- United States

- /

- Transportation

- /

- NasdaqGS:LYFT

A Look at Lyft’s Valuation After California’s Landmark Rideshare Labor and Insurance Overhaul

Reviewed by Simply Wall St

Lyft (LYFT) just landed in the headlines thanks to a major deal in California, where lawmakers, Governor Newsom, and the company agreed to allow rideshare drivers to unionize without changing their independent contractor status. At the same time, legislators are backing bills to reduce insurance expenses for rideshare firms, paving the way for lower operating costs. For investors, these regulatory changes are intriguing because they touch on everything from Lyft’s labor costs to the affordability of its rides for millions of users.

This regulatory reset comes as Lyft’s stock has been moving up, with the shares rising nearly 39% over the past year and about 19% in the past month. The pace of gains has sped up after a stretch of tepid returns going back several years, hinting that the market has started to factor in positive changes for the business, including growth in revenue and improving profits. Against the backdrop of headline-making incidents and policy shifts, momentum has returned to the stock.

With Lyft’s valuation shifting, the question now is whether the recent surge reflects the company’s long-term potential, or if investors are simply pricing in every ounce of future growth ahead of time.

Most Popular Narrative: 5.1% Undervalued

According to community narrative, current analyst projections suggest Lyft is trading at a modest discount to what is considered fair value. The consensus blend of revenue, earnings, and future growth points to more upside, based on strong catalysts and long-term assumptions.

The ongoing rollout and consumer adoption of autonomous vehicles, supported by new partnerships with tech leaders like Baidu and operational capabilities in both the U.S. and Europe, are expected to significantly expand Lyft's total addressable market, lower labor costs, and increase long-term gross margins and earnings.

Want to unlock Lyft’s future? The outlook centers on game-changing margins and aggressive revenue expansion. Which bold growth figures power the narrative? Explore the analyst mindset and see what is driving this fair value perspective.

Result: Fair Value of $17.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, persistent competition from rivals and additional regulatory hurdles could slow Lyft’s momentum. This may put downward pressure on profits and growth projections. Find out about the key risks to this Lyft narrative.Another View: SWS DCF Model

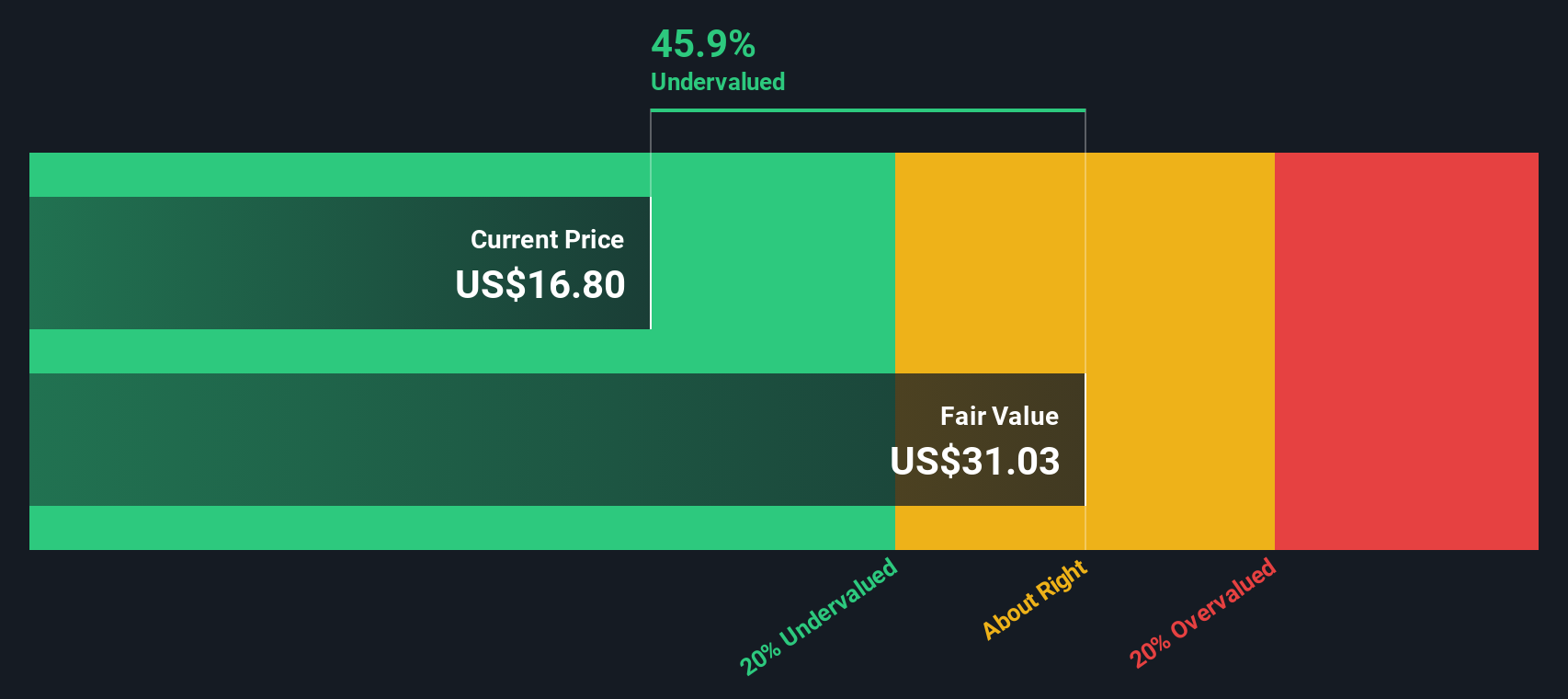

Taking a step back from analyst price targets, the SWS DCF model suggests a very different story. It indicates Lyft could be notably undervalued based on future cash flows. Could this gap reveal hidden upside, or just more risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lyft for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lyft Narrative

If you see the numbers differently or want to dig into the data on your own terms, it’s easy to build a customized narrative in minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Lyft.

Looking for More Smart Investment Opportunities?

Don’t let your next big win pass you by. There is a world of stocks brimming with potential waiting for you. Use the Simply Wall Street Screener to pinpoint fresh ideas that match your strategy and appetite. Move beyond the obvious to uncover your next portfolio standout with these options:

- Target value plays with promising upside and explore opportunities among undervalued stocks based on cash flows that stand out on cash flow metrics.

- Find technological breakthroughs early by searching for innovative companies driving change in the quantum computing space. Start with our curated list of quantum computing stocks.

- Boost your growth strategy by identifying income-producing stocks. Discover our picks of dividend stocks with yields > 3% that consistently deliver yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:LYFT

Lyft

Operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives