- United States

- /

- Marine and Shipping

- /

- NasdaqGS:GOGL

Golden Ocean Group Limited's (NASDAQ:GOGL) Price Is Out Of Tune With Revenues

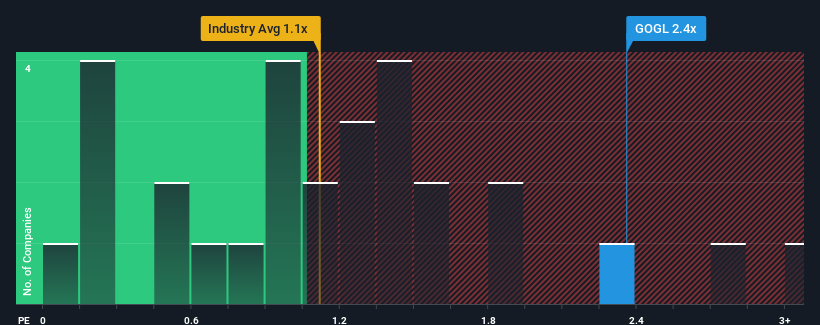

When you see that almost half of the companies in the Shipping industry in the United States have price-to-sales ratios (or "P/S") below 1.1x, Golden Ocean Group Limited (NASDAQ:GOGL) looks to be giving off some sell signals with its 2.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Golden Ocean Group

What Does Golden Ocean Group's Recent Performance Look Like?

Recent times haven't been great for Golden Ocean Group as its revenue has been falling quicker than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Golden Ocean Group.Is There Enough Revenue Growth Forecasted For Golden Ocean Group?

Golden Ocean Group's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 29% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 1.3% each year as estimated by the seven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 0.5% per year, which is not materially different.

With this information, we find it interesting that Golden Ocean Group is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On Golden Ocean Group's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given Golden Ocean Group's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Golden Ocean Group has 6 warning signs we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GOGL

Golden Ocean Group

A shipping company, owns and operates a fleet of dry bulk vessels worldwide.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives