- United States

- /

- Transportation

- /

- NasdaqGS:LYFT

Lyft (LYFT): Assessing Valuation Following Strong Recent Share Price Gains

Reviewed by Simply Wall St

Lyft (LYFT) shares have caught investors' attention lately after climbing 12% over the past week. The stock has also surged 18% in the past month, prompting questions about what is driving this renewed interest.

See our latest analysis for Lyft.

Momentum is clearly in Lyft’s favor lately. After a stellar 90-day share price return of 50.44% and a year-to-date rally of 74.36%, the latest gains suggest growing optimism around the company’s growth prospects and improving fundamentals. At the same time, the 32.81% total shareholder return over the past year reinforces the notion that Lyft’s turnaround story is starting to gain real traction rather than being a short-lived burst.

If the buzz around Lyft’s progress has piqued your interest, it might also be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares rising quickly and sentiment turning positive, investors are left wondering if Lyft is trading below its true value or if the market has already factored in all of its expected growth, leaving little room for upside.

Most Popular Narrative: 17.9% Overvalued

Compared to its last close price of $23.80, the most popular narrative estimates Lyft’s fair value at $20.18. This gap sets up a debate over whether optimism has started getting ahead of fundamentals as analyst confidence grows among autonomous vehicle bets and global partnerships.

Expansion into urban markets, innovation in autonomous vehicles, and global partnerships are set to drive sustained revenue growth and improve long-term margins. Enhanced platform features, disciplined operations, and European market integration are expected to boost user retention and accelerate international revenue opportunities.

Curious why the narrative puts Lyft’s value below the current stock price? It all comes down to bold assumptions such as international growth, margin upgrades, and future profit multiples that are more ambitious than industry norms. The key numbers behind these projections could catch you off guard. Find out what’s fueling this high-stakes valuation story.

Result: Fair Value of $20.18 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intense competition from rivals and potential regulatory hurdles could quickly undermine Lyft’s current momentum. This could cast doubt on its ambitious growth outlook.

Find out about the key risks to this Lyft narrative.

Another View: Discounted Cash Flow Model

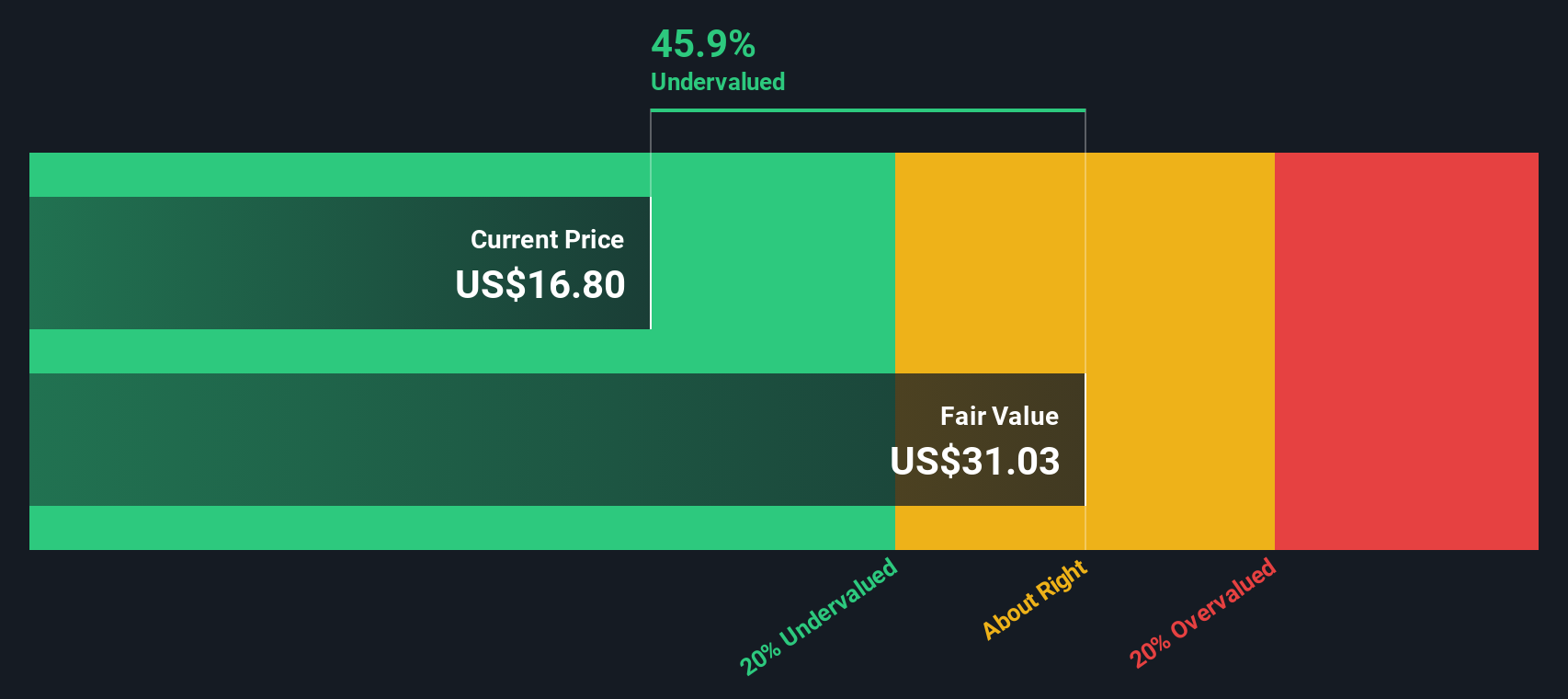

While much of the market chatter leans on analyst price targets and industry multiples, the SWS DCF model tells a different story. According to this cash flow analysis, Lyft is trading around 49.9% below its estimated fair value. This suggests there could be notable upside opportunity that the consensus view may not capture.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lyft for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lyft Narrative

If you have your own perspective or enjoy drawing your own conclusions from the numbers, you can easily craft a fresh view based on the data in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Lyft.

Looking for more investment ideas?

Smart investors know that opportunities rarely stand still. Keep your portfolio ahead of the curve by checking out these handpicked lists for fresh stock ideas and potential market winners.

- Capture growth opportunities by scanning these 27 AI penny stocks, which are blazing new trails in artificial intelligence and setting the pace for tomorrow’s innovation leaders.

- Multiply long-term gains by searching through these 870 undervalued stocks based on cash flows, where robust financials and attractive prices could set you up for the next breakout.

- Benefit from steady passive income by reviewing these 15 dividend stocks with yields > 3% offering reliable yields greater than 3%, perfect for building wealth over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LYFT

Lyft

Operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives