- United States

- /

- Logistics

- /

- NasdaqGS:HUBG

How Investors Are Reacting To Hub Group (HUBG) Margin Gains and New Essendant Delivery Partnership

Reviewed by Sasha Jovanovic

- Hub Group, Inc. recently announced third-quarter 2025 earnings, reporting US$934.5 million in sales and net income of US$28.55 million, with improved profit margins despite lower revenue compared to the previous year.

- Separately, Essendant revealed a three-year partnership with Hub Group to launch a Managed Delivery model, enhancing rapid, nationwide logistics capabilities and supporting both companies' supply chain strategies.

- We'll now explore how Hub Group's profitability gains and new logistics partnership could influence its broader investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

Hub Group Investment Narrative Recap

To consider being a Hub Group shareholder, you need to believe in the company’s ability to convert operational efficiencies and logistics innovations into reliable profit growth despite a mixed freight market. The recent Q3 earnings showed higher profits but lower revenue, highlighting margin improvements as a key short-term catalyst, while ongoing pressure on revenue from muted demand and competitive threats remains the biggest risk, these results modestly support the margin story but do not fully resolve revenue concerns.

The launch of the Managed Delivery partnership with Essendant is particularly relevant right now, as it expands Hub Group’s logistics reach and enhances its service promise for major customers, offering potential upside to efficiency and client retention, important factors for investors watching profitability and top-line recovery.

However, even as new partnerships offer hope, persistent headwinds from soft intermodal volumes and exposure to cyclical US freight markets remain a risk that investors will want to watch for...

Read the full narrative on Hub Group (it's free!)

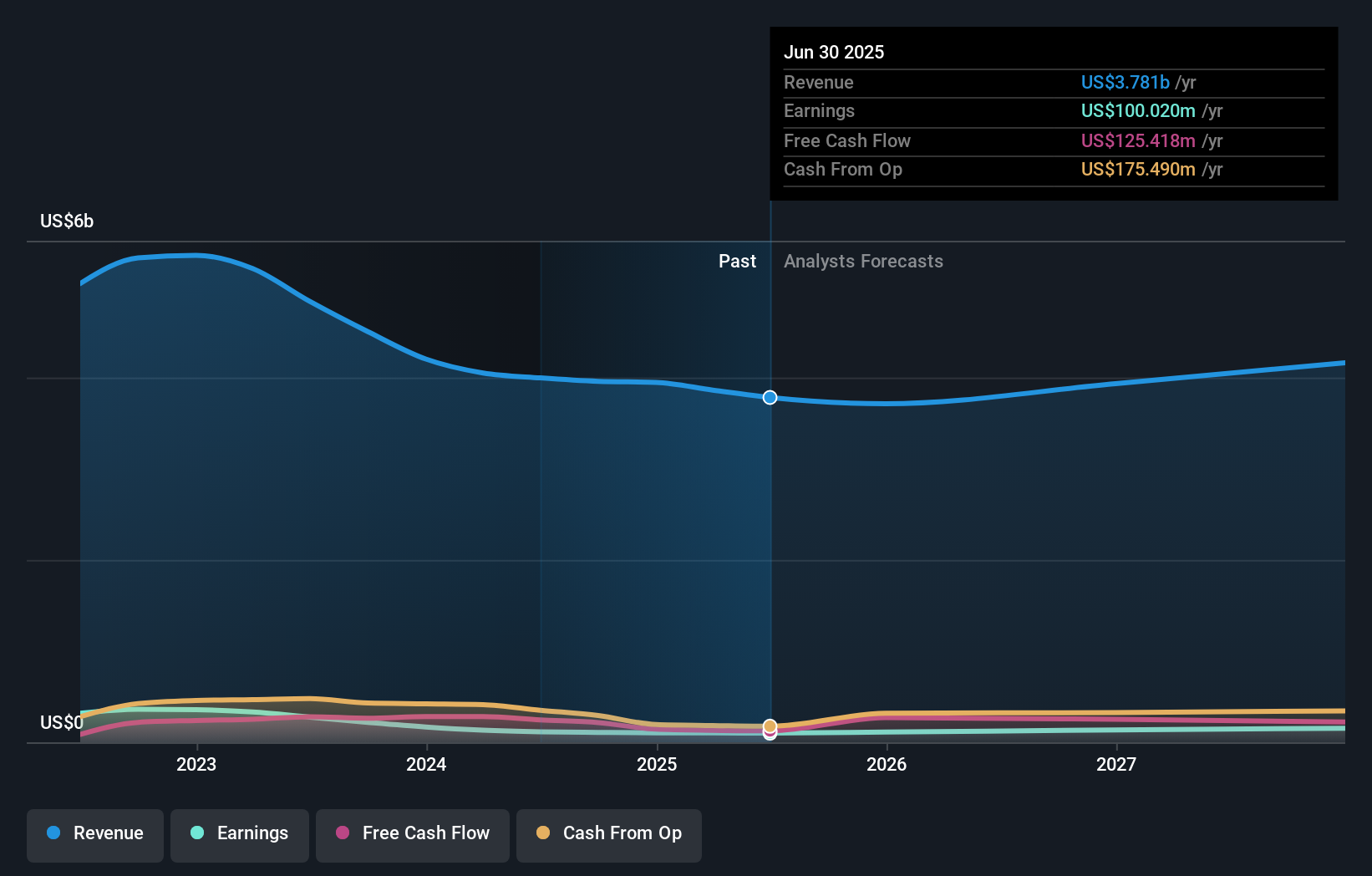

Hub Group's outlook anticipates $4.3 billion in revenue and $164.5 million in earnings by 2028. This scenario is based on a projected annual revenue growth rate of 4.3% and a $64.5 million increase in earnings from the current level of $100.0 million.

Uncover how Hub Group's forecasts yield a $39.94 fair value, a 13% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community shared three fair value estimates for Hub Group, ranging from US$39.94 to US$66.68 per share. While these diverse perspectives suggest disagreement on the company's upside, recent margin gains offset by ongoing industry pressures highlight why forecasts for sustainable growth vary so much, take a closer look at what different investors are considering.

Explore 3 other fair value estimates on Hub Group - why the stock might be worth as much as 88% more than the current price!

Build Your Own Hub Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hub Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Hub Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hub Group's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hub Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HUBG

Hub Group

A supply chain solutions provider, offers transportation and logistics management services in North America.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives