- United States

- /

- Airlines

- /

- NasdaqGS:JBLU

Could JetBlue’s (JBLU) New European Routes Reveal Its Long-Term Transatlantic Strategy?

Reviewed by Sasha Jovanovic

- JetBlue announced plans to launch new daily summer seasonal flights from Boston to Milan and Barcelona, expanding its transatlantic offerings from Boston Logan International Airport, with both routes set to begin in 2026 and tickets available from November 20, 2025.

- This move bolsters JetBlue’s position as Boston’s leading leisure airline and gives New England travelers greater access to top European destinations for future travel seasons.

- We'll explore how JetBlue's expanded European network could reshape its investment narrative given the scale of its Boston operations.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

JetBlue Airways Investment Narrative Recap

To be a JetBlue shareholder, you generally need to believe in the company's ability to capitalize on leisure travel demand, efficiently scale international operations, and manage costs in a competitive market. The recent Boston–Europe route expansion adds visible brand strength, but its impact on pressing issues like load factor volatility and revenue unpredictability is likely limited in the short term, as demand visibility and airline competition remain the primary near-term catalyst and risk, respectively.

The airline’s recently announced year-round nonstop service from Greater Rochester to Orlando stands out for its domestic focus, yet it complements JetBlue’s push for network breadth. While international expansion garners headlines, balancing core US growth remains central as JetBlue navigates both capacity and demand uncertainties within its broader strategy.

However, investors should also consider that despite network growth, persistent volatility in demand and continued margin pressure could...

Read the full narrative on JetBlue Airways (it's free!)

JetBlue Airways' outlook anticipates $10.6 billion in revenue and $728.0 million in earnings by 2028. Achieving this would require a 5.1% annual revenue growth rate and a $1.114 billion increase in earnings from the current -$386.0 million.

Uncover how JetBlue Airways' forecasts yield a $4.65 fair value, a 3% upside to its current price.

Exploring Other Perspectives

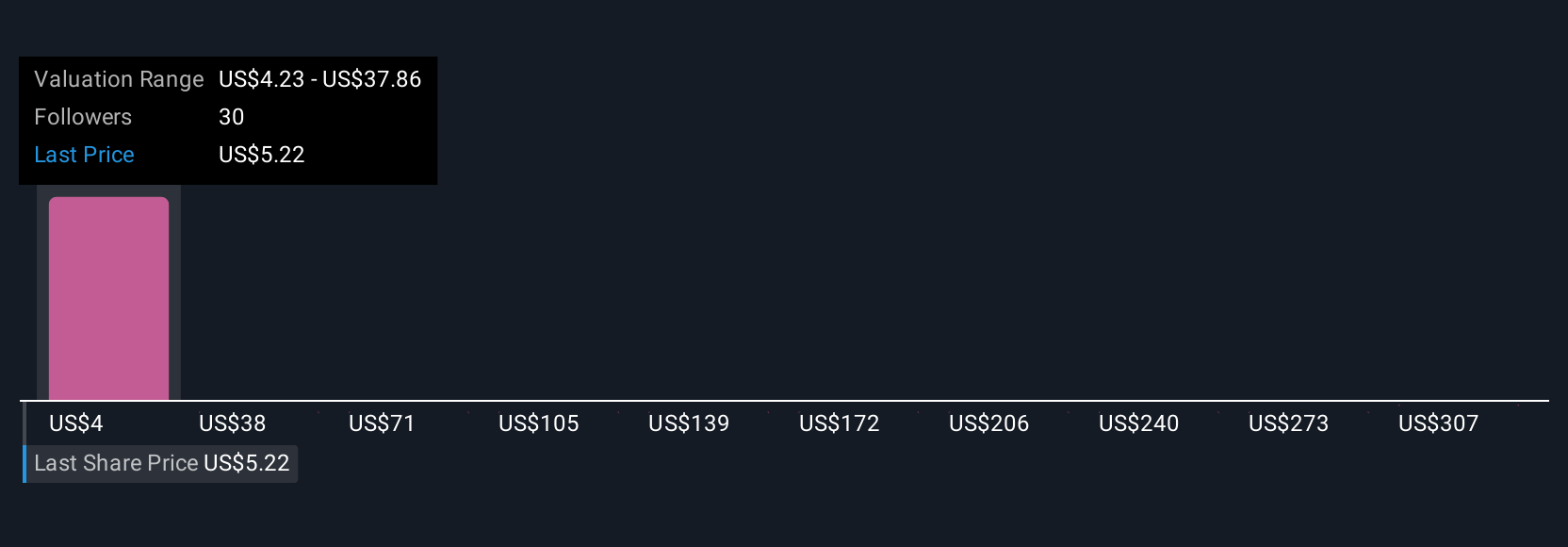

Simply Wall St Community members posted eight fair value estimates for JetBlue ranging from US$3 to US$340.49, reflecting sharply different outlooks on potential returns. Such diversity in views comes alongside ongoing debate about JetBlue's ability to sustain higher load factors and defend margins in a fiercely competitive travel sector.

Explore 8 other fair value estimates on JetBlue Airways - why the stock might be a potential multi-bagger!

Build Your Own JetBlue Airways Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JetBlue Airways research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JetBlue Airways research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JetBlue Airways' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JBLU

Fair value with minimal risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.