- United States

- /

- Airlines

- /

- NasdaqCM:JTAI

Jet.AI Inc.'s (NASDAQ:JTAI) Shareholders Might Be Looking For Exit

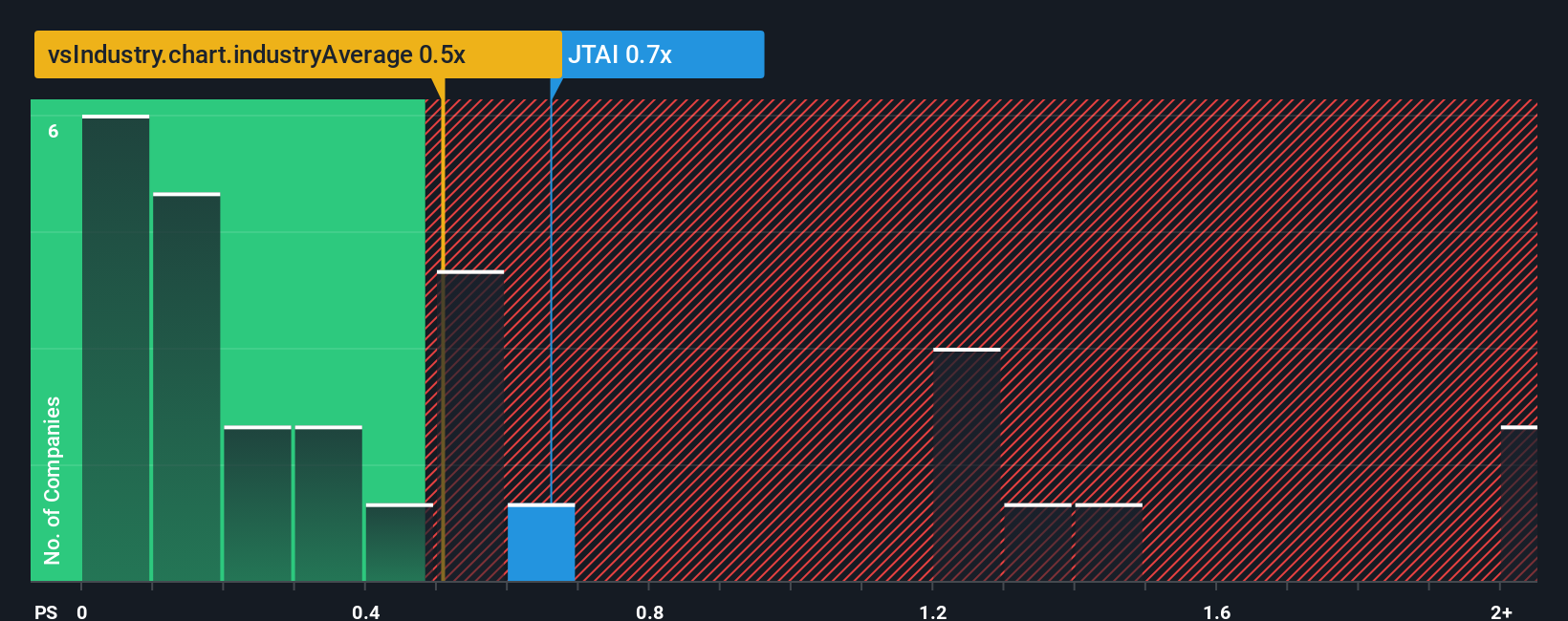

There wouldn't be many who think Jet.AI Inc.'s (NASDAQ:JTAI) price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S for the Airlines industry in the United States is similar at about 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Jet.AI

How Has Jet.AI Performed Recently?

Recent times have been more advantageous for Jet.AI as its revenue hasn't fallen as much as the rest of the industry. One possibility is that the P/S ratio is moderate because investors think this relatively better revenue performance might be about to evaporate. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues outplaying the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Jet.AI.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Jet.AI would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 3.8% decrease to the company's top line. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Turning to the outlook, the next year should generate growth of 71% as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 1,806%, which is noticeably more attractive.

With this information, we find it interesting that Jet.AI is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Jet.AI's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at the analysts forecasts of Jet.AI's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Jet.AI (at least 2 which make us uncomfortable), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:JTAI

Jet.AI

Engages in the development and operation of private aviation platforms.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives