Key Takeaways

- Evolving mobility trends and urban development threaten Hertz's traditional business model and future revenue growth potential.

- Financial constraints from legacy issues and market volatility limit Hertz's ability to modernize, pressuring margins and earnings.

- Fleet optimization, advanced technology adoption, cost control, and strategic channel focus are driving improved margins, operational efficiency, customer loyalty, and resilient revenue growth.

Catalysts

About Hertz Global Holdings- Operates as a vehicle rental company.

- Investors may be overestimating Hertz's ability to grow revenue due to a potential long-term shift away from traditional car rentals as the rise of ride-sharing and mobility-as-a-service platforms (like Uber and Lyft) continues to lower overall demand for rental vehicles, reducing future transaction volumes and weakening the company's growth profile.

- Long-term urbanization and the expansion of public transportation infrastructure in major cities may further reduce the addressable market for Hertz, eroding both revenue and fleet utilization rates and potentially leading to underperformance against aggressive future growth estimates.

- Hertz still faces high fleet depreciation and residual value risk, particularly as EV adoption accelerates industry-wide; unforeseen shifts in used vehicle values or changes in EV technology could drive up depreciation costs, compressing net margins and impacting long-term earnings.

- Legacy bankruptcy issues and high debt levels limit Hertz's flexibility to invest in technology, fleet modernization, and digital platforms at the pace required to remain competitive, implying ongoing elevated interest expenses and financial constraints that may keep net income and margins below optimistic expectations.

- The potential for tighter supply chains and continued volatility in used vehicle markets suggests Hertz could experience higher fleet acquisition and maintenance costs relative to current projections, squeezing future EBITDA margins and dampening the company's earnings outlook.

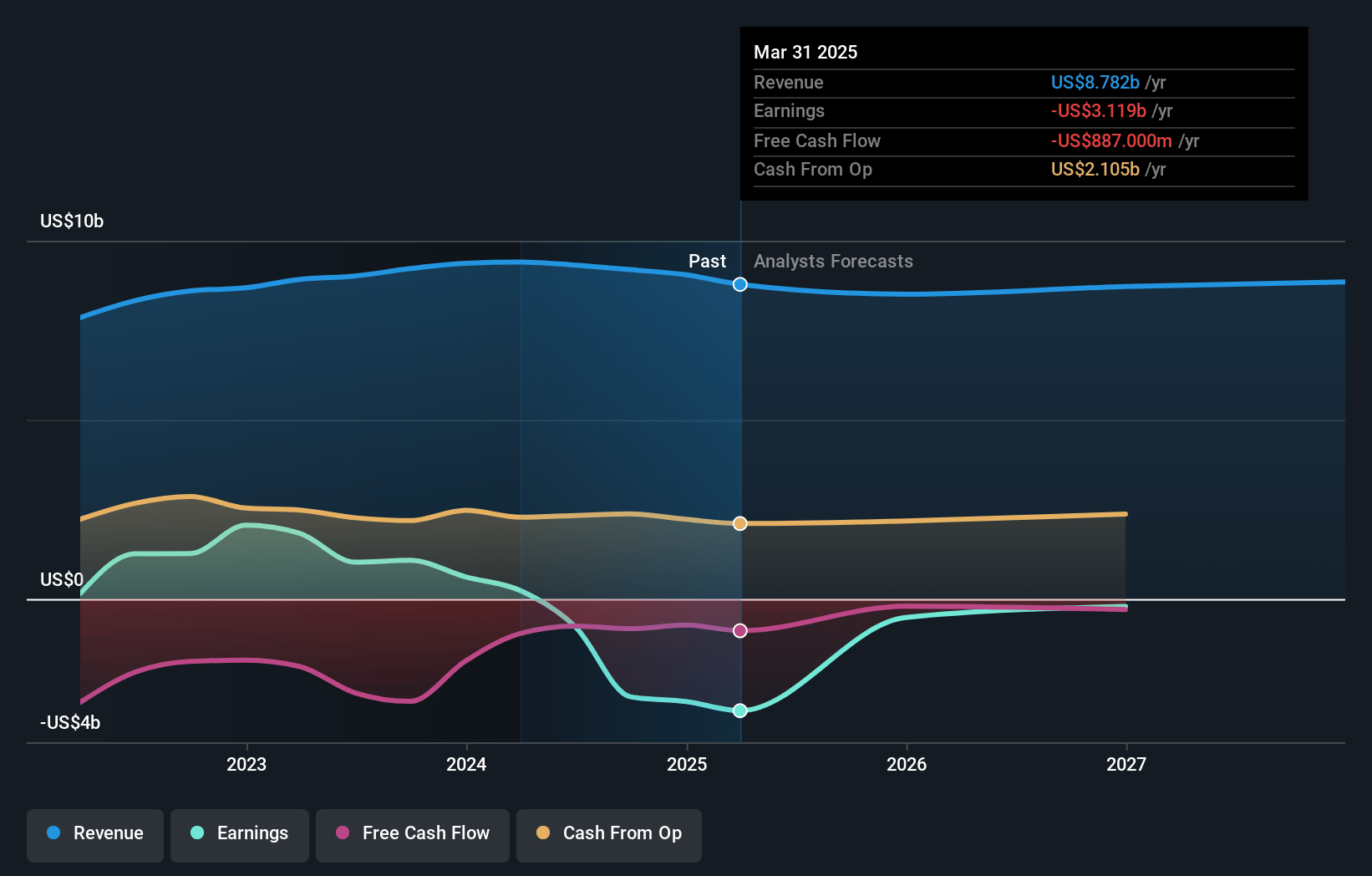

Hertz Global Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hertz Global Holdings's revenue will decrease by 0.0% annually over the next 3 years.

- Analysts are not forecasting that Hertz Global Holdings will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Hertz Global Holdings's profit margin will increase from -35.5% to the average US Transportation industry of 4.8% in 3 years.

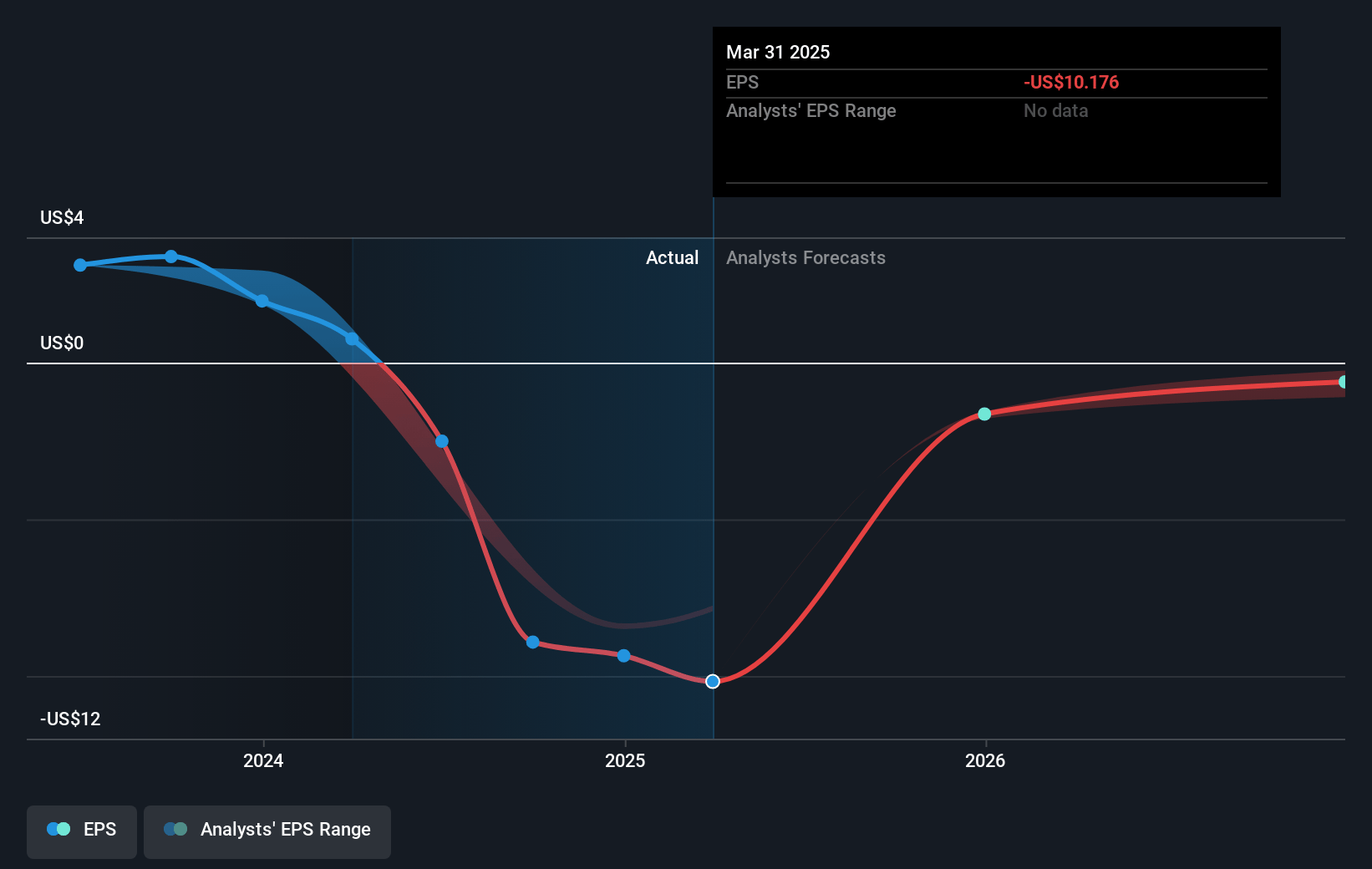

- If Hertz Global Holdings's profit margin were to converge on the industry average, you could expect earnings to reach $422.5 million (and earnings per share of $1.33) by about July 2028, up from $-3.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 3.8x on those 2028 earnings, up from -0.8x today. This future PE is lower than the current PE for the US Transportation industry at 26.5x.

- Analysts expect the number of shares outstanding to grow by 0.91% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.04%, as per the Simply Wall St company report.

Hertz Global Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Hertz's successful fleet rotation to a younger, lower-cost mix-combined with rising used vehicle residual values and proactive fleet management-positions the company to benefit significantly from favorable asset values, directly supporting improvements in net margins and earnings.

- Adoption and integration of advanced technologies (e.g., AI-driven fleet management, revenue optimization with Amadeus, digital-first customer experience) is already yielding enhanced operational efficiency, better pricing strategies, and increased customer loyalty, which underpin higher revenues and improved EBITDA margins over the long term.

- Execution of cost management initiatives-including structural cost removal and optimization of direct operating expenses (DOE)-is producing sustained improvements in P&L, supporting the ability to withstand volume fluctuations and boosting free cash flow and net earnings.

- Strategic channel diversification (e.g., focus on higher-margin off-airport, mobility, and retail car sales), expansion of loyalty programs, and an improved Net Promoter Score are contributing to more resilient and recurring revenue streams, increasing customer lifetime value and supporting steady top-line growth.

- Hertz's strong liquidity position, improved capital structure, and continued access to competitive fleet financing allow flexibility for further fleet optimization and technology investments, reducing financial risk and supporting ongoing growth in revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $3.993 for Hertz Global Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.0, and the most bearish reporting a price target of just $2.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $8.8 billion, earnings will come to $422.5 million, and it would be trading on a PE ratio of 3.8x, assuming you use a discount rate of 8.0%.

- Given the current share price of $7.73, the analyst price target of $3.99 is 93.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.