- United States

- /

- Transportation

- /

- NasdaqGS:HTZ

Will Hertz (HTZ) Fleet Leadership Shift Drive Real Operational Efficiency or Just Reflect Digital Ambitions?

Reviewed by Sasha Jovanovic

- Hertz Global Holdings recently promoted Mike Moore to Executive Vice President and Chief Operating Officer, granting him direct oversight of all fleet operations following his arrival at the company in July 2024.

- This leadership change coincides with Hertz’s advancement of its ecommerce platform and partnership with Amazon Autos, signaling an ambitious shift towards operational efficiency and digital retail expansion.

- We’ll explore how Moore’s fleet operations experience and Hertz’s digital push may influence the company’s investment narrative going forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Hertz Global Holdings Investment Narrative Recap

To own Hertz Global Holdings stock, you’d need to believe in a turnaround driven by operational efficiency and digital innovation, even as short-term profitability remains under pressure. Mike Moore’s promotion to Chief Operating Officer brings deep fleet operations experience, but this leadership change is unlikely to immediately shift the most urgent catalyst, restoring sustained earnings, or address the ongoing risk of heavy debt loads and unprofitability.

The company’s recent partnership with Amazon Autos is particularly relevant, offering new channels for used vehicle sales as Hertz emphasizes its digital retail push. While this supports broader revenue opportunities and modernizes its retail platform, the near-term impact on margins and investor sentiment will depend on execution and customer uptake.

However, investors should be aware, despite operational changes, persistent debt obligations remain a...

Read the full narrative on Hertz Global Holdings (it's free!)

Hertz Global Holdings' outlook points to $8.8 billion in revenue and $424.8 million in earnings by 2028. This scenario assumes a yearly revenue decline of 0.8% and an earnings increase of $2.9 billion from current earnings of -$2.5 billion.

Uncover how Hertz Global Holdings' forecasts yield a $4.01 fair value, a 28% downside to its current price.

Exploring Other Perspectives

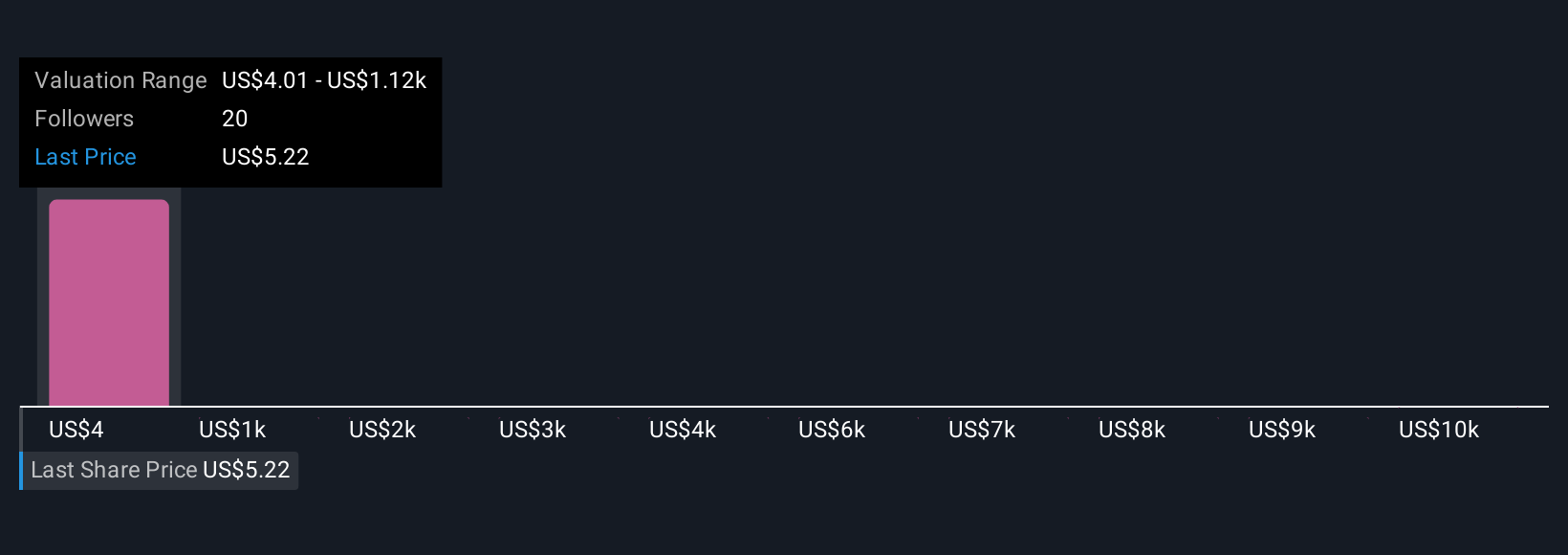

Seven Simply Wall St Community fair value estimates for Hertz range from US$4.01 to an outlier over US$11,000, showing opinions can diverge significantly. While many are optimistic about digital partnerships and retail expansion, continued net losses challenge the company’s financial resilience, explore several perspectives before forming your own view.

Explore 7 other fair value estimates on Hertz Global Holdings - why the stock might be worth 28% less than the current price!

Build Your Own Hertz Global Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hertz Global Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hertz Global Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hertz Global Holdings' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hertz Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HTZ

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives