- United States

- /

- Airlines

- /

- NasdaqGS:JBLU

How Investors May Respond To JetBlue Airways (JBLU) Launching Project Kuiper Wi-Fi and Expanding Condor Partnership

Reviewed by Simply Wall St

- JetBlue recently became the first airline to commit to Amazon's Project Kuiper low Earth orbit satellite broadband network, aiming to upgrade its free Fly-Fi onboard Wi-Fi with higher speeds and reliability starting in 2027, while also expanding its loyalty partnership with German carrier Condor to allow TrueBlue members to earn and redeem points on Condor flights.

- This dual move strengthens JetBlue’s unique position in onboard connectivity and customer loyalty, signaling a competitive push to differentiate its services and attract transatlantic travelers.

- We’ll explore how JetBlue’s decision to debut Project Kuiper technology onboard could impact its investment outlook and customer experience narrative.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

JetBlue Airways Investment Narrative Recap

To be a JetBlue shareholder, you must have confidence in the airline’s ability to differentiate through customer experience, technology, and partnerships, while facing risks tied to demand unpredictability and rising labor costs. The Project Kuiper announcement provides a long-term boost to JetBlue’s innovation narrative, but it does not materially shift near-term revenue or margin risks, which remain most sensitive to competitive pressures and operational costs.

Among recent moves, the expanded Condor partnership stands out for its immediate impact on JetBlue’s customer loyalty strategy, linking TrueBlue members with more transatlantic options, as JetBlue seeks to convert network enhancements and premium offerings like Fly-Fi into stronger preference and retention. The announcement adds incremental value to JetBlue’s loyalty platform, reinforcing a key commercial catalyst.

However, investors should take note: while technology and loyalty partnerships grab attention, persistent cost and demand pressures continue to weigh on JetBlue’s financial performance and the path to profitability...

Read the full narrative on JetBlue Airways (it's free!)

JetBlue Airways' narrative projects $10.6 billion revenue and $728.0 million earnings by 2028. This requires 5.1% yearly revenue growth and a $1,114 million increase in earnings from the current -$386.0 million.

Uncover how JetBlue Airways' forecasts yield a $4.42 fair value, a 15% downside to its current price.

Exploring Other Perspectives

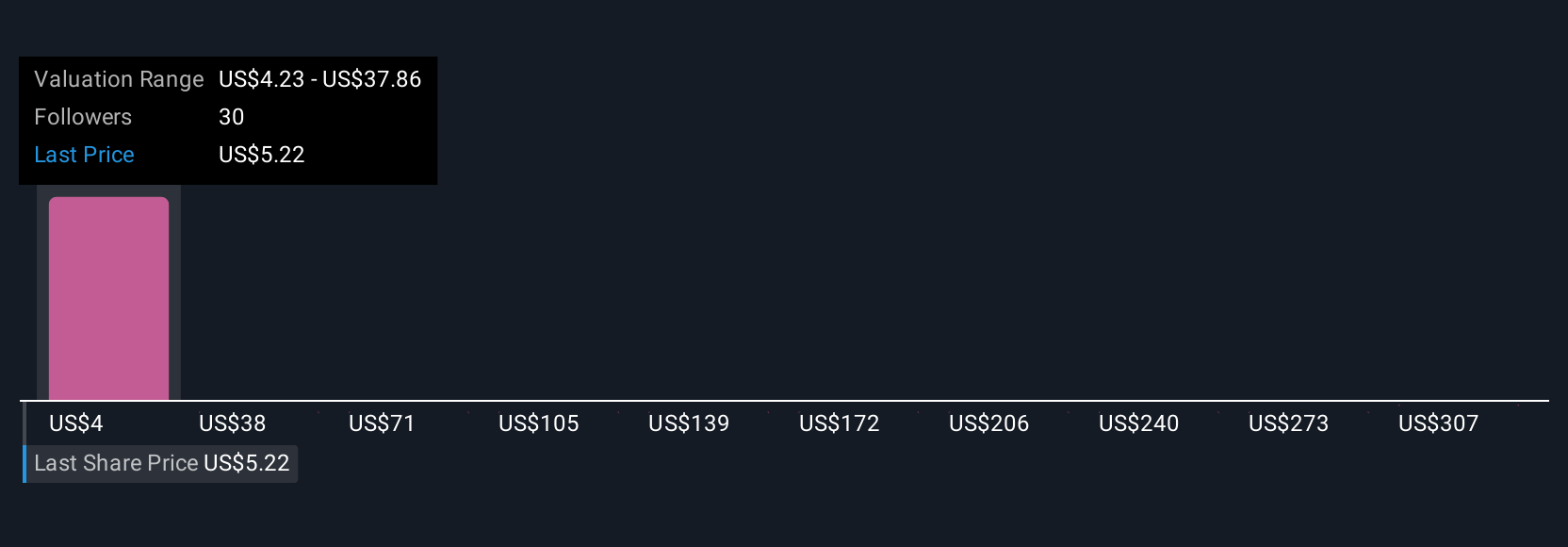

Seven fair value estimates from the Simply Wall St Community range from US$3.00 to US$340.49 per share, reflecting vastly different views on JetBlue’s future. Despite this diversity, operational costs and margin pressure remain a critical concern for many, suggesting you may want to consider a range of viewpoints before making any decisions.

Explore 7 other fair value estimates on JetBlue Airways - why the stock might be worth 42% less than the current price!

Build Your Own JetBlue Airways Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JetBlue Airways research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JetBlue Airways research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JetBlue Airways' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JBLU

Undervalued with minimal risk.

Market Insights

Community Narratives