- United States

- /

- Transportation

- /

- NasdaqGS:HTZ

Exploring Hertz (HTZ) Valuation After Recent Share Price Fluctuations

Reviewed by Kshitija Bhandaru

Hertz Global Holdings (HTZ) shares have seen some movement lately, sparking fresh curiosity about how the stock stacks up after a turbulent year. Investors are keeping an eye on recent trends and considering what these might signal for the future.

See our latest analysis for Hertz Global Holdings.

After a series of eventful quarters, Hertz Global Holdings’ recent share price movements hint at shifting market sentiment, with the latest price sitting at $6.25. While the company’s 1-year total shareholder return shows a modest gain, performance in the shorter term has wavered, which suggests momentum is still up for debate as investors weigh both recovery prospects and ongoing risks.

If you’re weighing fresh opportunities in today’s market, it could be a smart move to broaden your search. Discover fast growing stocks with high insider ownership

With shares rebounding but still far from their highs, investors may wonder whether Hertz Global Holdings is undervalued at these levels or if the recent momentum already reflects all the potential ahead. This raises the question: is this a real buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 55.7% Overvalued

With the most followed narrative suggesting a fair value of $4.01 and the last close at $6.25, the gap is striking. The narrative leans on emerging shifts in mobility and digital modernization, but key assumptions shape a very different outlook than the market’s price.

Disruptive mobility trends and alternative transport solutions threaten to reduce demand for traditional rentals, shrinking Hertz's core market and revenue prospects. Financial pressures from debt, fleet costs, and modernization needs constrain flexibility and jeopardize future profitability amid rising competitive and operational challenges.

Wondering what wild cards went into this bold calculation? The most ambitious revenue turnaround, margin bounce, and a jaw-dropping earnings leap sit at the heart of this valuation tug-of-war. Uncover the sharpest profit and growth moves the narrative bets on. Think you can guess how far they stretch expectations?

Result: Fair Value of $4.01 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Hertz’s digital expansion or younger, cost-efficient fleet delivers strong results, these factors could quickly challenge the prevailing overvaluation case.

Find out about the key risks to this Hertz Global Holdings narrative.

Another View: SWS DCF Model Suggests Deep Undervaluation

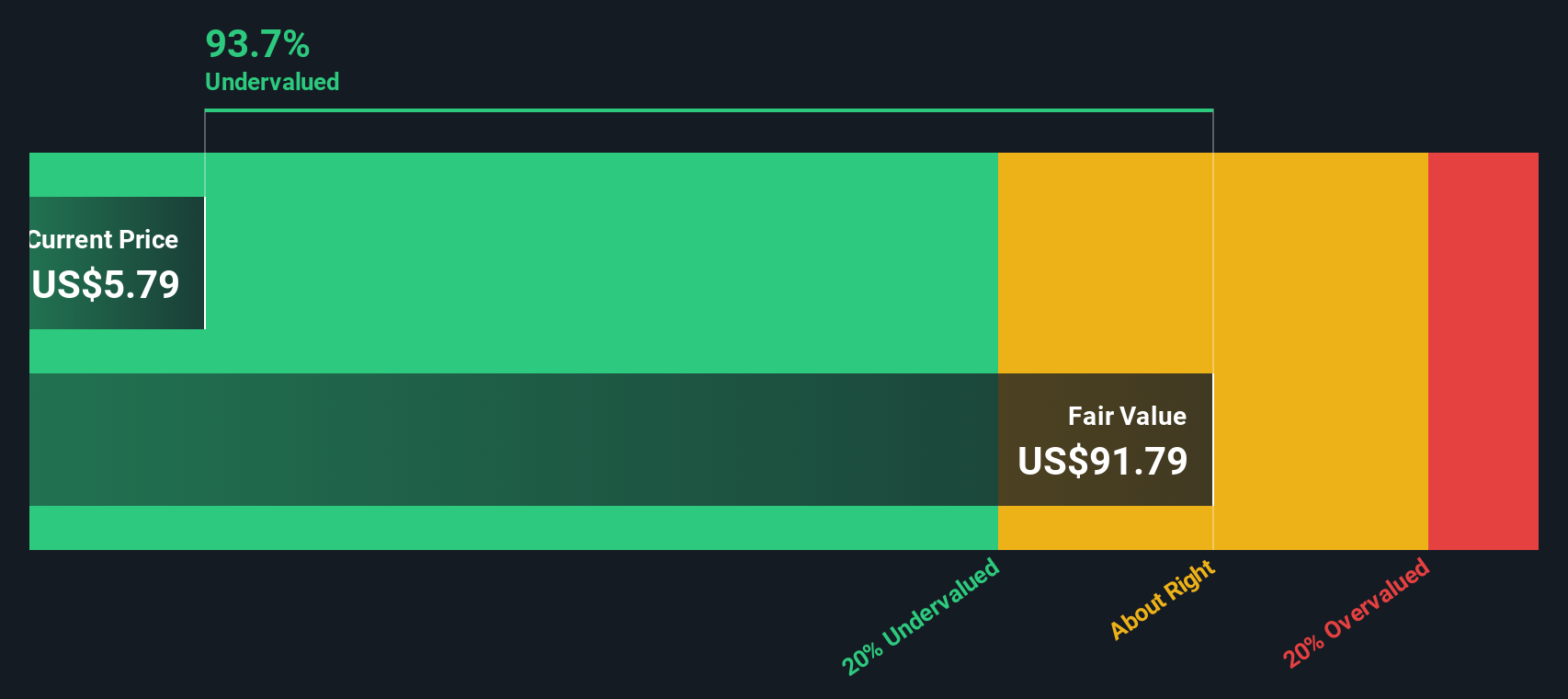

Taking a different approach, our DCF model finds Hertz Global Holdings to be trading well below its estimated fair value. With a calculated fair value of $91.79 compared to its current price of $6.25, this method implies a substantial undervaluation. Could long-term cash flows unlock hidden upside, or is this too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hertz Global Holdings Narrative

If the numbers or assumptions don’t quite fit your outlook, you’re welcome to take a fresh look and build your own story in just a few minutes. Do it your way

A great starting point for your Hertz Global Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip past you. Power up your portfolio by using the screener to uncover actionable stock picks that fit your goals perfectly.

- Unlock value by targeting market underdogs and track these 885 undervalued stocks based on cash flows that are poised to rebound based on robust cash flow analysis.

- Tap into innovation and get ahead of the curve with these 24 AI penny stocks that are shaping tomorrow’s biggest breakthroughs in artificial intelligence.

- Secure steady returns and spot these 19 dividend stocks with yields > 3% offering attractive yields, which can strengthen your long-term financial growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hertz Global Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HTZ

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives