- United States

- /

- Airlines

- /

- NasdaqGS:JBLU

JetBlue Airways (JBLU) Valuation: Analyzing Whether the Market Has Priced In a Recovery

Reviewed by Kshitija Bhandaru

JetBlue Airways (JBLU) shares have caught the attention of some investors after modest trading moves in the past week. Over the past month, the stock has retreated, while returns for the year remain in negative territory.

See our latest analysis for JetBlue Airways.

After a tough stretch, JetBlue Airways’ year-to-date share price return sits deep in the red. Its one-year total shareholder return is also negative, reflecting fading momentum despite some cautious optimism about growth. Short-term swings have been overshadowed by persistent challenges, so investors seem to be waiting for a clear shift in the company’s outlook.

If you’re tracking where travel and transport stocks are headed next, you might want to widen your search and discover fast growing stocks with high insider ownership

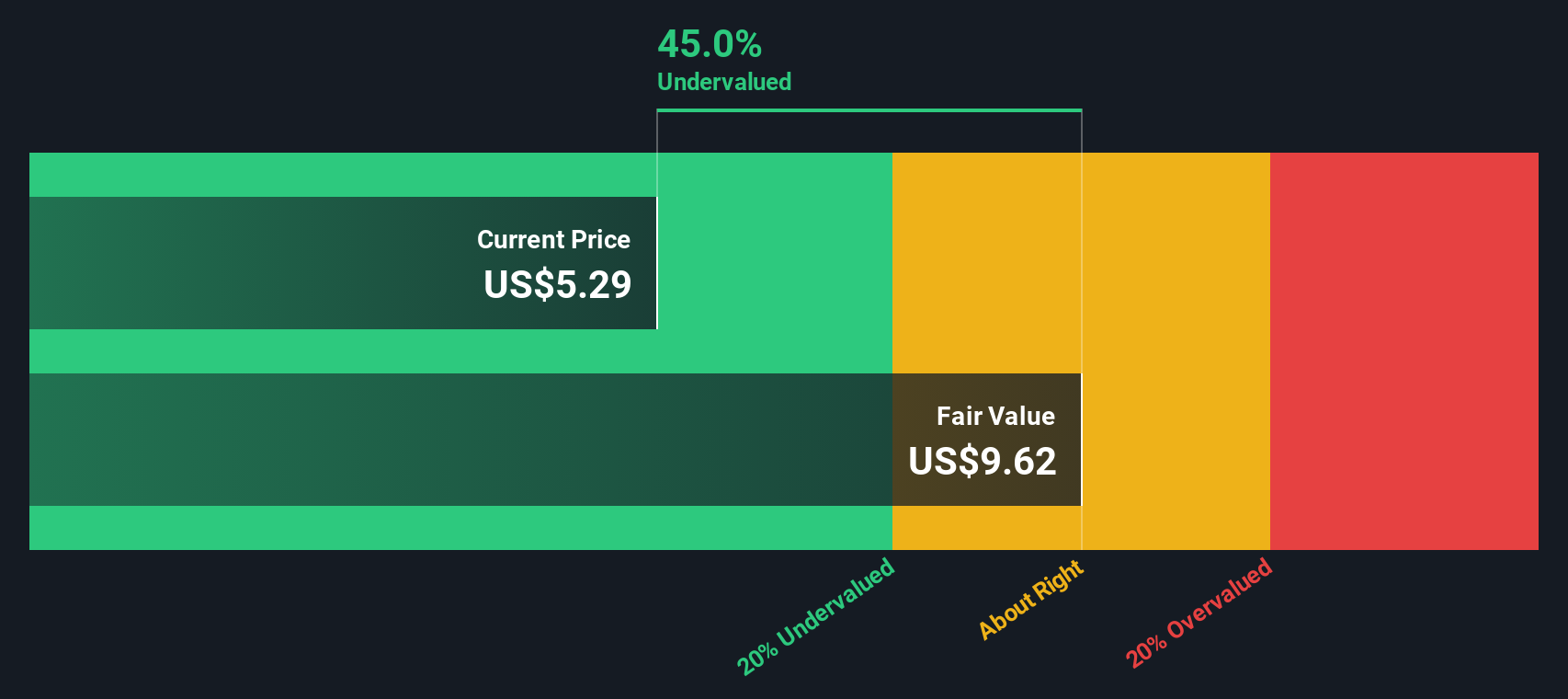

With such sharp declines this year, but hints of recovery in earnings growth, investors may be wondering whether JetBlue Airways is trading below its true value or if the market has already accounted for any future rebound.

Most Popular Narrative: 6% Overvalued

According to the most widely followed narrative, JetBlue Airways’ current fair value estimate of $4.42 is slightly below its last close price of $4.70. This suggests the stock is trading just above what analysts believe is justified. This sets the stage for examining how future growth prospects influence that valuation.

Major operational improvements, including leading on-time performance, network optimization (redeploying over 20% of network to core customers), and elevated customer satisfaction, are expected to support better load factors and boost both revenue and net earnings through increased preference for JetBlue.

Think performance upgrades are the whole story? Think again. This fair value is built on bold earnings and revenue projections, with future profit margins that could surprise even seasoned investors. Want to discover which financial levers are doing the heavy lifting? The full narrative reveals which numbers really drive JetBlue’s valuation.

Result: Fair Value of $4.42 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent uncertainty around demand visibility and ongoing labor cost pressures could quickly upend the optimism embedded in JetBlue's recovery story.

Find out about the key risks to this JetBlue Airways narrative.

Another View: Discounted Cash Flow Perspective

While the current valuation suggests JetBlue Airways is overvalued based on typical market multiples, our SWS DCF model offers a different perspective. It calculates a fair value of $8.61 per share, indicating the stock is actually trading well below this intrinsic worth. Is the market overlooking JetBlue’s long-term cash flow potential, or is lingering uncertainty justified?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own JetBlue Airways Narrative

If you'd rather form your own view or dig deeper into JetBlue Airways’ numbers, you can easily craft your own perspective in under three minutes. Do it your way

A great starting point for your JetBlue Airways research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Act quickly and access hand-picked opportunities that match your strategy. The market keeps moving, so make sure you don’t miss the next breakout stock.

- Catch seriously undervalued companies before the crowd by reviewing these 904 undervalued stocks based on cash flows, which features strong cash flow signals and healthy balance sheets.

- Add future-powered tech to your watchlist by targeting these 24 AI penny stocks, companies poised to benefit from the AI revolution and rapid sector growth.

- Secure steady income streams by checking out these 19 dividend stocks with yields > 3%, a selection boasting attractive yields above 3% for your income portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JBLU

Undervalued with minimal risk.

Market Insights

Community Narratives