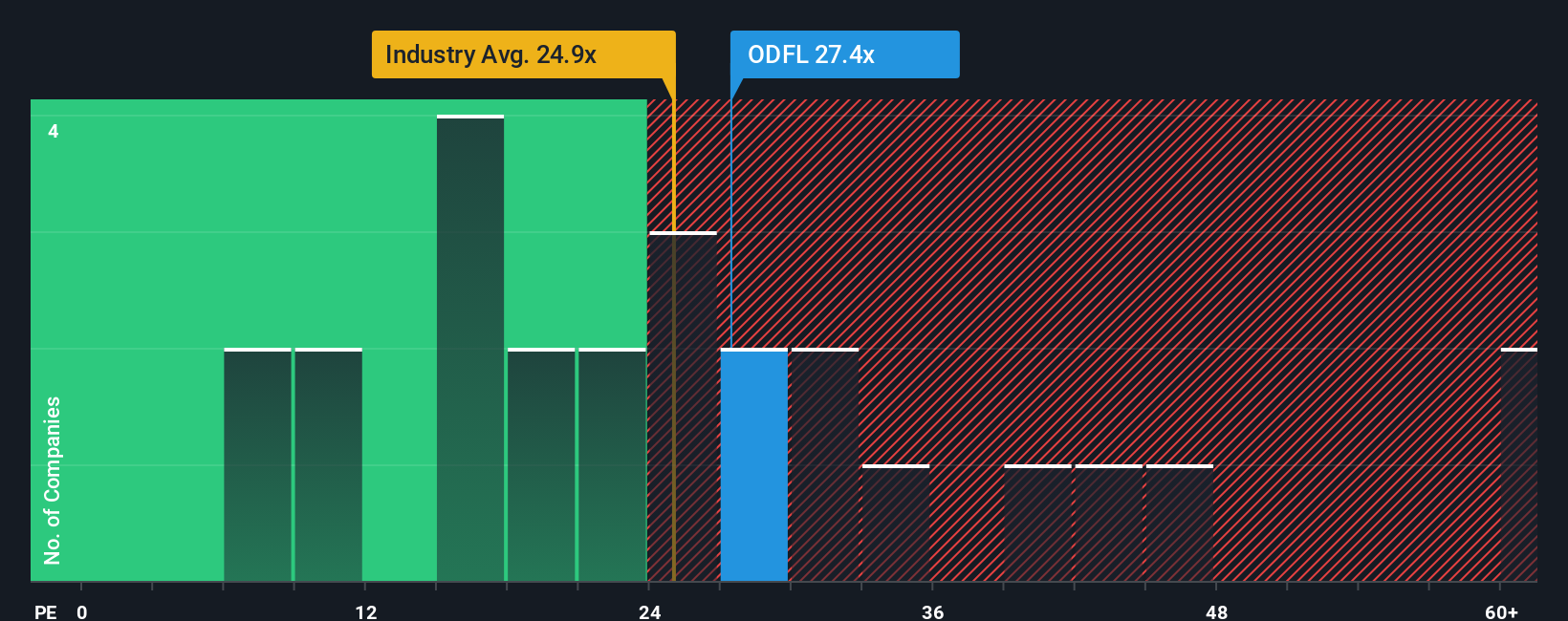

Looking at Old Dominion through the lens of price-to-earnings, its current ratio of 27.4x sits just above the US Transportation industry average of 27.2x but well below the peer group’s elevated 35.8x. However, compared to a fair ratio of 16.6x, there is meaningful downside risk if sentiment shifts. Is there more risk priced in than opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Old Dominion Freight Line for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 849 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Old Dominion Freight Line Narrative

If you see things differently or want to dig into the data yourself, you can build your own custom narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Old Dominion Freight Line.

Ready for More Standout Opportunities?

Don’t let your next winning stock slip away. Use these smart investment shortcuts and find companies others might miss before they make headlines.

- Boost your portfolio’s yield potential and uncover steady income ideas with these 17 dividend stocks with yields > 3%, offering yields above 3%.

- Target tomorrow’s industry disruptors by focusing on emerging trends with these 25 AI penny stocks, which are transforming everything from automation to deep learning.

- Capitalize on hidden value by reviewing these 849 undervalued stocks based on cash flows, which could offer significant upside, based on future cash flows and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ODFL

Old Dominion Freight Line

Operates as a less-than-truckload motor carrier in the United States and North America.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives