- United States

- /

- Transportation

- /

- NasdaqGS:JBHT

A Closer Look at J.B. Hunt (JBHT) Valuation After Recent Share Price Rally

Reviewed by Simply Wall St

J.B. Hunt Transport Services (JBHT) shares have seen modest movement lately, as investors watch closely while the transportation industry navigates ongoing shifts in freight demand and cost pressures. The company’s recent stock performance reflects wider market trends.

See our latest analysis for J.B. Hunt Transport Services.

J.B. Hunt shares have jumped more than 25% over the past month, signaling renewed momentum after a sluggish start to the year. While the one-year total shareholder return is still in negative territory, the recent rally hints that investors are warming to the company’s outlook as freight demand shows signs of stabilizing.

If you’re curious about what else is capturing attention beyond transportation, now is the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

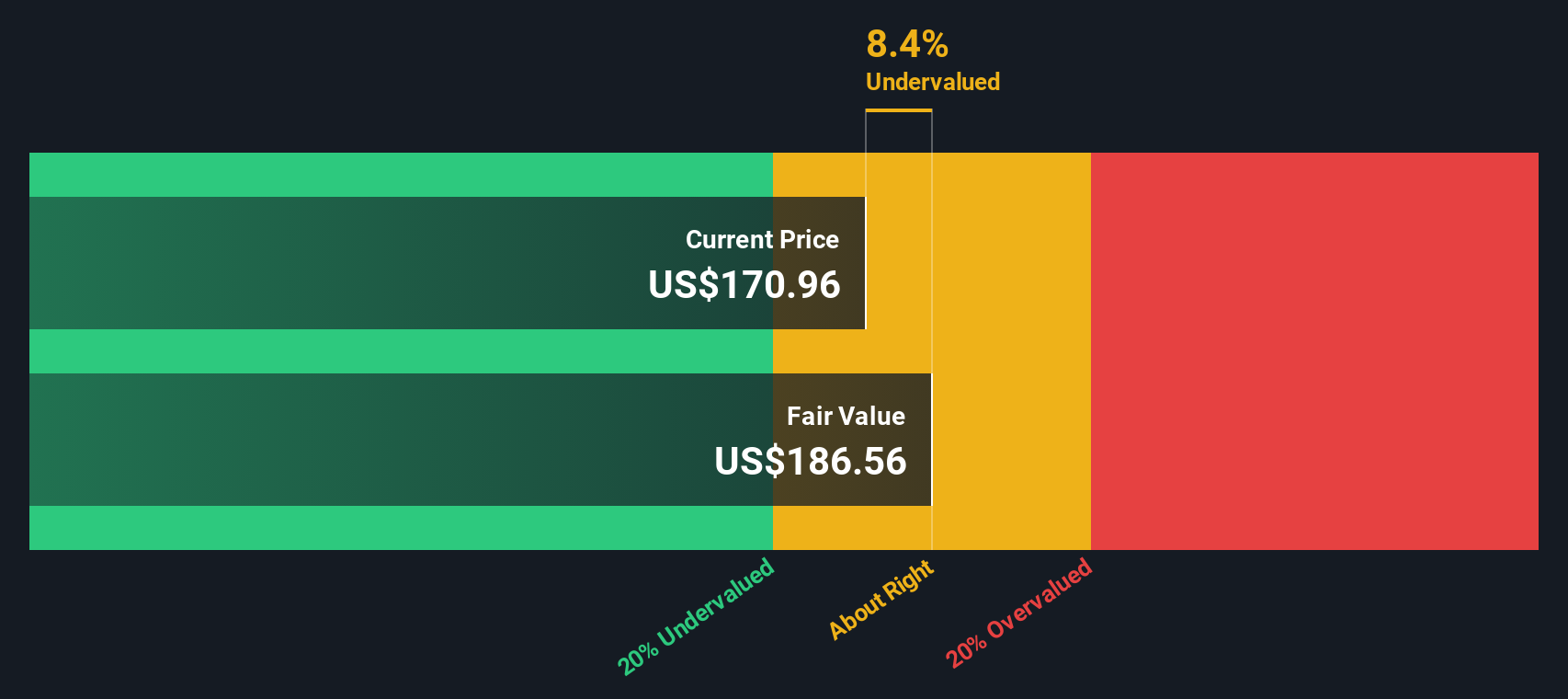

The recent surge in J.B. Hunt’s stock raises a central question for investors: is the company undervalued based on its fundamentals, or has the market already factored in the promise of future growth?

Most Popular Narrative: 4.0% Overvalued

J.B. Hunt's last close price of $172.64 sits slightly above the narrative’s fair value estimate of $166. This spread is fueling debate about whether analysts are counting too much on cost gains to justify the stock’s price premium.

Positive momentum in cost-led margin expansion is anticipated to continue. This provides upside potential as earnings estimates for coming quarters are revised upward.

Want to know the engine driving this optimistic price? The narrative hints at a transformation beneath the surface by mixing operational efficiency, margin expansion, and forward-looking financial bets. Find out which bold projections set the foundation for this valuation.

Result: Fair Value of $166 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflationary pressures and uncertain freight demand may quickly reverse margin gains and challenge the optimism behind recent analyst upgrades.

Find out about the key risks to this J.B. Hunt Transport Services narrative.

Another View: Discounted Cash Flow Results Differ

While the analyst consensus suggests J.B. Hunt is overvalued, our DCF model takes a different stance. According to this approach, the stock is actually trading about 7.9% below its estimated fair value of $187.49. This raises the question of whether the market could be underestimating its long-term earnings power.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out J.B. Hunt Transport Services for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own J.B. Hunt Transport Services Narrative

If the story above doesn't match your perspective or you'd rather dig into the numbers on your own, it takes just a few minutes to build your own view. Do it your way

A great starting point for your J.B. Hunt Transport Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunities slip by while others seize what’s next. Bold investors check out these stock ideas with just a click and sharpen their portfolios now.

- Boost your income stream by checking out these 20 dividend stocks with yields > 3%, featuring yields higher than 3% and consistent payouts year after year.

- Uncover tomorrow’s leaders by tapping into these 26 AI penny stocks, packed with companies innovating at the intersection of artificial intelligence and real-world problem solving.

- Take advantage of market mispricings using these 840 undervalued stocks based on cash flows, where you can uncover stocks that might be set for a strong rebound based on cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JBHT

J.B. Hunt Transport Services

Provides surface transportation, delivery, and logistic services in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives