- United States

- /

- Marine and Shipping

- /

- NasdaqGS:GOGL

Golden Ocean Group Limited's (NASDAQ:GOGL) Price Is Out Of Tune With Revenues

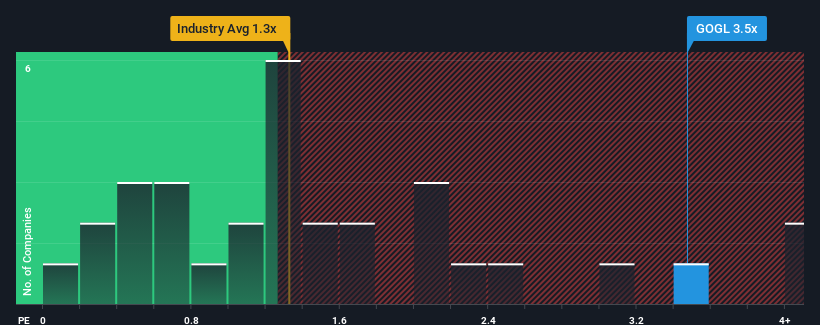

Golden Ocean Group Limited's (NASDAQ:GOGL) price-to-sales (or "P/S") ratio of 3.5x may look like a poor investment opportunity when you consider close to half the companies in the Shipping industry in the United States have P/S ratios below 1.3x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Golden Ocean Group

What Does Golden Ocean Group's Recent Performance Look Like?

Golden Ocean Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Golden Ocean Group's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Golden Ocean Group would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 45% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 2.6% per year during the coming three years according to the seven analysts following the company. Although, this is simply shaping up to be in line with the broader industry, which is also set to decline 1.0% each year.

With this in mind, we find it intriguing that Golden Ocean Group's P/S exceeds that of its industry peers. We think shrinking revenues are unlikely to make the P/S premium sustainable, which could set up shareholders for future disappointment. There's strong potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Golden Ocean Group's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Golden Ocean Group currently trades on a higher than expected P/S since its revenue forecast is in line with the struggling industry. Right now we are uncomfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. We're also cautious about the company's ability to resist further pain to its business from the broader industry turmoil. Unless the company's prospects improve, it's hard to see the P/S and share price remaining at these current levels.

Having said that, be aware Golden Ocean Group is showing 4 warning signs in our investment analysis, and 2 of those are concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GOGL

Golden Ocean Group

A shipping company, owns and operates a fleet of dry bulk vessels worldwide.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives