- United States

- /

- Transportation

- /

- NasdaqGS:HTLD

Heartland Express (NASDAQ:HTLD) Is Paying Out A Dividend Of $0.02

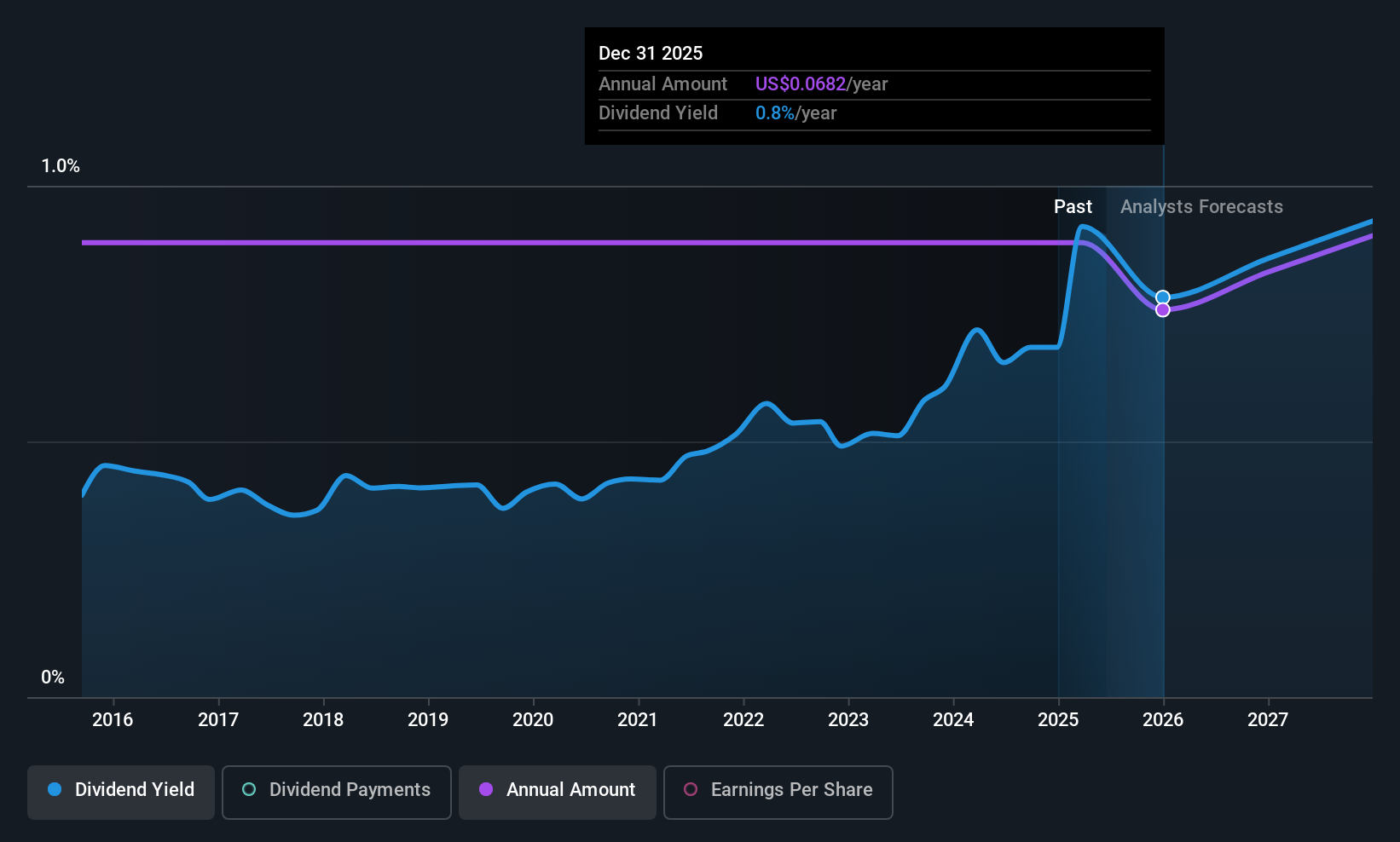

Heartland Express, Inc.'s (NASDAQ:HTLD) investors are due to receive a payment of $0.02 per share on 3rd of July. Including this payment, the dividend yield on the stock will be 0.9%, which is a modest boost for shareholders' returns.

Heartland Express' Future Dividend Projections Seem Positive

If it is predictable over a long period, even low dividend yields can be attractive. While Heartland Express is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

According to analysts, EPS should be several times higher next year. If the dividend extends its recent trend, estimates say the dividend could reach 3.7%, which we would be comfortable to see continuing.

View our latest analysis for Heartland Express

Heartland Express Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The most recent annual payment of $0.08 is about the same as the annual payment 10 years ago. Although we can't deny that the dividend has been remarkably stable in the past, the growth has been pretty muted.

Dividend Growth Potential Is Shaky

The company's investors will be pleased to have been receiving dividend income for some time. However, things aren't all that rosy. Over the past five years, it looks as though Heartland Express' EPS has declined at around 32% a year. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

In Summary

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Heartland Express' payments, as there could be some issues with sustaining them into the future. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Without at least some growth in earnings per share over time, the dividend will eventually come under pressure either from competition or inflation. Very few businesses see earnings consistently shrink year after year in perpetuity though, and so it might be worth seeing what the 4 analysts we track are forecasting for the future. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Heartland Express might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HTLD

Heartland Express

Operates as a short, medium, and long-haul truckload carrier and transportation services provider in the United States, Mexico, and Canada.

Fair value with moderate growth potential.

Market Insights

Community Narratives