- United States

- /

- Transportation

- /

- NasdaqGS:HTZ

Is Hertz’s Sharper Cost Focus Enough to Offset Lower Sales and Leadership Changes for HTZ?

Reviewed by Simply Wall St

- Hertz Global Holdings announced its second-quarter and first-half 2025 results, reporting sales of US$2.19 billion and a net loss of US$294 million for the quarter, both lower than the prior year, alongside plans for leadership changes including a new Chief Accounting Officer and a pending General Counsel departure.

- Although revenues declined, Hertz managed to significantly reduce its net losses compared to the same period last year, reflecting progress in expense management and operational efficiency amid ongoing industry shifts.

- With Hertz reporting a much smaller net loss despite falling revenues, we'll explore how these developments could shape its investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Hertz Global Holdings Investment Narrative Recap

To own Hertz shares today, investors need to believe the company can achieve profitable growth amid shifting mobility trends and persistent competition from ride-sharing platforms. The latest results, with sales and net losses both lower than the prior year, indicate efforts to strengthen operational efficiency. However, these quarterly figures do not materially alter the most important short-term catalyst, Hertz’s ability to optimize its fleet and capture higher utilization rates, or the biggest risk: ongoing exposure to residual value fluctuations in used and electric vehicles.

The company’s announcement of Mark Kosman as incoming Chief Accounting Officer is highly relevant, given the recent focus on cost management and operational execution. Kosman’s experience at Ford could contribute to further improvements in financial controls and reporting, supporting Hertz’s need to manage fleet costs and asset values amid evolving industry risks and catalysts.

But before assuming these positive steps are enough, keep in mind the company’s vulnerability to sudden changes in used vehicle prices is something investors should...

Read the full narrative on Hertz Global Holdings (it's free!)

Hertz Global Holdings' outlook anticipates $8.8 billion in revenue and $422.4 million in earnings by 2028. This scenario reflects a 0.0% yearly revenue growth and a $3.52 billion improvement in earnings from current earnings of -$3.1 billion.

Uncover how Hertz Global Holdings' forecasts yield a $3.99 fair value, a 33% downside to its current price.

Exploring Other Perspectives

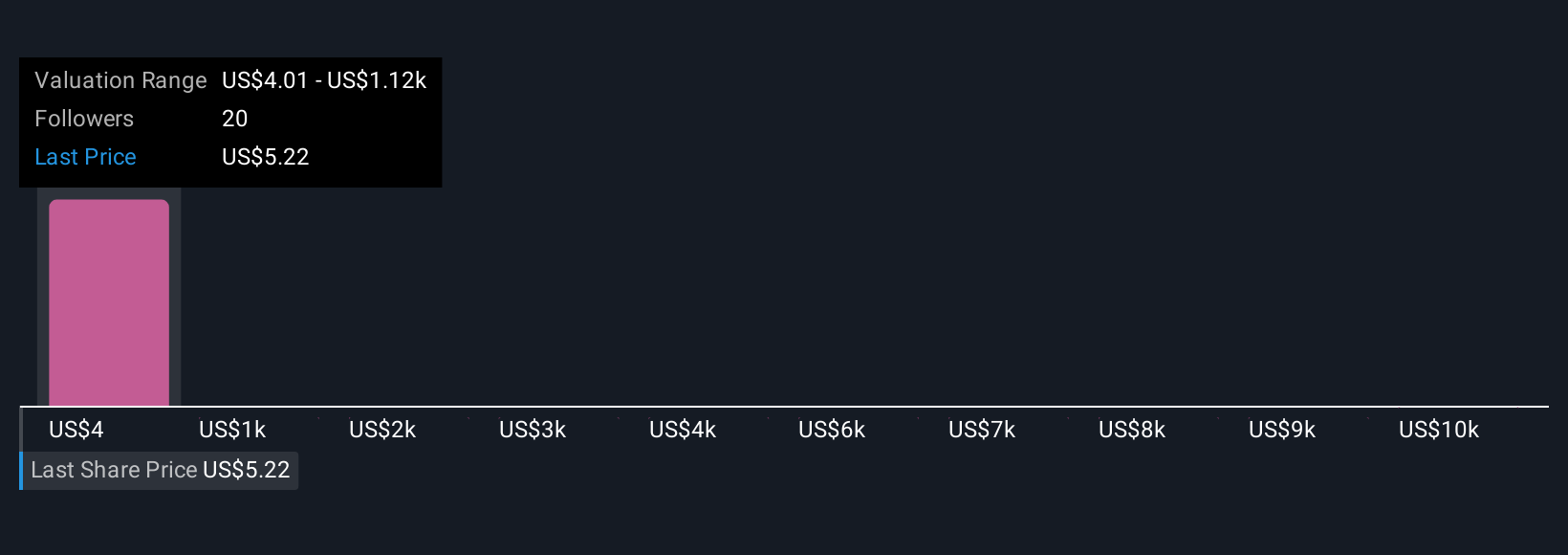

Five fair value estimates from the Simply Wall St Community span from less than US$1 to over US$11,000 per share. While opinions differ widely, ongoing risk from fleet residual values could weigh on future results, so it’s wise to explore other perspectives before forming your own view.

Explore 5 other fair value estimates on Hertz Global Holdings - why the stock might be worth less than half the current price!

Build Your Own Hertz Global Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hertz Global Holdings research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Hertz Global Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hertz Global Holdings' overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hertz Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HTZ

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives